Kenya to remove some tax exemptions in 2011/12 budget

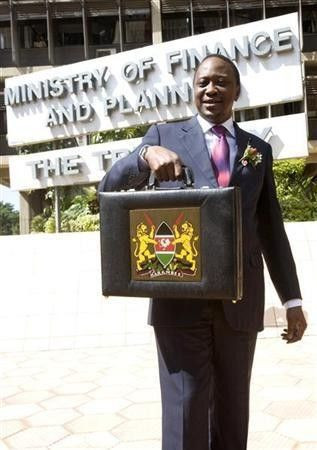

Kenya plans to remove tax incentives in the 2011/12 (July-June) fiscal budget and widen collection to rope in more small businesses to increase revenues, Finance Minister Uhuru Kenyatta said on Monday.

Last week, the International Monetary Fund said east Africa's largest economy could get an extra 40 billion shillings in tax by better collection of value added tax, widening tax brackets and cutting exemptions on imports.

Kenyatta said at present some value added tax exemptions given as investment incentives, were not beneficial and resulted in losses. Kenya's budget is tight as it puts in place a new constitution and spends on heavy infrastructure development.

We are working towards trying to remove some of the types of incentives that had been introduced in the VAT tax regime that are not necessarily useful, Kenyatta told a news conference.

In many ways they have resulted to leakages and we hope to include those measures in the upcoming budget.

Kenya's revenue for the first half of 2010/11 (July-June) fiscal year fell short by about 5 billion shillings to 303.1 billion shillings.

Kenyatta added that the government planned to get extra revenues from small businesses that operate informally.

We are looking at how we can expand the our (tax) base to raise additional revenues by bringing in the informal sector to raise additional revenues, he said.

Kenyatta did not give details on specific tax exemptions. It normally holds its budget on the second Thursday in June.

Kenya, a net importer, exempts exporters from paying value added tax, which is charged at 16 percent. .

The International Monetary Fund said the global financial crisis had lead to deterioration of fiscal accounts, which had forced many countries to spend more , but called upon effective revenue collection.

Very often these (tax) exemptions do not actually achieve what they are meant to achieve and they cause very large losses to the budget, said Carlo Cottarelli, director of fiscal affairs at IMF.

The Kenyan government and IMF are hosting a two-day conference to examine ways of increasing revenue collection in sub-Saharan Africa. IMF says that some countries in the region lose almost half their tax revenues through evasion.

© Copyright IBTimes 2025. All rights reserved.