How To Sign Up For Obamacare 2016: Open Enrollment Dates, Prices, Common Health Insurance Questions, Definitions And More

It's that time of year again: Obamacare open enrollment starts Sunday, and the Obama administration is urging people to sign up for health insurance. But choosing the right plan isn't always easy, so here's a thorough guide to demystify the process of buying health insurance through exchanges established by the Affordable Care Act.

What Is The Deadline To Sign Up For Obamacare?

If you need coverage starting Jan. 1, 2016, you must sign up for a plan by Dec. 15, 2015. For coverage starting Feb. 1, 2016, you should sign up by Jan. 15, 2016. The very last day you can sign up for a plan is Jan. 31, 2016, for coverage beginning March 1, 2016. But don’t wait until the last minute to sign up. Last year, many states as well as the federal website experienced glitches at the tail-end of the enrollment period, forcing some states to extend their deadlines.

Can You Walk Me Through The Process Of Buying Obamacare Insurance?

First, you need to know whether your state runs its own healthcare exchange or if it uses the federal platform. You can check here to find which category your state falls into.

There are four ways to sign up for health insurance: online, by phone (check this list for phone numbers), in person (find experts who can help you by entering your ZIP code using this tool), or with a paper application you write on and mail in. Instructions for filling out that paperwork can be found here.

If your state uses HealthCare.gov and you choose to enroll online, read on. First, go to HealthCare.gov and start the process by clicking on 2016 plans.

After you enter your ZIP code, the website will take you through a series of basic questions including for whom you're buying coverage and whether you bought insurance through the federal marketplace in 2015. You also are required to enter your age, sex and estimated pre-tax income for 2016, after which the website will tell you whether you qualify for a tax credit or other discounts for healthcare (scroll down to "tax credit" and "cost-sharing reductions" for more information on these).

There’s also a beta version of an optional tool to help you estimate your annual spending on medical care, based on your healthcare habits. It asks that you estimate your use of medical services in 2016 as low, medium or high, to help you decide later on which plan is the best for you. One caveat, however, is that because the tool is new, “Some information might be incorrect or incomplete,” the website warns.

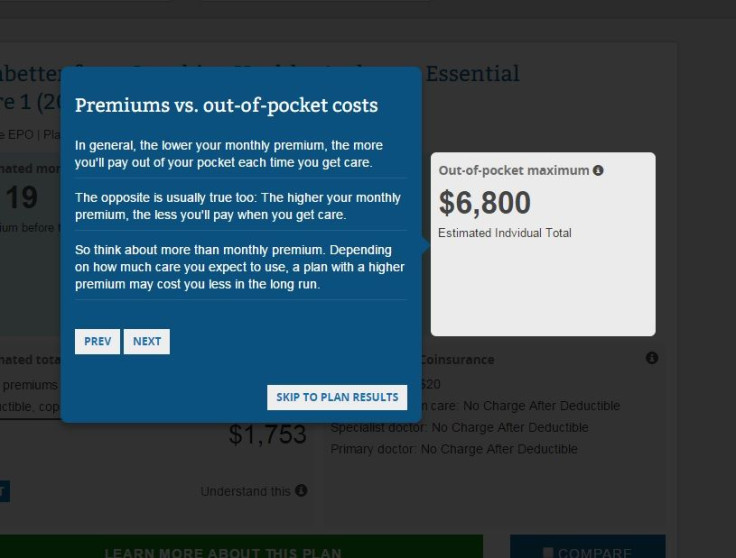

The site then takes you to a list of plans available to you and lays out details including a breakdown of costs and tax credits if applicable. You can also find links to check whether your favorite doctors are covered under a particular plan. If you used the tool to forecast your medical spending, every plan available will include a breakdown of how much you can expect to spend on healthcare over the next year. If you didn’t use the tool, the estimated total yearly costs will not appear.

So much information and so many numbers can be daunting. Sixty-nine plans to choose from? A $6,800 deductible? An estimated tax credit of $79.46 a month? Shopping for health insurance is not a simple process, but it’s not impossible once you grasp the basics. A key point to remember is that plans with lower premiums often have higher deductibles and out-of-pocket costs, and vice versa. People will often be drawn to plans with lower premiums only to be deterred from going to the doctor by deductibles and copays they did not realize were so high. Make sure you fully understand the breakdown of costs before you pick a plan.

What If I Don’t Buy Health Insurance At All?

If you do not have health insurance, through Obamacare or otherwise, perhaps through your employer, you will be required to pay a penalty when you file your 2016 taxes. The amount is 2.5 percent of your annual household income or $695 per adult or $347.50 per child, whichever is higher.

What Are These Tax Credits That The Government Keeps Talking About, And How Do I Qualify?

Eligibility for tax credits that discount the price of your monthly health insurance premium depends on your income and how many people are in your household. Typically, those whose incomes range from 100 to 400 percent of the federal poverty line qualify. Find out here if you qualify for subsidies.

The tax credits are done through advance payments, so you don’t have to pay up front. Instead, you pay a reduced amount every month for your premium. But if you underestimate your income and receive more in tax credits than your actual earnings allow, you have to pay that amount back come tax day. On the other hand, if you overestimate your income and receive too little in advance payment tax credits, you’ll receive credit when you file your 2016 taxes.

What Are Cost-Sharing Reductions?

Cost-sharing reductions are discounts on out-of-pocket costs – costs that you, the consumer, must pay directly – including deductibles and copays. For instance, your insurance plan might have a deductible of $750, but if you qualify for reductions, your deductible might be lowered to $300. Similarly, if your co-pay when you see a doctor is $20, it might be reduced to $10. Those who qualify for these discounts have to meet certain specifications: They must buy a silver plan, which in turn must be purchased through the marketplace, and income must be below a certain threshold. You can use this tool to estimate whether you qualify for any cost-sharing reductions.

I Already Have Insurance Through Obamacare. Do I Need To Sign Up Again?

It depends on your plan. Paperwork from your health insurance company should tell you if you’ll be automatically re-enrolled for 2016. If you did not receive a letter, contact your insurance company, not the marketplace, according to the government.

Whether you’ll be re-enrolled automatically or not, the U.S. government strongly recommends reviewing your plan and updating your records by Dec. 15, 2015. If your information is not accurate and you are receiving tax credits, you may end up having to pay part of it back, or you could wind up with coverage you’re not actually qualified for, or you might overpay for insurance.

In addition, because premiums are slated to rise in some slates, it’s worth checking to see if switching to a different plan from your current coverage would be less expensive. Customers who switched their healthcare plans between 2014 and 2015 saved an average of $400 on premiums over the course of a year compared to those who did not switch, according to the Department of Health.

If your health insurance company says it will not automatically re-enroll you in coverage for 2016, you can sign up through HealthCare.gov as if you were purchasing any new plan.

What Is A Deductible?

A deductible is how much you, as a customer, must pay for medical care before your insurance pays for anything. That means if you have a deductible of $2,000, until you’ve paid that amount in medical expenses, your insurance is not going to cover any costs.

What Is A Co-Pay?

A co-pay is a fixed amount that you, the consumer, pay for a specific healthcare service, like a lab test or a doctor’s visit. Co-pays vary by plan.

© Copyright IBTimes 2024. All rights reserved.