Green Finance: Climate-Friendly Investments Grew Nearly 20 Percent In 2014

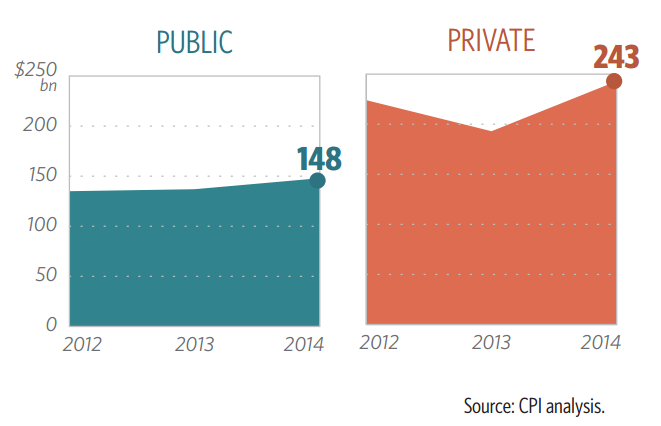

Negotiators tasked with hammering out a global climate deal in Paris may have more reason to be hopeful, based on investment news out Monday. According to a new report, climate-related investments grew to $391 billion in 2014, an increase of 18 percent over the previous year.

The surge was driven in large part by ballooning private-sector investments in renewable energy and other climate-friendly initiatives. Private investments accounted for $243 billion, or 62 percent, of global climate finance, according to the Climate Policy Initiative.

Public investments in clean energy and sustainability projects also picked up, though at a slower pace, as governments have increased their commitments to climate action. More than half of public funding came in the form of grants and ultra-cheap loans, which totaled $83 billion in 2014.

The green tide has provided "a strong hope that the Paris Climate Summit could represent a turning point in the global fight against climate change," the report said.

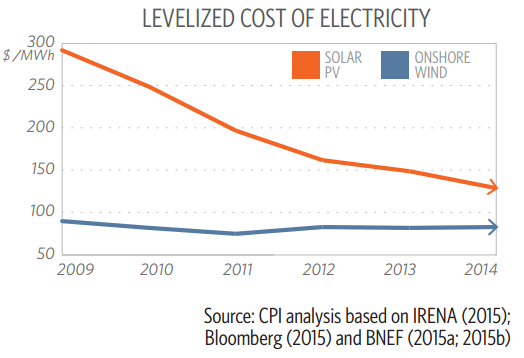

The numbers were especially notable given the rapidly falling prices of clean energy. Total spending on renewables increased even as the price of utility-scale solar energy fell by half in the past five years and wind energy became as much as 15 percent cheaper. The report also highlighted China's rapidly expanding green sector, which racked up growth of 36 percent in installed solar and wind energy in 2014.

The news comes as investors continue grappling with the implications of a warming world on financial markets. At one extreme, activist campaigns have pushed university endowments and private foundations to divest from oil, gas and coal companies. The Norwegian Sovereign Wealth Fund, the Rockefeller Brothers Foundation and Stanford University are among the institutions that have committed to pulling billions out of fossil fuel stocks.

But mainstream investors are also warming up to the idea of clean investments. A recent report issued by asset manager BlackRock found that public companies investing the most in reducing their carbon footprints have outperformed the broader market by nearly 6 percent. Meanwhile, companies dragging their feet have lagged by 6 percent.

"Sustainable investing is not a passing fad," wrote the researchers from BlackRock, whose $5 trillion in assets makes it the largest asset managment company in the world. "This is not just about doing or feeling good."

© Copyright IBTimes 2024. All rights reserved.