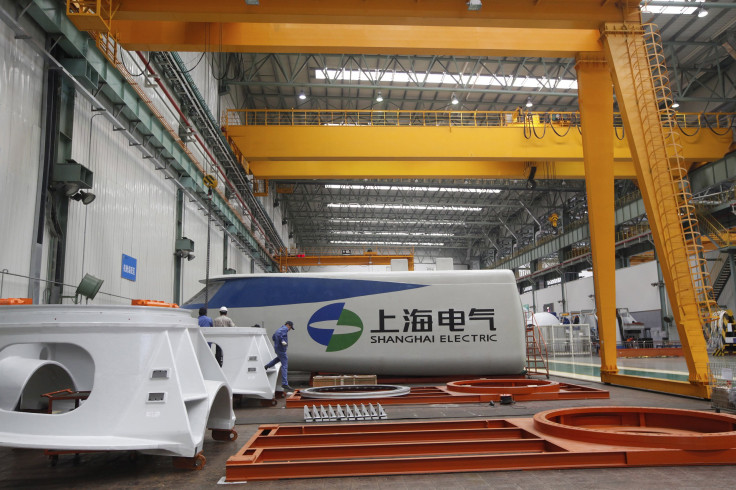

Shanghai Electric To Take Stake, May Bid For Manz

Chinese power and electrical group Shanghai Electric has agreed to buy at least a quarter of German technology group Manz in a deal that could lead to a full takeover offer, Manz said Sunday.

The acquisition, the latest in a recent string of Chinese takeovers of German technology companies, will be carried out through a rights issue in which Manz will issue new shares to increase its capital by about 43 percent.

The German group, which makes machines to produce solar panels, smartphone displays and batteries, and counts Apple as a major customer, said the rights issue would give Shanghai Electric at least 27 percent of the newly expanded share pool or a maximum of 29.9 percent.

The deal shows the growing momentum of Chinese buyers as they race to acquire expertise in technologies deemed strategic by their government. The increasing Chinese appetite has enabled German sellers to obtain better prices than they would otherwise fetch.

So far this year ChemChina has agreed to buy German industrial machinery maker KraussMaffei for $1 billion, Beijing Enterprises Holdings to buy Germany's Energy from Waste for 1.44 billion euros ($1.62 billion) and Chengdu Techcent Environment Co. to buy Bilfinger's water treatment unit for 200 million euros.

Manz, which reported a loss for the first nine months of 2015, had said it was carrying out a strategic review of its solar business along with a group restructuring. The company has a market value of 204 million euros ($223 million).

Shanghai Electric has agreed to buy all of the new Manz shares not subscribed to by existing shareholders, including a 35.2 percent stake held by Chief Executive Dieter Manz, and a further 3.8 percent owned by his wife Ulrike Manz, both of whom will not exercise their subscription rights.

The subscription offer for the new shares is expected to take place during the first six months of 2016 and the price will be set as close as possible to the market, up to a maximum of 40 euros per share, Manz said.

Manz shares closed at 37.35 euros ($40.80) on Friday.

Manz and Shanghai Electric also agreed to allow the Chinese group to request voting rights from Dieter Manz, enabling it to reach the 30 percent threshold that would trigger a mandatory takeover offer to other shareholders.

Dieter Manz, 54, will remain chief executive and has had his contract extended by five years, Manz said, adding that he intends to continue to hold a major participating interest in the company.

© Copyright Thomson Reuters 2024. All rights reserved.