Li Ka-Shing Hits Back At ‘Cultural Revolution Style’ Chinese Media Attacks On His Asset Sales In China

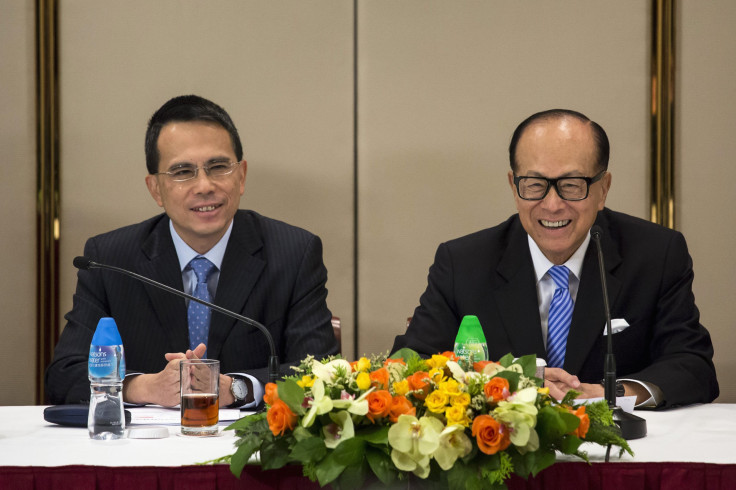

SHANGHAI -- Hong Kong’s richest man Li Ka-shing has hit back at Chinese media in a row over his decision to sell off some of his assets in China. Li suggested claims from critics online and in official media that he was unpatriotic were chillingly reminiscent of “Cultural Revolution-style thinking.”

His comment was a reference to the Maoist political movement of the 1960s, which led to millions being denounced, jailed or killed for capitalist tendencies. However, Li said he did not believe these criticisms represented the views of the Chinese government. The bitter attacks over the past week have stirred both debate in China, and fears among investors about the safety of investing in the country.

Li, a long-time supporter of the Chinese leadership, has been attacked online as an “evil capitalist” after announcing plans to sell off real estate investments, including a $2 billion project in Shanghai. A commentator at a think tank linked to the official Xinhua News Agency accused him of abandoning the country and undermining public confidence, by selling off holdings at a time of “economic tension” and slowing GDP growth.

“Don’t let Li Ka-shing run away,” the commentary pleaded, accusing him of “double standards” and “egocentric self interest,” since he had previously benefited from his close ties with the government, and tax breaks and other incentives, to develop projects in China. Meanwhile, the People’s Daily, a government mouthpiece, said China should build up its economy to make sure Li regrets his decision to pull out.

However other Chinese media later stepped in to defend Li’s right to make decisions based on business logic in a globalized economy. And the 87-year-old billionaire finally broke his silence in a strongly worded response to what he called “groundless allegations,” on Tuesday.

Emphasizing that he personally would not “reap any proceeds” from the restructuring, Li expressed “deep regret” at the “twisted logic and language of the articles,” which he said “sent a shudder of fear down one’s spine.” He said he had not spoken out sooner because he did not wish to undermine President Xi Jinping’s message about deepening economic reforms during his just-concluded state visit to the United States, and didn’t want to cause unnecessary worry to the commercial sector and investors. Expressing his "deep admiration for President Xi’s stable leadership," Li said he was confident that China's leaders were committed to reform, and were striving to “improve the business environment” in what he called “Our beautiful and beloved country.”

The statement also emphasized Li’s charitable donations to China: he famously gave a university to his home town of Shantou in Guangdong province, and the statement said he had given a total of just over $2 billion to projects in the greater China region.

The tycoon, the warmth of whose ties with previous leaders Jiang Zemin and Hu Jintao is not seen as being echoed by those with current President Xi Jinping, this year began restructuring his business interests -- which range from supermarkets and drugstores to container ports, real estate and telecommunications giant 02. He has merged his two main businesses, Cheung Kong and Hutchison Whampoa to form CK Hutchison, and has moved its base from Hong Kong to the Cayman Islands, while investing more in Europe.

Analysts said the angry criticisms of Li’s move reflected fears it would hit investor confidence. However the unprecedented row over a man who for decades has displayed unswerving loyalty to the Chinese government has highlighted worries that the current slowdown could stoke nationalist sentiment in China, something Hong Kong's South China Morning Post said “casts a shadow over the welcome mat” Xi promised to investors during his U.S. trip.

It has also highlighted anxiety about the potential for capital flight from China in current economic circumstances. Worries about China’s economy and the yuan, which was devalued by some 2.8 percent in August, compounded by speculation that the U.S. would raise interest rates, saw China’s foreign exchange reserves fall by $93 billion in August, according to official figures.

The Chinese government has played down the risk of capital flight -- saying the outflow was not “abnormal nor large scale.” However it has taken steps to limit currency movement. This week the State Administration of Foreign Exchange said it was limiting how much Chinese travelers could spend on their Chinese bank cards while abroad, and the South China Morning Post said there would be an annual cap of 100,000 yuan (about $16,000) next year, and 50,000 yuan over the next three months.

© Copyright IBTimes 2024. All rights reserved.