Here’s Your Smaller Government: Personal Incomes Grew In All Industries, Except Civilian US Government Sector

If you’re a Texas roughneck, your income probably increased noticeably last year. If you work as a Pennsylvania warehouse manager, chances are your paycheck didn’t increase very much if any in 2013. And if you work under a non-defense-related federal contract, it’s a fair bet that you didn’t see any growth in personal net earnings and should feel lucky you still have that job.

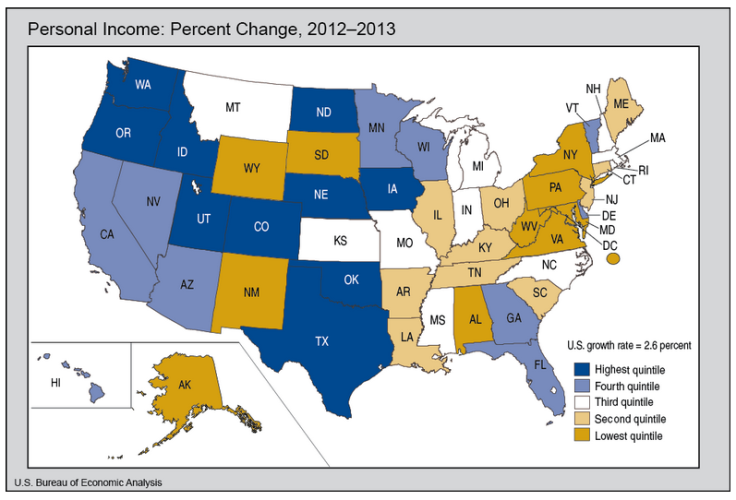

The Bureau of Economic Analysis released Tuesday data on state personal income growth for 2013, and it shows the pace slowed to an overall 2.6 percent compared to 4.2 percent in 2012. Personal income growth reflects how much more money is in the pockets of working Americans over time, is used by federal agencies to allocate funds and matching grants to the states and is used by states to project tax revenue and determine the need for public services.

The BEA cited two main reasons for this decline in personal incomes. One was the end of the two-year Social Security payroll tax break that had reduced the amount taken from payrolls by two percentage points in 2011 and 2012. Without that temporary tax “holiday,” personal income growth would have been smaller in those years.

The other factor contributing to a considerable drop in personal income last year compared to 2012: employers and companies paid out bonuses and dividends prior to the end of 2012 in anticipation of higher taxes in 2013. By making those payments early, recipients were able to report that income in 2012.

In other words, don’t put much stock on the drop in overall growth from 2012 to 2013. What’s more interesting is where incomes grew then most and least, and in which industries.

As you can see from the map above the best growth (the dark blue states) was in the west while the eastern half largely saw the slowest rates of growth.

“Nationwide, earnings grew in 2013 in every industry except civilian federal government, which fell $6.7 billion,” the BEA said in announcing the figures.

Since most federal government operations (including civilian contractors) are based on the eastern seaboard, especially around Washington D.C., cuts to federal spending affected that region the most. Washington D.C. personal income grow well under the average, at 1.6 percent. Maryland and Virginia were also below the average at 2 percent and 2.1 percent respectively. West Virginia was hit by declines in coal mining, manufacturing and construction and was the state with the lowest growth rate of 1.2 percent.

The current boom in oil and gas drilling has given a considerable boost to personal incomes in Texas, Oklahoma and North Dakota, which have all outpaced the national average since 2009. Nevada is enjoying a rebound in construction and hospitality, pushing personal income growth to 4.3 percent.

Industries that are delivering the biggest growth in paychecks right now: professional services, construction and health care. Meanwhile farming has been hit lower crop prices, output and earnings.

© Copyright IBTimes 2024. All rights reserved.