Tesla Motors Inc (TSLA) Shares Hammered: Price Touches 52-Week Low Ahead Of Crucial Earnings Report

Shares of Tesla Motors plunged 9 percent Monday as investors questioned the electric car company’s ability to meet important benchmarks this year. The stock closed at its lowest price since Dec. 18, 2013, after touching a 52-week low earlier in the day.

Investors appeared to be focused on recent guarded comments from bullish analysts who observed that production and delivery for the new Model X sport utility vehicle was slower than had been anticipated late last year.

“We believe [Wall] Street estimates may need to be lowered to reflect the Model X production ramp,” Ben Kallo, Baird’s energy technology analyst, said in recent note to investors. Kallo estimates that the company ended 2015 producing about 238 Model X vehicles a week and needs to be currently producing about 450 a week to meet delivery targets in 2016.

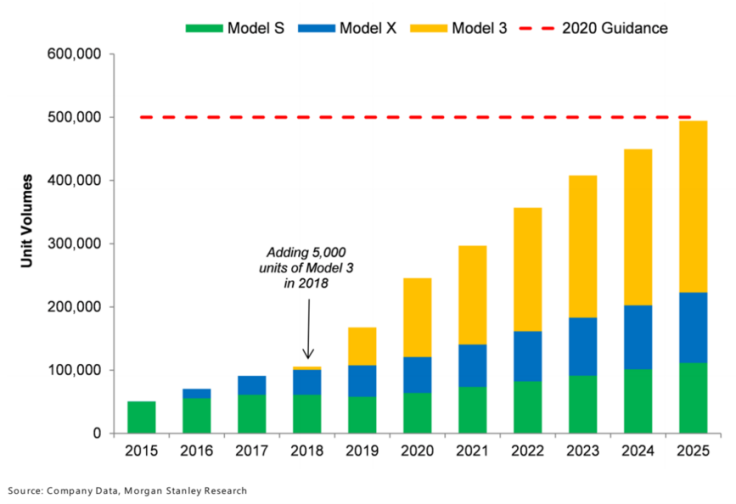

Morgan Stanley also cited Model X “manufacturing and engineering challenges” as a factor that could delay the introduction of the crucial sub-$40,000 Model 3. The lower-priced Tesla electric car is due out by the end of 2017, and the public is scheduled to see a first glimpse of the prototype next month.

Tesla Motors will report its fourth-quarter and full-year 2015 results on Wednesday after markets close in New York. Investors will want to see Tesla continue to grow revenue while meeting production and sales targets.

Tesla’s cash burn will also be in question. The company has offered 2.7 million shares, its third offering since 2011, to raise capital. It could face increased scrutiny from shareholders if it continues to dilute its stock in 2016. Could a strategic partnership be in the works to raise more capital?

© Copyright IBTimes 2024. All rights reserved.