Gloomy Outlook For Gold: No Help In Sight For Near Future

It looks like gold will face a gloomy Thanksgiving and beyond, as the decreasingly precious metal falls to four-month price lows and finds little support from the diverse factors that have buoyed it.

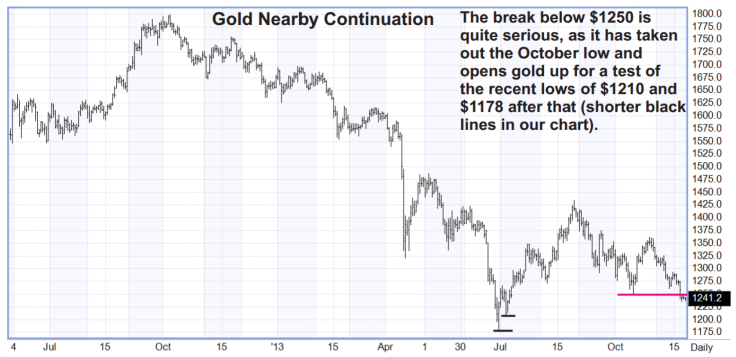

The yellow metal dipped below $1,250 per ounce late last week, levels last seen in July 2013. Gold prices opened at $1,241 per ounce on New York’s COMEX exchange on Monday.

“Gold has eroded to a four-month low on account of revived fears that the Fed may start its tapering program somewhat earlier than expected, coupled with strength in the dollar against the yen, soaring U.S. equity markets and deteriorating technicals,” wrote precious metals analyst Edward Meir in a note late Sunday night.

Gold prices breaking below $1,250 is “quite serious," wrote Meir, since it opens gold up to test recent lows of $1,210 and $1,178, the lowest level seen all year.

“We remain rather bearish about gold’s upside prospects going forward,” concluded Meir. Barclays PLC (LON:BARC) gold analysts point out further bad news for gold, in a research note from Monday. A stronger dollar, traditionally bad news for gold prices, stronger U.S. Treasury yields, and buoyant equity markets all spell doom-and-gloom for gold, they said.

“External markets continue to create an unfavourable backdrop for gold, as the physical market lends little support during the seasonally strong period for consumption,” they wrote on Monday.

Gold held worldwide in exchange-traded products fell below 2,000 metric tons, levels not seen since 2010, they noted. That three-year low still leaves open “scope for further downside risk,” they said.

Even HSBC Holdings PLC (LON:HSBA) analyst James Steel, who is usually a bit more upbeat about gold’s prospects, concluded late last week that there’s little positive news on the horizon for gold.

“Market chatter concerning deflationary pressure helped dissuade investors from going long gold, and with no major buyers coming forward, prices eased lower,” he wrote on Friday. Deflationary pressures, a weaker euro and soft commodity prices all foretell negative trends for gold, said Steel. If deflation is strong, fewer investors will turn toward gold as a hedge against inflation, for example.

“In the short term we do not see any likely turn of events that would bolster gold,” wrote Steel on Friday. “The Chinese New Year is not close enough to prompt greater physical demand and Indian demand remains stunted. … Before gold prices rally, prices may have to sink to the level where physical demand is stimulated, the scrap market contracts, or producers seriously discuss limiting production.”

Gold bugs hoped that Federal Reserve Vice Chair Janet Yellen’s Senate confirmation hearings last week would push gold prices up, if the next Fed chief was shown to be significantly dovish and more hesitant about tapering back bond purchases. But gold prices haven’t reacted as strongly as those who favor the yellow metal would’ve liked.

The gold market has remained insulated to what seems like bullish headlines, according to Scott Carter, Lear Capital CEO, who heads a major precious metals retailer.

“The gold price is a bit of a disconnect, in my view, to the news coming out of Washington, D.C., and the Fed,” Carter told IBTimes last week. He’d expected Yellen’s cross-examination by lawmakers to push gold prices up, as she seemed hesitant about the timing of tapering, on his view.

Another long-term gold bull, Brien Lundin of Jefferson Companies, put it well in a newsletter last week.

He said only very bad unemployment data, indicating widespread joblessness, could help gold at this point, short of an Israeli attack on Iran’s nuclear facilities.

“Western speculators are pouncing on any excuse to sell gold right now,” he wrote on Nov. 21. “The focus will be squarely on the November nonfarms payroll report due on Friday, Dec. 6. I plan to be out of the office on that day, and I recommend that all gold bugs do the same.”

U.S. Commodity Futures Trading Commission data showed that speculative investors limited their exposure to gold, with the fastest reduction in those betting on gold since March 2012, happening in early November. Many investors are shorting the metal, betting that prices will fall, with such positions rising to their highest in 14 weeks, wrote Barclays analysts.

© Copyright IBTimes 2024. All rights reserved.