Tax Free Weekend 2014: Dates And List Of States Offering No Sales Tax In August

It may feel as though summer just started, but it’s already time to begin shopping for back-to-school. Thankfully, this weekend, when many states will celebrate Tax Free Weekend, is your chance to save.

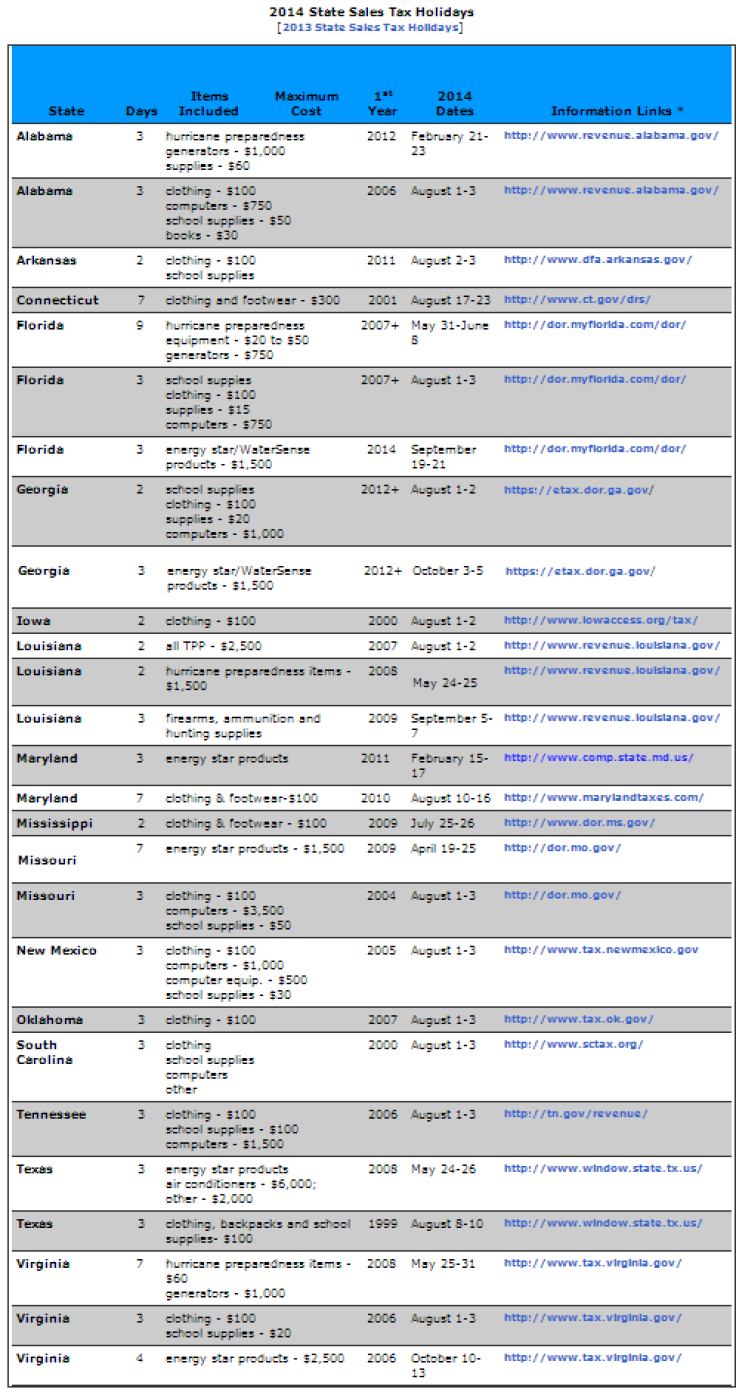

Tax Free Weekend is a holiday where no sales tax is tacked onto purchases for eligible items on a state-by-state basis. For the first weekend of August and several weekends thereafter, 16 states won’t impose sales tax on select items during the tax-exempt promotion. Consumers will save on many items for back-to-school like clothing, footwear, computers and school supplies.

The tax-free deals work automatically, with no special coupons or rebates needed. Stores will deduct the sales tax from purchases at the register in participating states. Consumers who live in states that do not offer tax exemptions during the weekend can simply travel to states that do and shop there.

Tax Free Weekend is an annual tradition generally held in the first two weekends in August to promote back-to-school shopping. The list of items eligible is long but each state has its own list of eligible items as well as the price cap for those items. Offers.com has a handy guide to review which items qualify in each state.

Some states only hold the holiday on Saturday and Sunday, while others include Friday. Other states like Connecticut and Maryland extend the tax-free holiday long past the weekend, ranging from a couple extra days to an entire week.

Alabama, Florida, Georgia, Iowa, Louisiana, Missouri, New Mexico, Oklahoma, South Carolina, Tennessee, Texas and Virginia will participate beginning Friday. Arkansas starts a day later on Saturday. Connecticut and Maryland start theirs mid-way through August on the 17th and the 10th, respectively. Texas begins its Tax Free Weekend Aug. 8. Mississippi already held its promotion last Friday and Saturday.

North Carolina offered Tax Free Weekends in past years but will not offer it again this year following repeal July 1. Offers.com also noted Massachusetts will offer a tax-exempt weekend but it is unclear on which weekend it will be held. The site reported it could occur either Aug. 9-10 or 16-17.

Alaska, Delaware, Montana, New Hampshire and Oregon don't impose sales tax and will continue their regular policies. The other 45 states and the District of Columbia impose sales taxes ranging from as low as 2 percent to nearly 12 percent on goods. However, Pennsylvania and Vermont never charge sales tax on clothing.

Here's a list of participating states this weekend as well as dates and items eligible for the tax exemptions. Visit your state’s Department of Revenue website to review qualifying purchases. Stores will generally begin offering tax-free items effective at 12:01 a.m.

Alabama: Aug. 1-3; clothing, computers, school supplies, books

Arkansas: Aug. 2-3; clothing, school supplies

Connecticut: Aug. 17-23; clothing and footwear

Florida: Aug. 1-3; clothing, computers, school supplies; Sept. 19-21 for energy star/WaterSense products

Georgia: Oct. 3-5; energy star/WaterSense products

Iowa: Aug. 1-2; clothing

Louisiana: Aug. 1-2; all TPP (tangible personal property); Sept. 5-7 for firearms, ammunition and hunting supplies

Maryland: Aug. 10-16; clothing and footwear

Mississippi: July 25-26; clothing and footwear

Missouri: Aug. 1-3; clothing, computers, school supplies

New Mexico: Aug. 1-3; clothing, computers, school supplies, computer equipment

Oklahoma: Aug. 1-3; clothing

South Carolina: Aug. 1-3; clothing, computers, school supplies and more

Tennessee: Aug. 1-3; clothing, computers, school supplies

Texas: Aug. 8-10; clothing, backpacks, school supplies

Virginia: Aug. 1-3; clothing and school supplies

© Copyright IBTimes 2024. All rights reserved.