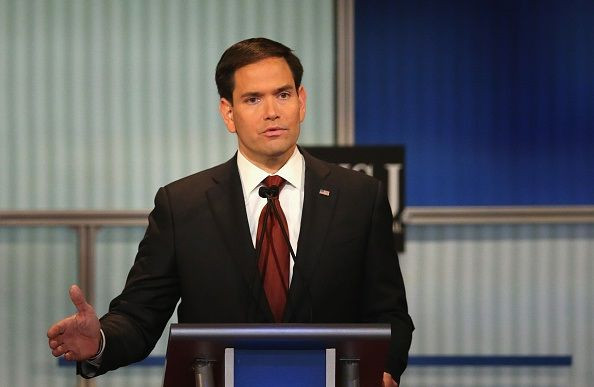

Marco Rubio Reels In More Wall Street Cash Than Any Other Candidate For President In 2016: Report

Marco Rubio appears to be Wall Street’s preferred candidate for president. According to a Reuters review of campaign finance disclosures, the Republican senator from Florida has raked in more cash from banks and investment firms than any other candidate vying for the White House in 2016.

Rubio has received more than $4 million from employees of banks and investment firms so far. His closest competitor for Wall Street donations was Jeb Bush, who announced Saturday that he was dropping out of the race for the Republican nomination after a string of disappointing primary results. The former Florida governor reeled in $2.45 million from Wall Street. Democratic contender Hillary Clinton came in third with $723,361.

The amounts include contributions to the campaigns and their allied super PACs, officially unaffiliated organizations that spend money in support of particular candidates. The largest pro-Rubio super PAC is the group Conservative Solutions. The group Priorities USA, meanwhile, has spent considerably on behalf of Clinton.

With Bush now out of the race, some of his donors may redirect their support to Rubio, according to Reuters, which spoke with Bush backers. The Florida senator is widely seen as the establishment favorite against front-runner Donald Trump and fellow nominee seeker, Texas Sen. Ted Cruz. Rubio bested Cruz for second place in South Carolina but has not yet won a primary himself. Trump has carried New Hampshire and South Carolina, losing Iowa to Cruz.

Cruz, for his part, hauled in just under $85,000 from Wall Street. Trump, meanwhile, received a paltry $1,566.

Democratic contender Bernie Sanders, the self-described socialist who has called for breaking up the largest banks, took in $26,650 from Wall Street employees.

A poll released Monday by the Associated Press-NORC Center for Public Affairs Research underlined public anxieties about the financial sector: More than half of those polled said they considered “regulating financial institutions and markets” to be important. Forty-two percent said post-2008 crisis regulations have not gone far enough; 31 percent said they’re about right and 25 percent believe they’ve gone too far.

© Copyright IBTimes 2025. All rights reserved.