The Future For E-Grocery: Amazon (AMZN) Fresh Retains Lead, But Startups Jump In

This story was updated on January 29, 2014, at 8:10am. CORRECTION: An earlier version of this story said Relay Foods operates in Williamsburg, Brooklyn. Actually, they operate in Williamsburg, VA.

Amazon.com, Inc.’s (NASDAQ:AMZN) AmazonFresh still leads the field among online grocers, but startups are carving out niches in the challenging industry, according to a recent industry presentation.

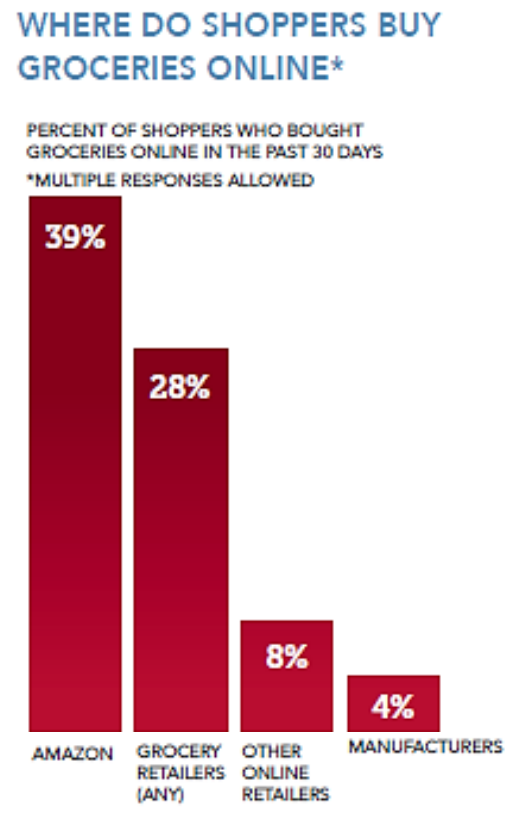

Almost 40 percent of e-grocery shoppers preferred AmazonFresh over other online food retailers, according to a survey by retail consultancy Brick Meets Click. The company polled more than 22,000 shoppers.

A subsection of shoppers who’d bought groceries online in the past 30 days were surveyed.

AmazonFresh could roll out its grocery business in 20 more urban markets in 2014, reported Reuters, challenging retailers from Whole Foods Market, Inc. (NASDAQ:WFM) to Wal-Mart Stores, Inc. (NYSE:WMT). Currently the $299/year service is only offered in Los Angeles, San Francisco and Seattle.

“More customers who are shopping online today are using pure play online retailers than traditional grocers,” said Brick Meets Click principal Bill Bishop at a Food Institute presentation last week.

“That reflects the fact that with a few outstanding exceptions, brick-and-mortar retailers have been a little slower to move,” he continued.

AmazonFresh is one dominant player in a crowded field, worth an estimated $15.4 billion of sales in 2013, according to Forrester Research. Still, that’s only a fraction of the annual $1 trillion U.S. food retail market.

The challenge for online grocers, haunted by the collapse of failed grocers like Webvan in the early 2000s, is competing with traditional supermarkets on price and sales volume, while controlling distribution costs.

Many shoppers simply don’t like buying produce online. The industry needs to rise above “insult pricing,” according to presentation remarks. That’s a term for when consumers are charged dearly for shipping or subscription fees they don’t understand, so that price comparisons with normal supermarkets come across as offensive.

About one in 10 shoppers are buying groceries online, according to Brick Meets Click, which is bullish on e-groceries.

"Amazon needs to figure out their offering first to really understand what it is that they'll be rolling out. They seem to still be perfecting the service, with many apparent growing pains," said Tom Furphy, who formerly led the AmazonFresh business, to IBTimes. "If they are able to work out the kinks - providing a great service, with good prices, good local selection and high-quality fresh foods - then they will be a force. But if they are not able to work out the kinks, I think they will struggle to gain significant share in any market, thus leaving room for others."

Though Amazon’s scale and infrastructure intimidates rivals, smaller companies are innovating rapidly, sometimes just to survive. Sales success can be slow, though shopper and investor expectations can be high.

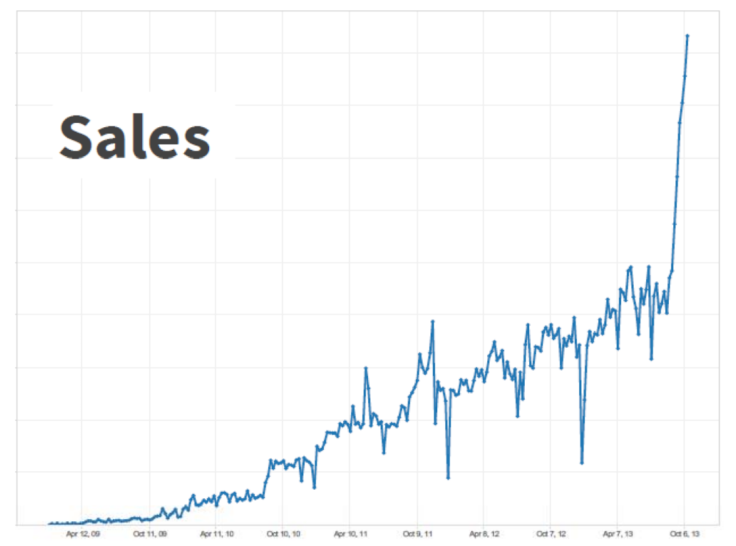

Organic and artisanal e-grocer Relay Foods, which operates in Virginia, Washington D.C., and Williamsburg, VA, started in 2009 but only saw sales spike in late 2013. The company loads a truck with groceries and then parks it in a central, convenient location, where urbanites can swing by for their goods. It targets densely trafficked locations, like downtown street corners.

Online grocers need to develop their own logistics infrastructure, unlike other e-retailers, who can rely on FedEx Corporation (NYSE:FDX) and U.S. Postal Service products, according to Relay Foods President Arnie Katz. That’s because Fedex lacks “perishable and frozen” temperature zones for produce.

Investors were also scared off by Webvan’s spectacular multimillion-dollar collapse and shied away from nascent online grocers for a decade, added Katz. Financing was scarce.

“During its first four years of operation, Relay Foods' management focused on building a robust online platform and a quickly scalable on-the-ground operation, rather than falling in the “Webvan trap” of rapid expansion without core business fundamentals being in place,” wrote Katz to IBTimes.

“By mid-2013, market opportunities clearly indicated growing consumer openness to online grocery,” he continued.

Relay declined to disclose actual sales figures, but said its sales in the last quarter of 2014 doubled that in Q3.

In an alternate business model, West Coast e-grocer rival Yummy.com, guarantees delivery within 30 minutes. The company plans to partner with a national retailer eventually, and will expand from four markets to five in 2014.

“We can see the day when a national retailer uses our system to fulfill online orders in about 30 minutes directly from their stores,” Yummy.com CEO Barnaby Montgomery told IBTimes in an email. “Our system is faster and more convenient than a trip to the store, or conventional online fulfillment methods.”

Yummy.com declined to share actual revenue or sales.

Montgomery has also been scarred by his earlier experiences in online retail. He used to work for Stater Bros. Market Vendor, which helped retailers set up online operations in 2000. He gave that up in 2002, he said.

Consumer researcher the Hartman Group estimates that $1 billion in sales happens through pure online grocers, with major players including Peapod.com and FreshDirect, which together sell over $500 million annually.

Still, there are hundreds of smaller online retailers, alongside the web operations of traditional food sellers, who make up the remaining $12 billion in annual sales.

Amazon doesn’t specifically break out sales figures for its AmazonFresh business. But by bundling AmazonFresh with its membership-only AmazonPrime service, Amazon has created an ingenious and profitable “Trojan horse,” according to Amazon specialist Scot Wingo.

“People are buying more and more of their other products in addition to groceries. That’s enough margin to tip this thing over the scales to be quite profitable for Amazon,” said Wingo at a recent retail industry presentation. “The Trojan horse is the groceries, where they’re effectively losing money. The real money is made when the TV rides along, or the X-Box, or the high-margin products.”

Amazon has systematically placed its warehouses near highly populated urban areas, according to Wingo, who has followed Amazon closely for years and advises companies on the Seattle giant’s business strategy. That placement could help when it comes to expanding its grocery business.

He pinpointed an AmazonFresh greater New York rollout and a nationwide expansion to up to 40 markets as potential developments in 2014.

Despite Amazon’s official silence on these fronts, it’s reasonable to connect the dots, Wingo told IBTimes earlier in January.

“It’d be crazy to have refrigeration and then rip it out,” he said of a reportedly refrigerated Amazon warehouse in New Jersey, placed well within shipping reach of the New York metropolitan market.

A recent Wall Street Journal experiment found that online grocers may offer similar or cheaper prices relative to normal food retailers, though systematic comparisons were difficult.

There’ll always be some shoppers who won’t shop online, though, said Bishop.

“Many people won’t necessarily see the value,” he said to an industry audience. “We’re the converted here.”He added that conventional food retailers had already upped their game by revamping Main Street stores to win back traffic.

“Just going up and down the street, many people are not going to see the value. A lot of people do like to shop for groceries, at least some of the time…While this will be an enormous business, it’s not going to be the majority anytime soon.”

© Copyright IBTimes 2025. All rights reserved.