Hong Kong Protest 2014: Investors Look To Other Finance Hubs Like Singapore, Tokyo As Tensions Rise

As protesters continue to take to the streets of Hong Kong to protest China’s attempts to further its influence there, experts and analysts fear that greater involvement from the mainland could jeopardize its reputation as a finance hub -- and that investors may already be looking elsewhere for a replacement.

The "special administrative region" is known as a relative haven for those looking to gain a foothold in the region without the harsh restrictions found in mainland exchanges like Shenzhen or Shanghai. Hong Kong ranked fourth in this year’s International Institute for Management Development's World Competitiveness Yearbook, just below Singapore, Switzerland and the United States, and above Sweden, Germany and Canada. Meanwhile, China fell two spots to 23rd place, mainly due to “concerns about its business environment.”

“Ultimately the legal system is pretty much answerable to Beijing, but they have chosen to allow Hong Kong to live in a bit of a bubble,” Nigel Davis, a lecturer of law at the University of Hong Kong, told the Wall Street Journal.

However, on Sunday China’s National People’s Congress Standing Committee rejected democrats’ demands to freely choose the territory's next leader in 2017, adding fuel to Hong Kong's "Occupy" pro-democracy movement known as Occupy Central, and sending hundreds into Hong Kong’s streets in protest.

“It looks to me like that bubble could be burst,” Davis said.

Unlike other Occupy protests that swept around the world in 2011, Hong Kong's is largely supported by well-paid white-collar workers, according to a December public opinion survey from the Hong Kong Transition Project. Hong Kong’s financial sector accounts for 16 percent of its total GDP and was responsible for employing 228,000 people in 2012, according to government data.

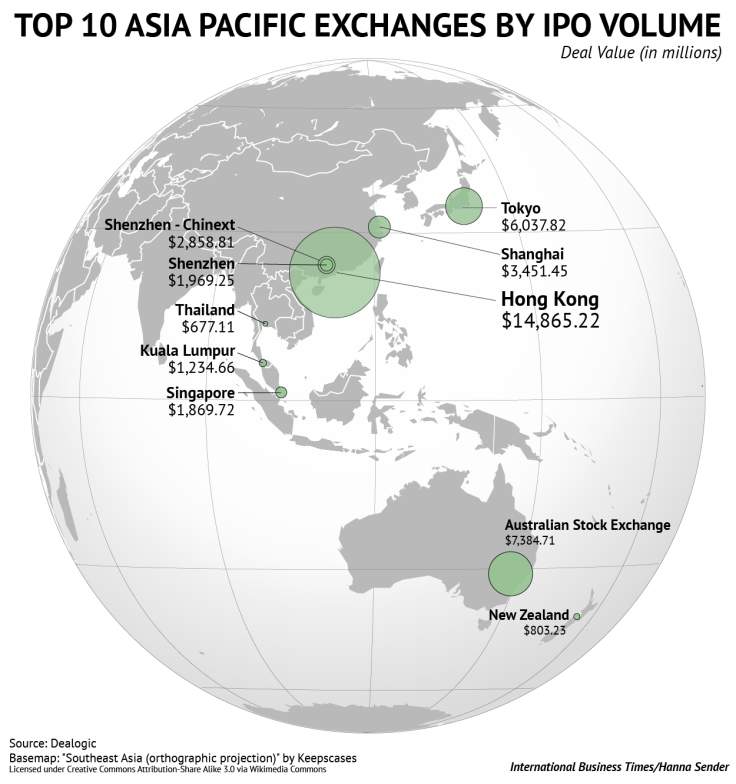

The Hong Kong Stock Exchange (SEHK) is home to 34 percent of all initial public offerings among Asia-Pacific exchanges -- the largest share. It also has the biggest number of deals with the greatest value, according to data from Dealogic.

Amid the increasing tensions, many analysts are considering other finance hubs in the region that may rise up as alternatives. The second-largest exchange by IPO volume is the Australian Stock Exchange, with 16.9 percent, followed by Tokyo, with 13.8 percent. Other cities, such as Singapore and even Kuala Lumpur, have emerged as possible competitors.

“Hong Kong is becoming increasingly a part of China, with the Chinese government interfering more and more, which will compromise the quality of governance,” John West, head of research firm the Asian Century Institute, told CNBC. “Looking ahead, I think that Singapore has a distinct advantage.”

© Copyright IBTimes 2024. All rights reserved.