Five Things To Know About The World’s Largest Shipping Company: Maersk Cautiously Optimistic About Global Outlook

Denmark’s A.P. Moller-Maersk (OMX:MAERSK) is the largest shipping company in the world, and has long been seen as a bellwether for the global economy, and it's doing rather well these days, despite difficult economic conditions.

The company reported a relatively good fourth quarter 2013 with a $936 million profit. Though the figure is a 7 percent drop from last year, the shipper still beat analyst expectations.

On Thursday executives issued data about last year and their expectations for 2014.

Here are a few things to know about what the shipping giant has been up to, according to its annual report.

1. Maersk is more than ships -- oil is a major part of the company.

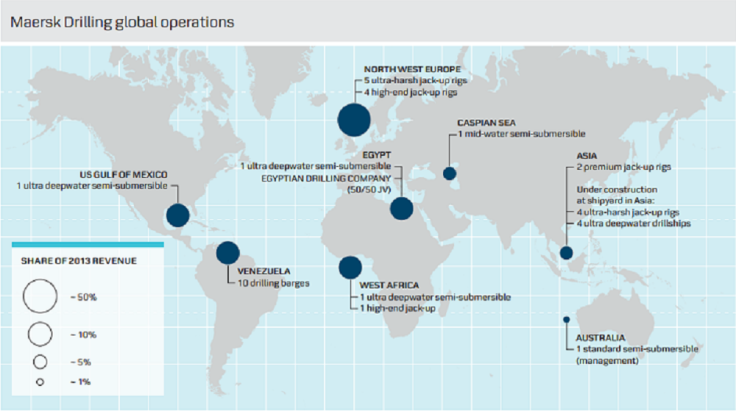

Maersk Oil operates 77 platforms and three floating production, storage and offloading units around the world. It also has 16 drilling rigs and 10 drilling barges around the world, responsible for 235,000 barrels of oil daily. Maersk also owns a fleet of 130 tankers.

The sector saw a “historically high profit” of $528 million in 2013, up from $347 million the year before. The company expects to deliver a profit of $1 billion within five years.

It also has a 50 percent stake in Egyptian Drilling Company, which operates 66 rigs mostly on land. Maersk made $19 million from this venture last year.

It's expecting eight more rigs in the next few years.

“The oil price has averaged above $100 per barrel in 2013, and thus continued to provide support for the oil companies’ exploration and development activities,” the report reads.

2. In fact, the company is teaming up with BP for new projects.

Last year, Maersk Drilling and BP (NYSE:BP) agreed to co-develop a “new breed of advanced technology offshore drilling rigs that will be critical to unlocking the next frontier of deepwater oil and gas reserves,” the report reads.

These new rigs should be able to operate in areas up to 350 degrees Fahrenheit and under up to 20,000 pounds per square inch of pressure. Today’s technology can only handle up to 250 degrees and 15,000 PSI.

BP predicts these advances could help them access 10 billion to 20 billion barrels worth of resources.

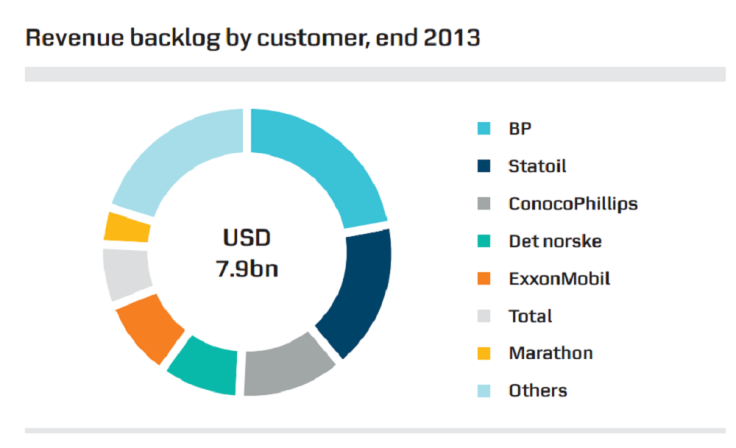

The oil and gas company is one of their largest customers, accounting for nearly a quarter of Maersk's total $7.9 billion in revenue backlog.

3. Maersk also owns dozens of ports around the world.

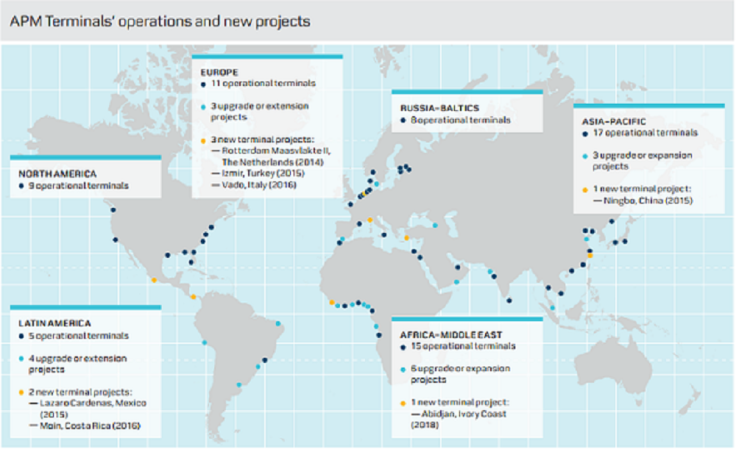

The company operates 65 terminals around the world and employs 20,300 people.

Last year it secured new projects in Izmir, Turkey, and Abidjan, Ivory Coast.

Last year 36.3 million TEU (20-foot equivalent unit, a measure for container capacity), went through APM ports, up from 35.4 million in 2012.

The segment made $4.3 billion in revenue and $770 million in profits last year. It accounts for 12 percent of the company’s total invested capital.

“The shipping industry is trending towards more global alliances and larger vessels, with an associated cascading of bigger vessels down the shipping lanes,” the Maersk report reads, adding that their ports should see fewer calls, but bigger ships which could be more demanding on the infrastructure.

4. Profits from the container shipping business tripled last year.

Altogether Maersk has 584 ships capable of lugging 2.6 million 20-foot containers, which means it owns about 15 percent of the global supply, according to Reuters.

Last year, the company implemented a new strategy for certain ships to travel slower through certain routes. This and other efforts saved 12 percent in fuel consumption and helped it report a net profit of $1.5 billion up from $446 million in 2012.

Of course in 2014 Maersk is not expecting such vast gains, though it still expects global demand for container ship transport to grow by 4 or 5 percent.

“Maersk Line aims to improve its competitiveness, although unit cost reductions will be less than in 2013,” reads the annual report.

“Global demand for seaborne container transportation is expected to increase by 4 – 5 percent and Maersk Line aims to grow with the market.”

5. There are too many ships globally, which could be a problem.

“We expect container freight rates will surge up and down. There is overcapacity in the market and it will be until at least 2016,” said CEO Nils Smedegaard Andersen in a teleconference, according to Reuters.

In 2007, a record 3.1 million extra containers were added to the market just before global trade fell in 2008, according to the Wall Street Journal.

Consequently, shipping companies were charging less of a premium for spaces on their vessels. But oil prices and other costs continue to rise.

In 2014, the company estimates demand for container shipping will grow by 4 to 5 percent, while capacity will increase 9.8 percent.

“Thus, without significant capacity adjustments, the container shipping market is most likely expected to see a continued downward pressure on freight rates in 2014,” the report reads.

© Copyright IBTimes 2025. All rights reserved.