New York Board Of Trade Dismisses Last Human Traders: A Look At Other Bygone Exchanges

For a set known mainly for how loud they used to be, they sure went down with a whimper.

In a development that quietly heralded the end of a 140-year-old tradition, traders on Friday marked the final day of the rowdy "open outcry" practices that used to define the New York commodity trading pits, like those of "Trading Places" fame.

The occasion came as the inevitable denouement of a process that began in 2006, when exchange operator IntercontinentalExchange Inc. (NYSE: ICE) first replaced specialists executing orders on the trading floor with computers.

ICE had previously eliminated all nonelectronic trading in its agricultural and petroleum futures exchanges. But the complexity of options trading for goods such as cocoa, coffee, eggs, orange juice and sugar meant there were still places for about 200 flesh-and-blood specialists. With the closing of its agricultural options pit, ICE became the first commodity exchange in the U.S. to fully eliminate the open-outcry system.

Traders who return to work Monday will be there only to help computers process orders, sitting in cubicles at the edges of the gargantuan trading hall, according to the Wall Street Journal. Many will simply hang up their blue-and-yellow trading jackets and move on to other careers, trading from home, or retirement.

"I didn't think I would get sentimental, but looking around it, I am," Jonathan Kleisner, managing director at REX Capital Partners, told the Journal, as he surveyed the desolate trading floor on Thursday.

There is no doubt the end of human-to-human trading on the floor of what used to be the New York Board of Trade represents a milestone. It is the latest chapter in a long history that has seen New York exchanges, once varied, open and plentiful, slowly become more private, consolidated and scarce.

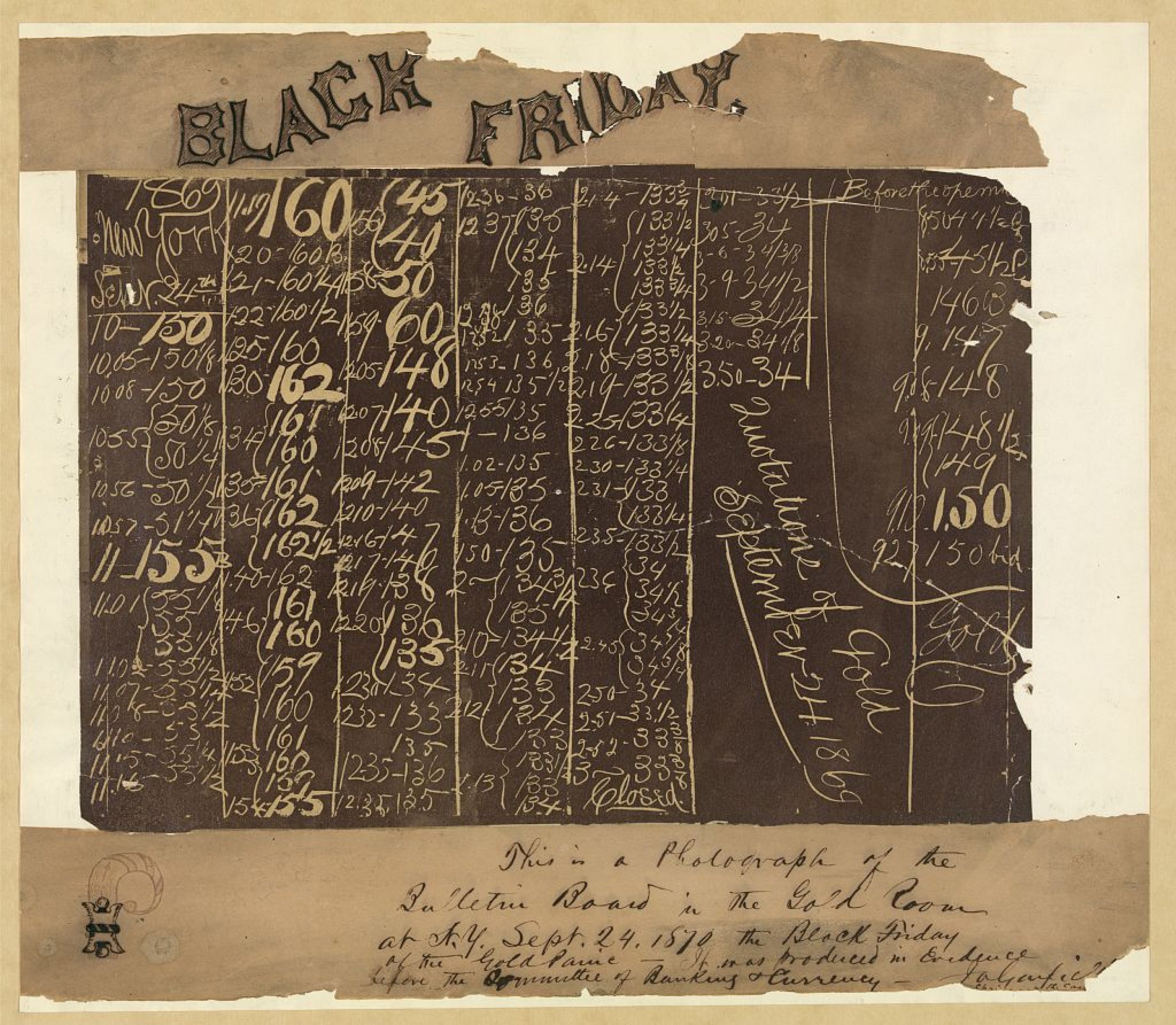

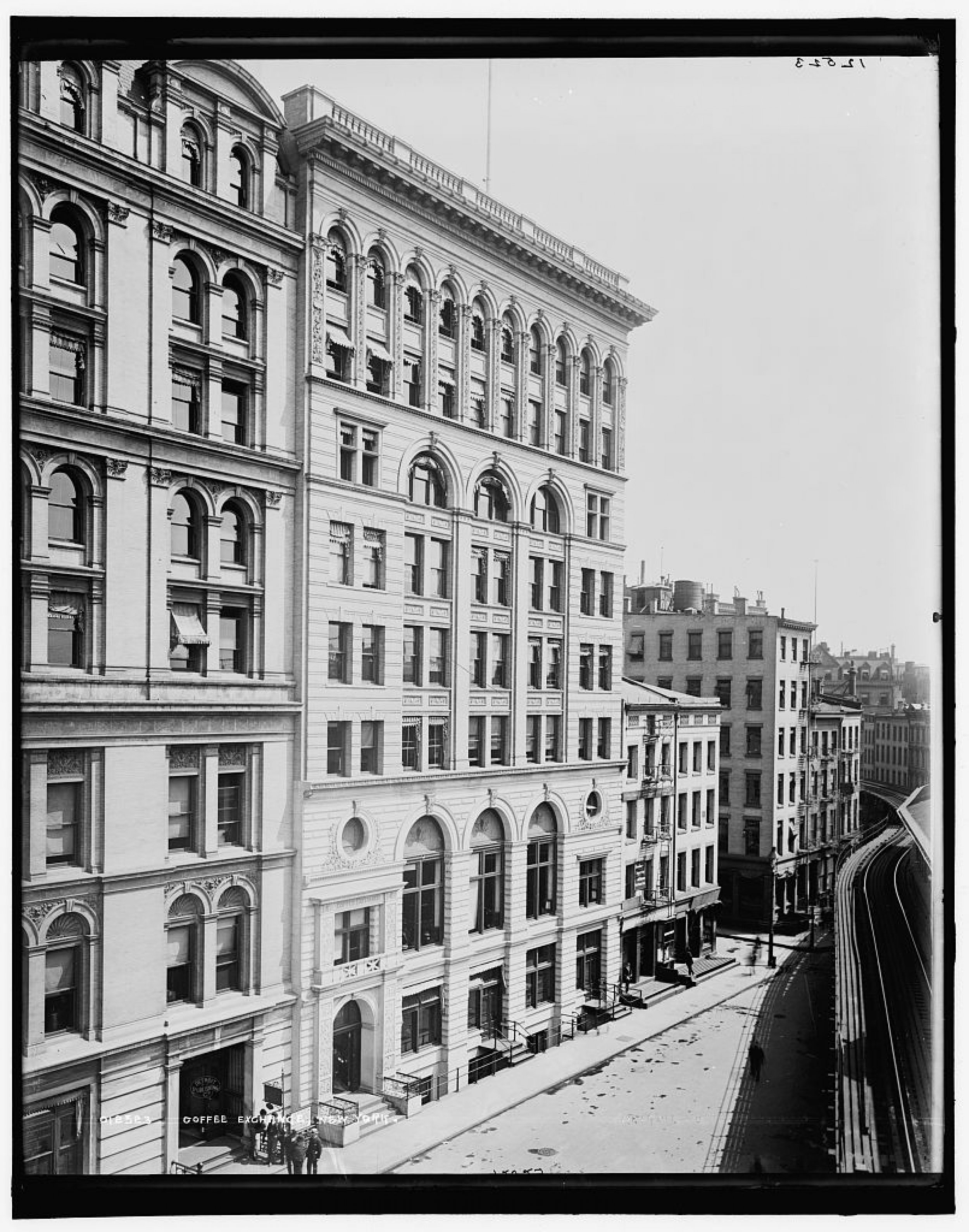

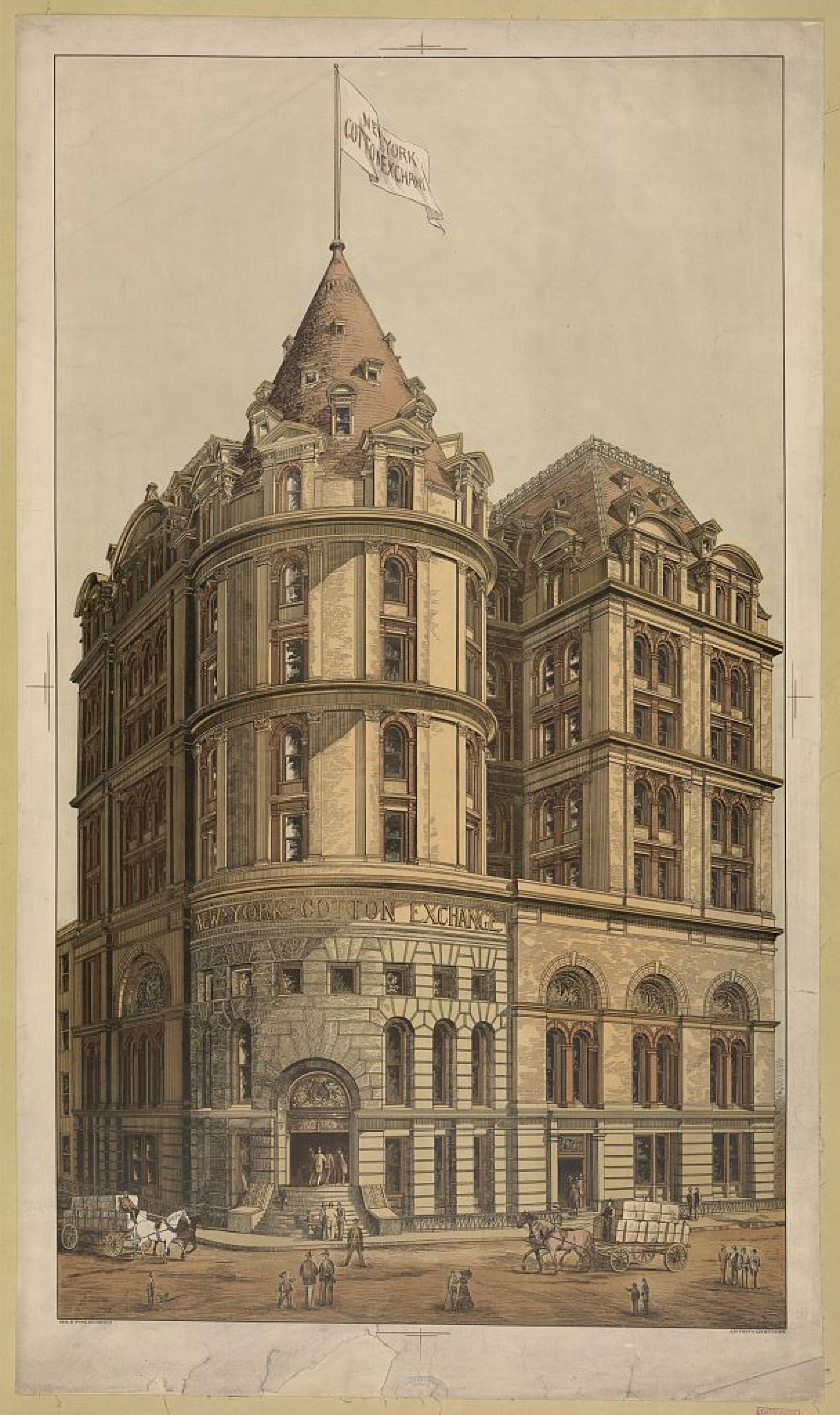

Compared with the mid-19th century -- when all it took to be a "stockjobber" was a loud voice and the ability to stand with a crowd of traders on a corner of Lower Manhattan; when separate cocoa, coffee, corn, cotton and produce exchanges were set up around New York; and when a notorious futures trading pit conducted its after-hours business in the basement of a Midtown hotel -- trading at present is an absolutely antiseptic affair.

To commemorate the long history of commodities trading in New York, the following slideshow features some long-gone exchanges. Click "Start" to view it.

© Copyright IBTimes 2025. All rights reserved.