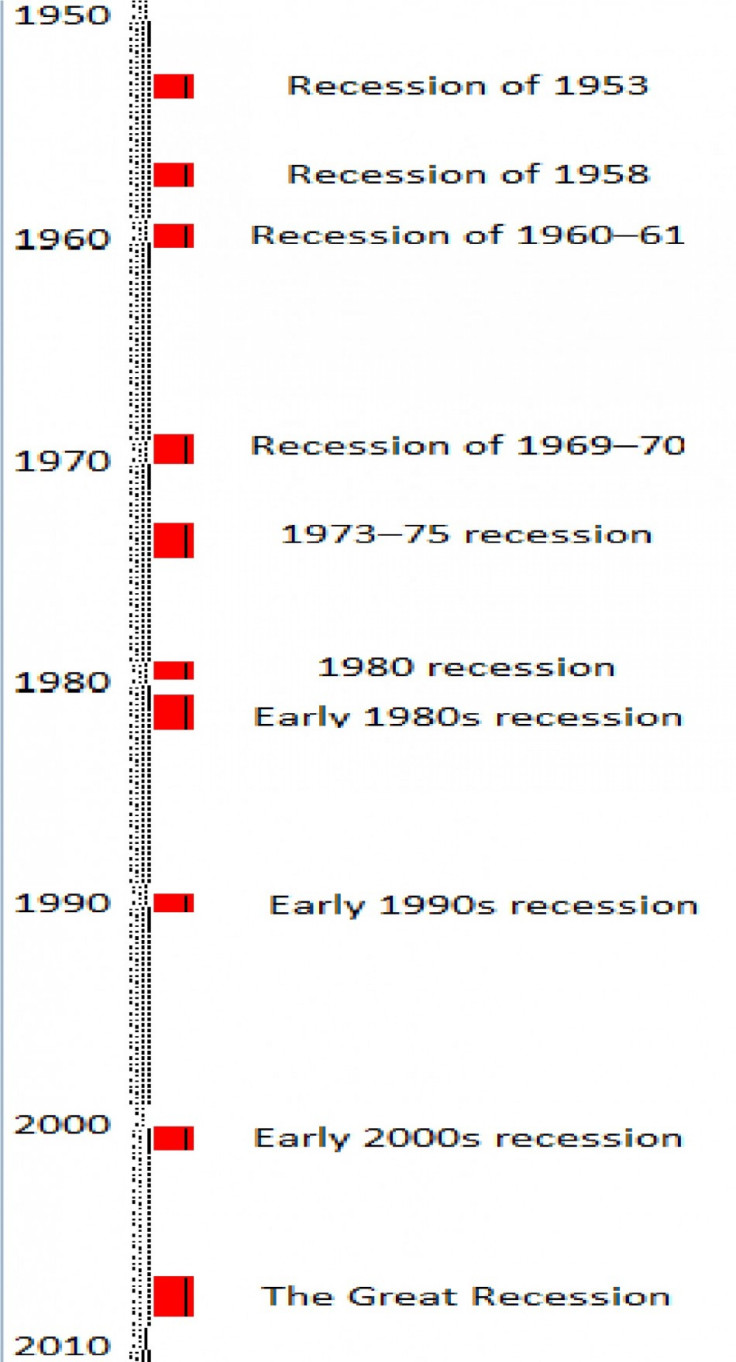

Recession Fears: It's Coming Because ... It’s About Time? [CHART]

When legendary investor Jim Rogers was asked if a recession is coming soon, he said recessions come “because, because, because.”

For one reason or another, recessions occur in America “every four to six years,” he said.

“We’re overdue late in 2011, in 2012, 2013,” he said.

Rogers is right.

The longest economic expansion in U.S. history (occurring mostly under the Clinton administration) was 10 years. That period was boosted by an IT revolution, asset boom, and relatively low-interest rates.

Usually, though, it’s less than 10 years, or about 4 to 6 years (see chart below).

The Great Recession ended in June 2009, according to the National Bureau of Economic Research (NBER).

At the end of 2011, it will have been 2.5 years. Although it would be unusual for the economy to relapse in such a short time by 2011, it occurred in a shorter time-span in the early 1980s.

Rogers said he is troubled that measures meant to combat the European debt crisis only add more debt to the indebted countries.

He also said when the next recession comes, the U.S. government will be low on options because it already printed huge amounts of money and took on an enormous debt burden in response to the Great Recession.

E-mail Hao Li at hao.li@ibtimes.com.

For more useful global markets information, visit ibtimes.com/sections/global-markets.

© Copyright IBTimes 2025. All rights reserved.