Rising US Income Inequality Is Hurting State Tax Revenues: S&P

Rising income inequality is hurting state tax revenues, according to a Standard & Poor’s report released Monday.

The analysis builds on a previous one this year by S&P that said the widening gap between the wealthiest Americans and everyone else has slowed the economy’s recovery from the Great Recession.

For the past five years, wages have risen for the wealthiest Americans while barely floating above inflation for most people. Since the wealthy tend to shelter much of their income from taxes and save more than others, they often limit sales tax revenue growth, the report argues. Consumer spending fuels about 70 percent of the economy.

"When the economy operates below its potential, state tax revenues tend to suffer," the report said.

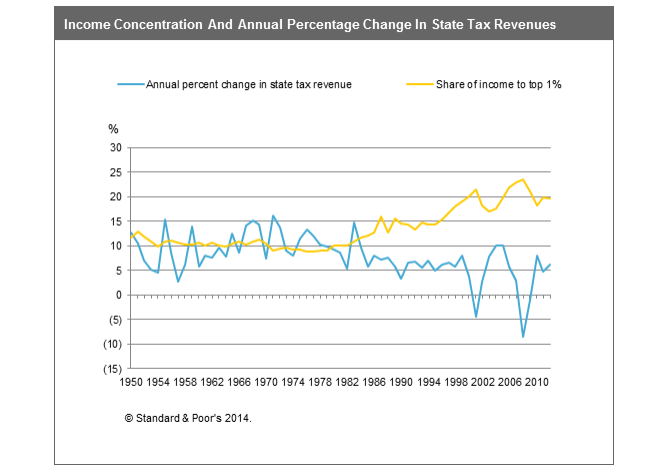

From 1980 to 2011, the average annual state tax revenue growth fell by half, from 10 percent to 5 percent, while the total income doubled for the richest 1 percent, the report said. Before income inequality began to rise steadily, state tax revenue grew by about 10 percent each year from 1950 to 1980.

States facing slower tax revenue growth must decide whether to raise taxes or cut spending to balance their budgets as legally required. As most people have not seen their wages rise much, states are under more pressure to maintain funding for schools, highways and social programs, but these rely on tax revenue from current economic activity like personal income and consumption.

Across all states, sales taxes make up about 30 percent of revenue, personal income taxes another 36.6 percent, and the rest comes from other taxes like those on fuel, alcohol and cigarettes, according to the National Conference of State Legislatures.

A rise in untaxed services like Netflix subscriptions, online dating services and mp3 downloads has also contributed to the slowdown in states’ tax revenue growth, so some states are trying to tax more online services.

And the 33 states with progressive tax features rely more on the wealthiest to generate tax revenue, which has made it harder for those states to plan budgets. The income of those states varies significantly year to year as they depend more on the financial markets, where many of the wealthiest earn their income.

But S&P says tax code revisions won’t fully repair the problem.

"The findings from our research indicate that tax revenue growth slows as income inequality rises, regardless of a state's tax structure," the report said.

© Copyright IBTimes 2025. All rights reserved.