Reforms In France To Further Constrain Short-term Economic Growth

France is now seen as the new “sick man of Europe.” At a time when many other European countries are tackling their own competitiveness issues, the single currency bloc’s second-largest economy is struggling to revive its moribund economy.

Over the past three years, France’s economic growth has averaged only 0.8 percent, half of Germany’s 1.6 percent. In recent months, France’s recovery has even fallen behind that of some peripheral countries such as Spain.

Since the beginning of the year, business and consumer surveys have moved sideways at best. “We remain cautious about the capacity of the economy to rebound, particularly amid ongoing policy uncertainty,” said Barclays economist Fabrice Montagne.

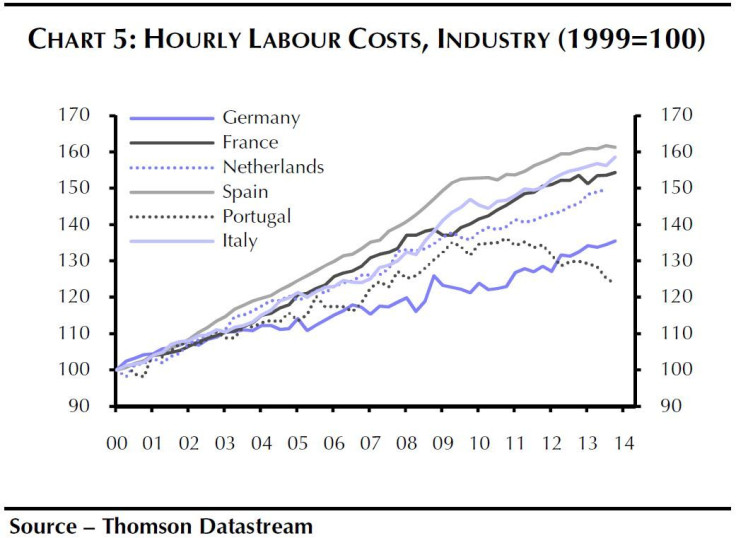

While domestic demand has grown at a decent pace over the last decade, there has been a significant deterioration in the external sector. France’s trade balance has gradually slid from a surplus of 1 percent of gross domestic product in 1999 to a deficit of 3 percent last year.

“The deterioration in France’s external sector reflects both cost and productivity pressures on French firms," according to James Howat, an economist with Capital Economics.

French nominal labor costs are amongst the highest in the euro zone, but its output per capita between 1999 and 2013 was one of the lowest in the Organization for Economic Co-operation and Development.

“France’s onerous regulatory environment, particularly the country’s dysfunctional labor market rules, probably explains much this poor performance,” Howat said.

According to the World Economic Forum, France’s labor market efficiency ranks 71st out of 148 countries, with hiring and firing practices ranked as the 144th most efficient. Even at the height of the boom years in early 2008, the French unemployment rate only fell to 7.4 percent.

With public debt already equivalent to 93.5 percent of GDP and the peripheral economies implementing their own structural reforms over the last few years, the costs of inaction are mounting for France.

Against this background, President Francois Hollande has already announced two key policies – labor market reform and tax cuts – to revive the French economy.

Although a weak labor market and additional fiscal austerity will weigh on the French economy this year, Capital Economics expects growth to pick up in 2015.

“While the French economy may not be the ticking time-bomb it is sometimes portrayed as, the country’s reform efforts may disappoint its external partners, straining the Franco-German axis that has traditionally driven euro zone policymaking,” Howat said.

© Copyright IBTimes 2024. All rights reserved.