The Rent Really Is Too Damn High: Harvard Study

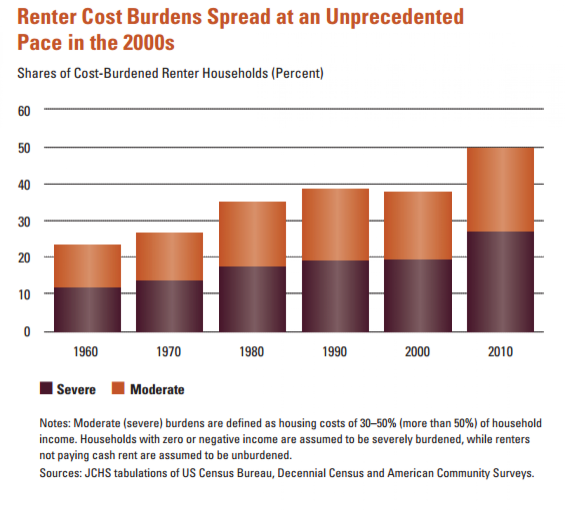

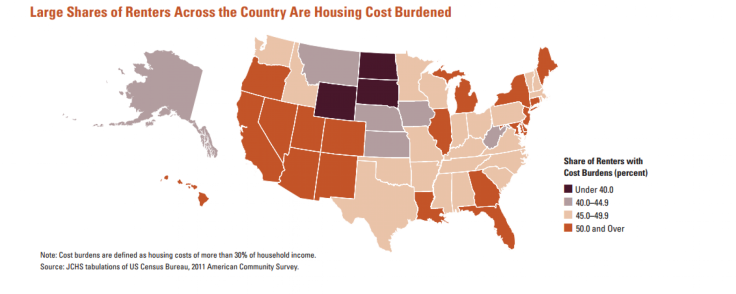

Half of all American renters now spend more than 30 percent of their income on housing, as growing demand from people who are either unable or unwilling to purchase homes drives up prices.

That's the depressing reality revealed in a new study from Harvard University's Joint Center For Housing Studies.

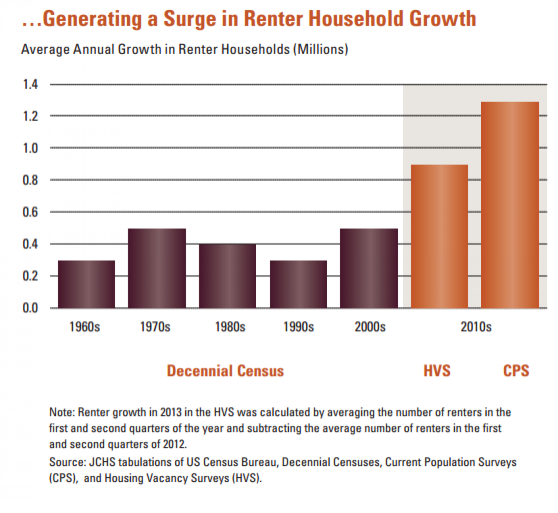

"Reversing the long uptrend in homeownership, American households have increasingly turned to the rental market for their housing. From 31 percent in 2004, the renter share of all U.S. households climbed to 35 percent in 2012, bringing the total number to 43 million by early 2013," the study's authors said.

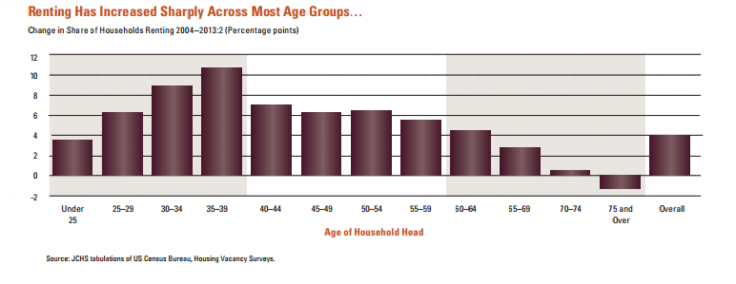

That shift toward renting has been seen across all age groups except the oldest demographic, while the largest increase has been in the 30-39 group. The number of people in that age group joining the rental market rose 9 full percentage points over a recent eight-year span, the report said.

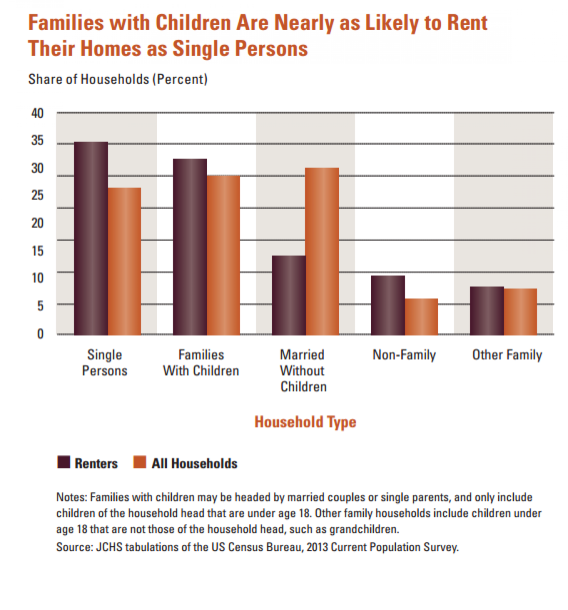

Here, a series of charts from the published study explain the reality facing renters in the U.S. today.

(Note: Display photo by Shutterstock.com.)

© Copyright IBTimes 2024. All rights reserved.