Pfizer-Allergan Merger: Tax Inversion Deal Would Help US Pharma Giant Dodge $35B In Taxes, Report Says

U.S. pharmaceutical giant Pfizer will be able to avoid an estimated $35 billion in taxes by merging with Botox-maker Allergan and shifting its headquarters to Ireland, Americans for Tax Fairness (ATF) — an advocacy group — alleged in a report released Thursday.

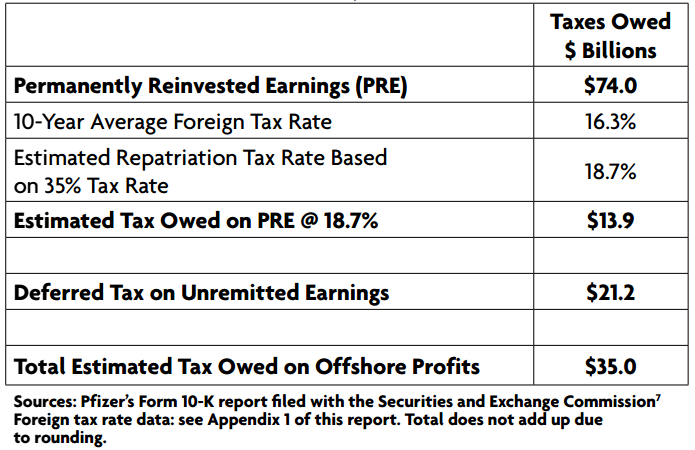

The figure is based on two of Pfizer’s disclosures — the first one stating that as of 2014, the company had a deferred tax liability of $21.2 billion on unrepatriated foreign earnings, and a second one revealing that it has about $74 billion in overseas earnings that it plans to hold there indefinitely.

According to ATF, as a result of the $160 billion corporate tax inversion deal that Pfizer finalized in November, the company would be able to “permanently dodge” U.S. taxes owed on about $148 billion in profits it currently maintains offshore.

If the $74 billion is repatriated to the U.S., ATF said that Pfizer would have to pay approximately $13.9 billion in taxes at an estimated tax rate of 18.7 percent. This, combined with the deferred tax liability of $21.2 billion, yields a figure of roughly $35 billion.

“By dodging taxes while boosting prescription drug prices, Pfizer squeezes American families and communities from two sides at once,” ATF Executive Director Frank Clemente said in a statement accompanying the report. “If Pfizer wants to be an Irish company to cut its taxes but still be based in America, then it should charge American patients the same much lower drug prices it charges Irish consumers. Pfizer charges 12 times as much, on average, on this side of the Atlantic under the Medicare program for the same seven top-selling drugs as it charges in Ireland.”

The report would provide further ammunition to U.S. lawmakers who, in recent years, have become increasingly frustrated by the flood of companies moving overseas to lower their tax rate. Pfizer’s deal with Allergan, which would create the world’s largest drugmaker, was followed by one from Johnson Controls, which announced January that it would merge with Tyco and move its headquarters to Cork, Ireland.

The corporate tax rate in Ireland is 12.5 percent — one of the lowest in the world — compared with 35 percent in the U.S., which is the highest in the developed world.

© Copyright IBTimes 2025. All rights reserved.