UK Retail Sales Surged 2.3% In January, Public Finances Improve

Britain’s retail sales in January increased by the most in more than two years, boosted by a sharp rise in purchases of clothing and computers. The country also recorded the largest public finances surplus for any January since 2008, according to official figures released Friday.

January retail sales jumped 2.3 percent from December, almost three times the pace of growth expected by economists polled by Bloomberg. U.K.’s Office for National Statistics (ONS) said growth was helped by post-Christmas discounts as retailers looked to clear excess inventories. Compared to a year earlier, retail sales rose 5.2 percent in January, the office said.

“Amid the recent heightened concerns over the U.K. economy, this [January retail sales] is a major boost to first quarter GDP growth prospects. However, it will be tempered by concern that the U.K. economy remains unbalanced and too dependent on consumer spending and the services sector,” Howard Archer at IHS Global Insight told the Guardian.

The retail sales surge reversed the drop in sales in December when mild weather curbed spending on clothing.

More people in the U.K. took to online shopping in January, with the value of online sales increasing by 10.4 percent in January 2016 compared with January 2015, and increasing by 2.7 percent from December 2015.

U.K.’s public finances, excluding banks, also rose to 11.21 billion pounds ($16.01 billion) from 10.22 billion pounds ($14.6 billion) a year earlier. While the month is usually a surplus month due to self-assessment tax return receipts, the surplus was short of a 12.65 billion pounds ($18.07 billion) forecast in a Reuters poll.

While public finances saw a gradual improvement for the second month in a row, economists reportedly raised concerns about whether the government could limit borrowing to meet its earlier goal of cutting the budget deficit to 73.5 billion pounds ($104.96 billion) -- or 3.9 percent of U.K.’s GDP -- by the end of the tax year in March.

The government’s borrowings for the current year, from April 2015 to January 2016, are 66.5 billion pounds ($94.97 billion), ONS said in a statement Friday. For U.K. to hit its target budget deficit, government borrowing will need to come in at 7 billion pounds or less in February and March.

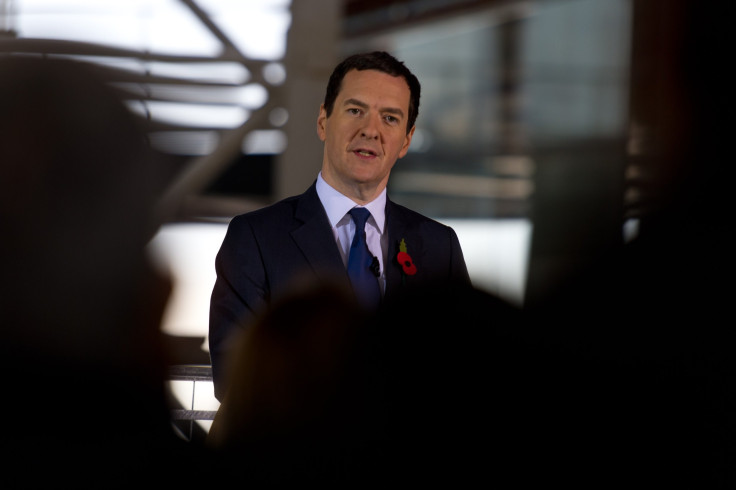

Chancellor of the Exchequer George Osborne, due to publish his annual budget plan on March 16, tweeted that Friday’s positive data showed that the U.K was moving toward its goal of full employment and fixing its public finances, but cautioned that there was still a long way to go.

© Copyright IBTimes 2025. All rights reserved.