How Sequestration Is Hitting Student Loan Borrowers

Sequestration is hitting the wallets of a demographic that really can’t afford the extra expense.

Recipients of some federal student loans will now have to pay additional expenses as a result of the automatic budget cuts, known as sequestration, that went into effect March 1. The Department of Education, or DOE, has sent letters to graduate students and parents of dependent undergraduates who received a Direct PLUS loan.

Those loans, funded by the DOE, have a fixed interest rate of 7.9 percent. According to a letter announcing the fee increase obtained by Fox News, rates will go up by about 0.2 percentage points.

“On Aug. 2, 2011, Congress passed the Budget Control Act of 2011, which put into place automatic federal budget cuts, known as the ‘sequester.’ While this law does not otherwise change the amount or terms or conditions of your Direct loan, it does raise loan fees on Direct PLUS loans first disbursed after March 1, 2013,” the letter states. “Specifically, the fee on your loan will increase from 4.0 percent of your loan amount to 4.204 percent. For example, the fee on a $10,000 PLUS loan will increase by $20.40 from $400.00 to $420.40.”

Of the approximately 20 million Americans who attend college each year, the Chronicle of Higher Education reports close to 12 million -- or 60 percent -- will borrow money to help cover the cost of tuition and fees. As of the first quarter of 2012, about 14 million young adults under the age of 30 had some student loan debt, according to American Student Assistance.

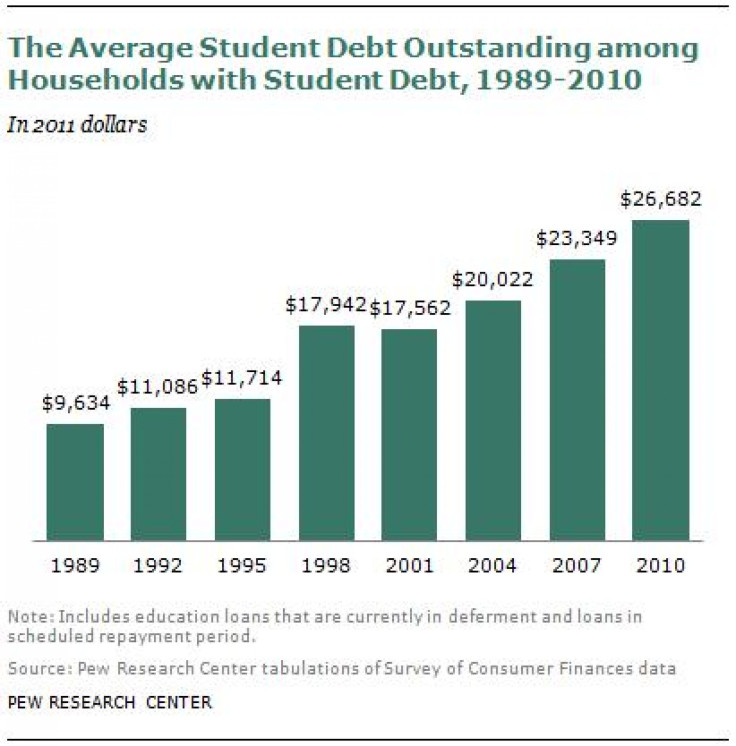

The amount of student debt held by Americans has skyrocketed in recent decades. According to the Federal Reserve, student loan debt now exceeds $1 trillion, more than what is held from auto loans or credit card debt.

About one in five of the nation’s households had student debt in 2010, according to a 2012 analysis from the Pew Research Center, more than double the share held two decades earlier.

“Because outstanding student debt has been rising and household incomes have been falling since 2007, outstanding educational debt has risen as a share of household income for all income groups considered. The outstanding student-debt-to-income ratio nearly doubled for the richest fifth of households from 2007 to 2010, but it remains the case that in both years the ratio of student debt to income was markedly higher for the lowest fifth of households by income,” the study reports.

The poorest fifth of Americans typically devote about a quarter of their household income to student loan repayment.

© Copyright IBTimes 2024. All rights reserved.