UK manufacturers face margin compression, will BOE raise rates?

Margin compression is a nasty thing in business.

According to government data, this is precisely what UK manufacturers are facing.

For January 2011, the cost of materials and fuels for manufacturers spiked 13.4 percent from the previous year and 1.7 percent from the previous month.

Even when volatile components like food and oil are excluded, inflation is 9.9 percent from last year and 1.5 percent from last month.

Compared to last year, crude oil jumped 28.8 percent, home food materials rose 11.2 percent, and imported metals surged 26.4 percent.

Meanwhile, UK manufacturers have been unable to fully pass the costs on to the customers as output prices rose only 4.8 percent from the previous year and 1 percent from the previous month.

UK manufacturing represents only about 11 percent of the GDP, so margin compression in this sector alone won’t force the Bank of England (BOE) to raise rates. However, the data has serious implications.

By absolute numbers, the UK is still one of the largest manufacturers in the world. Also, the margin compression applies, by varying degrees, to other large manufacturing countries like the US, Japan, China, Germany, and France, so global manufacturing may be facing a crunch.

Moreover, the costs – like fuel and food – also impact, to varying degrees, the services industry and UK consumers, whose costs will ultimately determine the BOE’s rate decision.

Indeed, consumer inflation amounted to 3.7 percent in December 2010 compared to the previous year.

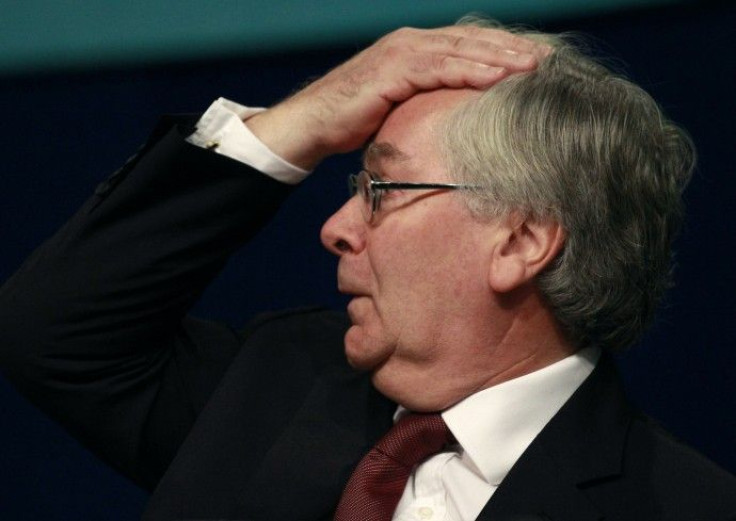

In the last BOE monetary policy meeting on Feb. 10, 2011, Governor Mervyn King held off inflation hawks and kept rates at 0.5 percent at the 23rd consecutive month.

However, there is no denying that inflation is rising rapidly for UK consumers and at an even faster rate for UK manufacturers.

Email Hao Li at hao.li@IBTimes.com

Click here to follow the IBTIMES Global Markets page on Facebook.

Click here to read recent articles by Hao Li.

© Copyright IBTimes 2024. All rights reserved.