PMI Rises In Egypt, A Sign That Country's Economic Woes May Soon Be Over

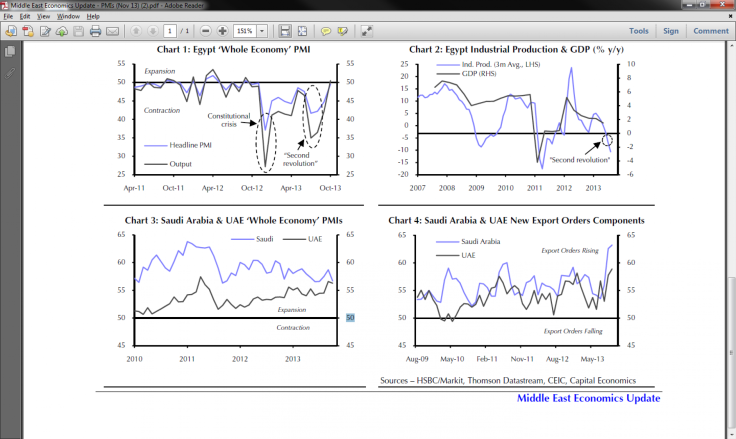

In a sign that its economy may be recovering from the fallout caused by the second revolution, Egypt’s Purchasing Manager’s Index rose to 49.5 last month, it’s highest level in 11 months, up from 44.7 in September.

The main output index, one of the constituent measurements of the PMI headline index, rose above the 50 mark, the demarcation point between expansion and contraction.

Data showed a sharp economic deterioration following the ouster of former President Mohammed Morsi. Industrial production contracted year-over-year in July and August while the tourism industry collapsed, according to a report by Jason Tuvey, assistant economist at Capital Economics.

Because of the limited data history, it is difficult to gauge the relationship between PMI and hard activity data. Despite this, there are other external signs of hope -- mainly the government’s $3.2 billion stimulus package.

However, it’s doubtful that a strong recovery can occur before political tensions -- highlighted by the acrimonious beginning to Mr. Morsi’s trial Monday -- have eased and the country enters a period of renewed stability.

Other Gulf state economies continue to expand. While the whole economy PMI fell back in October in both Saudi Arabia and the United Arab Emirates, both nations remain far above the 50 mark.

© Copyright IBTimes 2024. All rights reserved.