Fewer Americans File Initial Unemployment Claims, Down 33,000 But Still Five Times Higher Than Last Year

KEY POINTS

- Initial unemployment claims fell but are still five times higher than last year at this time

- BLS pegged the unemployment rate for the week that ended Sept. 5 at 8.6%, up 0.2 point from the August average

- There was no sign of movement on the next round of coronavirus stimulus with supplemental unemployment benefits a major sticking point

Fewer Americans filed initial unemployment claims last week, down 33,000 to 860,000 from the previous week's level, the Labor Department reported Thursday. The Bureau of Labor Statistics, however, pegged the four-week moving average at 912,000.

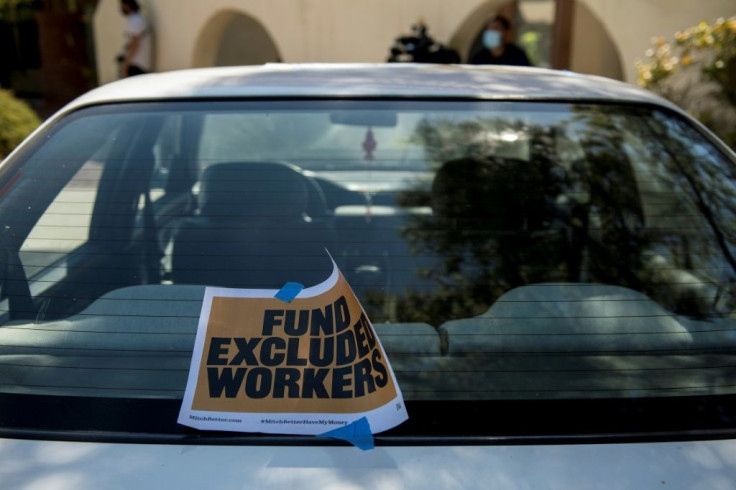

The numbers come as Democrats and the White House remain deadlocked on the next round of coronavirus stimulus, with supplemental unemployment benefits a major sticking point.

BLS estimated the unemployment rate at 8.6% for the week that ended Sept. 5 at 8.6%, down 0.7 point from the previous week. The unemployment rate for August was 8.4%.

"Some of the key pain points for the economy remain as before including small business, airlines, bars and restaurants and retailers,” Bankrate.com senior economist Mark Hamrick said in an email to International Business Times. “At the same time, interest rate-sensitive sectors including housing fare relatively well. Builder sentiment just notched a record high as just one positive sign for the housing market.

"Companies which have helped to provide a bridge to some semblance of normalcy, principally in technology, have seen increased demand for their services. Even so, consumers will remain cautious about the risks of being exposed to COVID-19 as they avoid public-facing businesses. Others won’t spend because of losses of income and employment."

Century Foundation senior fellow Andrew Stettner told IBT Thursday’s report “represents a major warning sign about the state of the economic recovery.”

“After falling more steeply in the summer, the number of workers filing unemployment claims has remained stubbornly high over the last five weeks,” he said. “The high level of claims is coming as the patchwork provided by the temporary lost wages assistance program is wearing thin.”

Stettner noted seven states have exhausted all grants and 20 states have yet to pay supplemental benefits provided under the lost wages program.

Diane Swonk, chief economist at Grant Thornton, said the unemployment figures still are at record highs, and though housing does appear to be a bright spot, housing starts came in weaker than expected and are “off month-to-month from a year ago.”

For the week that ended Sept. 5, the biggest increases in unemployment claims were in California, Texas, Louisians, New Jersey and Washington while the largest decreases were in Kentucky, Florida, Pennslvania, Kansas and Michigan.

Nearly 29.8 million Americans were collecting unemployment benefits for the week that ended Aug. 29, up 98,456 from the previous week. That compares to fewer than 1.5 million in the comparable week for 2019.

The seasonally unadjusted claims showed 790,021 people filed initial claims last week compared to 171,134 people in the comparable week last year.

All but two states – Idaho and South Dakota – offered extended benefits. The 50 states reported nearly 14.5 million people claimed Pandemic Unemployment Assistance benefits and 49 states reported 1.5 million claimed pandemic emergency unemployment compensation benefits.

The states reporting the highest unemployment rates were Hawaii, California, Nevada, New York Louisiana and Connecticut with both Puerto Rico and the District of Columbia making the top 10 list.

© Copyright IBTimes 2024. All rights reserved.