'Light On The Horizon': German Business Morale Improves

German business morale rose more strongly than expected in March, a key survey showed Friday, raising hope there is "light on the horizon" for Europe's crisis-hit top economy.

The Ifo institute's closely watched confidence barometer, based on a survey of around 9,000 companies, rose to 87.8 points, from 85.7 in February.

Analysts surveyed by financial data firm FactSet had forecast a reading of 86.

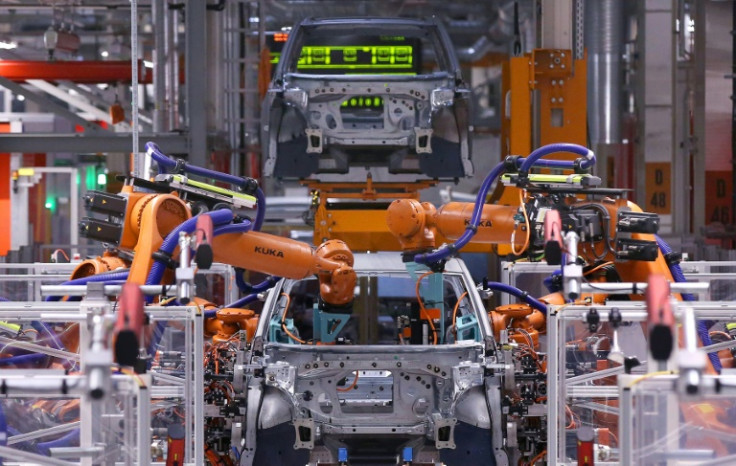

The improvement will bring hope that the eurozone's traditional growth engine is starting to recover after being battered by surging inflation, higher interest rates and an industrial slowdown.

"Sentiment in German companies has improved noticeably," Ifo president Clemens Fuest said.

"The German economy glimpses light on the horizon."

The business climate reading rose across all sectors surveyed by Ifo in March -- manufacturing, services, trade and construction.

The component of the index that refers to future expectations rose sharply, although the component covering businesses' current situation increased more modestly.

Despite the improvement, ING economist Carsten Brzeski noted that the reading "is still far lower than levels seen last summer".

Combined with other recent more positive data, "the message is clear", he said.

"The German economy is bottoming out -- but a strong recovery is not in sight yet."

He warned of several factors that could hit growth in the short term, including supply chain woes caused by tensions in the Red Sea and a wave of recent strikes.

Andrew Kenningham of Capital Economics added that "the outlook remains very gloomy".

"Stagnant real incomes, the continued drag from high interest rates, weak external demand and tight fiscal policy all suggest that the economy is unlikely to grow much, if at all, over the rest of the year."

Kenningham and other analysts predict the economy will contract for a second successive quarter at the start of this year, sending Germany into a technical recession.

Output shrank 0.3 percent last year and while a rebound is expected this year, growth is still expected to be weak.

In recent times, the German government, the central bank and economic institutes have all downgraded their 2024 growth forecasts, predicting the recovery will take longer than previously expected.

© Copyright AFP 2024. All rights reserved.