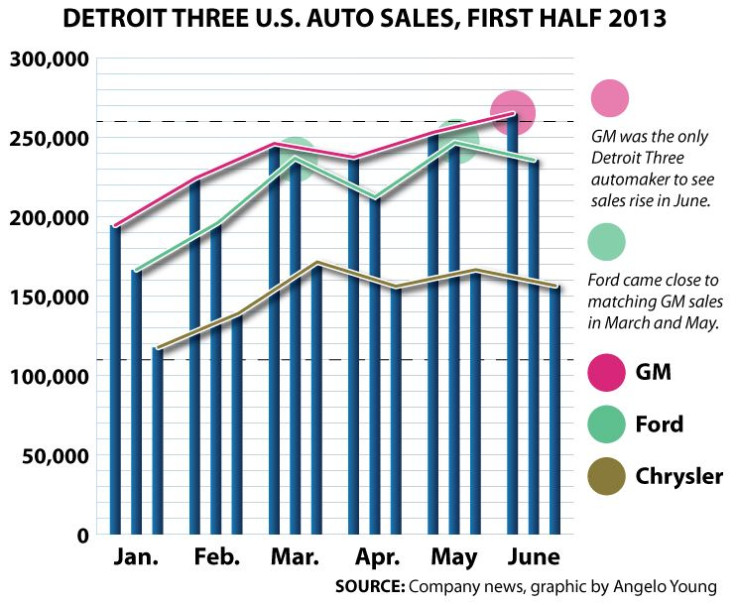

First Half 2013 Detroit Three US Auto Sales: Ford Up 13.9%; GM Up 8%; Chrysler Up 4%; Total US Sales For US Automakers Touches 3.27M

The Detroit Three automakers announced Tuesday they sold 3.27 million cars and light trucks in the United States in the first half of 2013, with a combined average increase in sales of 8.6 percent from the first half of 2012.

General Motors Co. (NYSE:GM) sold the highest volume, as usual, with 1.42 million units from January to June, marking an 8 percent increase compared to the first half of 2012. Ford Motor Co. (NYSE:F) came in second at 1.26 million units, but its pace of sales put it at No. 1 with a 13.9 percent increase compared with last year.

General Motors, which typically releases the first running monthly estimate for U.S. annual car sales, said the seasonally adjusted annualized rate (SAAR) touched 15.8 million units in June, the highest SAAR since November 2007. This measurement is a valuable indicator that gauges the overall health of the auto sector. Most estimates say 2013 will end with between 15 and 15.5 million cars and trucks sold in the U.S., up from 14.5 million last year.

In March and May Ford came close to matching GM’s total unit sales, but like Chrysler its month-to-month sales declined in June compared to May.

"GM had a very strong month and its successes in June were found mostly in trucks and small cars,” said Michelle Krebs, senior analyst for automotive information provider Edmunds.com. "Much like GM, Ford saw overwhelming strength last month with trucks and small cars. Both Ford F-150 and Ford Fiesta posted huge gains.”

Chrysler Group LLC posted an 8 percent gain in June on considerably lower volume compared to its competition in Michigan. The first half of the year saw it gain 4 percent to 594,059 units. Sales have been strong enough to push up transaction prices. According to the latest figures from Kelley Blue Book, the automotive vehicle valuation company, the average closing price for a vehicle in June edged up 1.2 percent to $31,663 from the previous month and 0.9 percent from June 2012.

Incentive spending is down, too.

According to auto information provider TrueCar.com, the average amount of money the Detroit Three marked down to get customers to buy their vehicles is about $3,193. This is considerably higher when you factor in incentive spending by foreign competitors -- the industry average for the world’s Big 8 auto companies (the Detroit Three plus Toyota, Honda, Nissan, Hyundai/Kia and Volkswagen) was $2,357 in June.

Transaction prices and incentive spending can provide a snapshot of sales performance. For the vehicle manufacturer, it is ideal when transaction prices are high and incentive spending is low.

© Copyright IBTimes 2024. All rights reserved.