Record $80 Billion Left Bond Mutual And Exchange-Traded Funds In June: TrimTabs Report

A staggering $80 billion left exchange-traded and mutual bond funds in June, twice the amount pulled from bond funds during the worst of the 2008 financial crisis.

According to TrimTabs Investment Research, bond mutual funds lost about $70.8 billion in June, while bond exchange-traded funds lost $9 billion, according to CNBC.

TrimTabs CEO David Santschi attributed the record outflows to higher bond yields, often up to 2.5 percent, and the resulting drop in bond prices plus hints from central banks that monetary stimulus could slow or stop in the near future.

“The herd is scrambling for the exit this month,” Santschi wrote in a research note.

TrimTabs said the “unprecedented” exit from bonds could even step up in coming weeks as bond investors see their incoming quarterly statements and realize their “safe” bond funds are losing, not gaining.

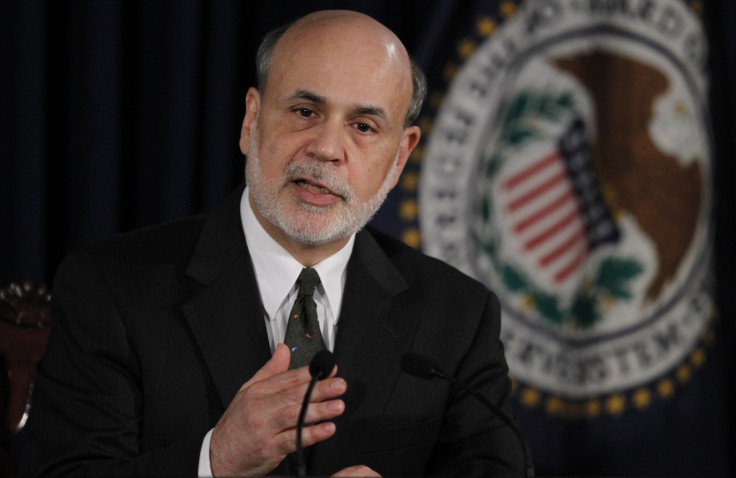

Bond yield rates on 10-year U.S. treasuries, a key benchmark, have fluctuated heavily in recent weeks, with investors hanging on every word coming from the Federal Reserve and its chairman, Ben Bernanke.

Investors poured $109.6 billion into bond funds earlier this year, as they banked confidently on heavy and continued central bank stimulus.

© Copyright IBTimes 2025. All rights reserved.