Tobacco Firms Exploit Legal Loopholes To Avoid Higher Taxes: Government Watchdog

The United States government potentially lost over $3 billion in tax revenues after a 2009 law imposed greater levies on tobacco products, according to a U.S. Government Accountability Office, or GAO, report released Tuesday.

The Children's Health Insurance Program Reauthorization Act, or CHIPRA, passed in 2009, “created opportunities for tax avoidance and led to significant market shifts toward lower-taxed products by manufacturers, importers, and price-sensitive consumers,” the report stated.

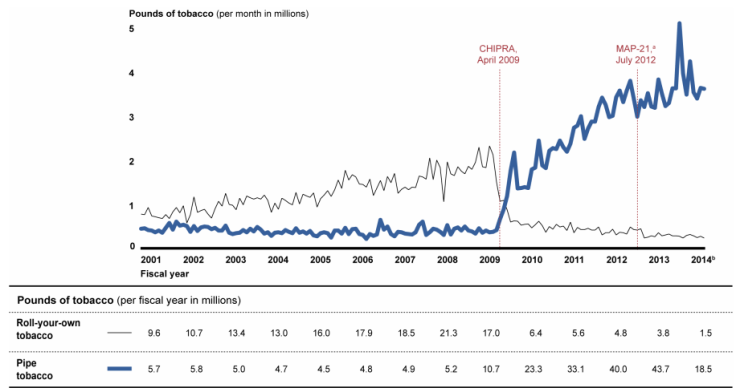

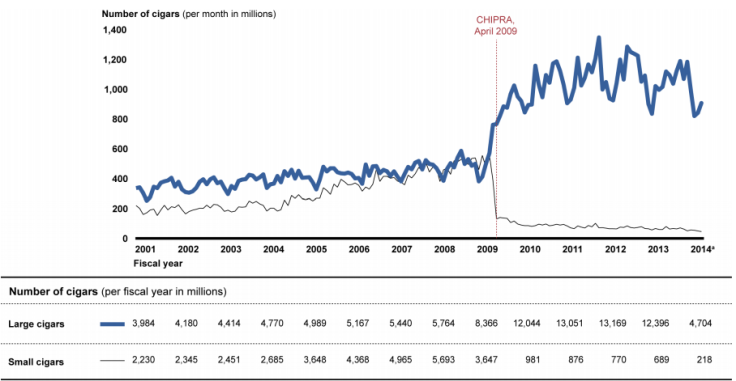

CHIPRA, which was introduced as a measure to discourage smoking, imposed higher taxes on roll-your-own cigarette tobacco and small cigars. This caused, according to the report, a drastic shift in consumption as well as in the manufacture of pipe tobacco and large cigars, which were subjected to a smaller tax increase.

Senate Finance Committee Chairman Ron Wyden criticized the Alcohol and Tobacco Tax and Trade Bureau for failing to clamp down on tobacco manufacturers attempting to avoid taxes by exploiting loopholes in the law.

“Dozens of companies that make tobacco products are dodging taxes simply by changing a few words on packaging labels...as a result, America’s taxpayers have taken a hit worth billions of dollars, and children and teens are more exposed to tobacco and its harmful effects,” he said, at a Senate hearing on Tuesday.

“From fiscal year 2008, the last year before CHIPRA, to fiscal year 2013, annual sales of domestic and imported pipe tobacco increased from about 5.2 million pounds to 43.7 million pounds, while sales of domestic and imported roll-your-own tobacco declined from about 21.3 million pounds to 3.8 million pounds. Over the same period, annual sales of domestic and imported large cigars increased from about 5.8 billion sticks to 12.4 billion sticks, while sales of domestic and imported small cigars declined from about 5.7 billion sticks to 0.7 billion sticks,” the report stated.

This shift to pipe tobacco from roll-your-own tobacco and, to large cigars from smaller ones, reportedly caused an estimated federal revenue loss of about $2.6 billion to $3.7 billion between April 2009 and February 2014.

The report also claimed that, in order to avoid paying higher taxes, many manufacturers resorted to mislabeling products.

“One company changed the cut of its roll-your-own tobacco and labeled it as pipe tobacco, although a company representative acknowledged that there was no real difference between its roll-your-own tobacco and its pipe-cut tobacco,” the report said.

Similarly, since weight was the only distinguishing feature between large and small cigars, many manufacturers added weight by simply packing the tobacco more tightly and relabeling the product.

The GAO report, however, admitted that, “In the absence of legislative changes, Treasury has limited options for effectively addressing the continued tax avoidance behavior.”

© Copyright IBTimes 2024. All rights reserved.