HK stocks may open lower as oil prices hit record

Hong Kong stocks are expected to open lower on Thursday, pressured by a surge in oil prices on fears turmoil in Libya could spread to other oil exporters in the region, and declines in global markets.

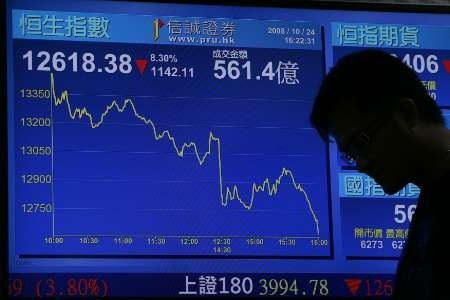

On Wednesday, the benchmark Hang Seng Index .HSI fell 0.36 percent, down for a third straight session, to 22,906.9, its lowest in more than a week.

Crude prices in New York and London reached their highest levels since October 2008 on concern the potential of unrest in other oil-producing nations could choke supplies.

Across the region, most markets traded lower, with Japan's Nikkei .N225 down 1 percent and South Korea's KOSPI .KS11 off 0.1 percent. Taiwan's TAIEX index .TWII was up 0.6 percent.

STOCKS TO WATCH

* Oil-sensitive stocks such as transport companies and oil distributors are likely to be in focus.

* CLP Holdings Ltd said it expected an HK$881 million gain from the sale of a 13.36 percent stake in Electricity Generating PCL for HK$2.13 billion.

* Technology services provider Digital China Holdings Ltd is bidding for the rights to sell Apple Inc's iPad and Research in Motion Ltd's tablet PC in China, its chief executive said.

* SmarTone Telecommunications Holdings Ltd said it proposed a bonus offering of one share for every existing share held and to increase authorised share capital to HK$200 milllion from HK$100 million to increase trading liquidity of the shares.

* Great Eagle Holdings Ltd said profit attributable to equity holders soared 253.4 percent to HK$4.2 billion in 2010 on strong growth in its hotel business and an increase in rental income from investment properties. It said its businesses in 2011 should benefit from the positive economic outlooks for Hong Kong and China.

© Copyright Thomson Reuters {{Year}}. All rights reserved.