US Companies' Profits Continue To Fall In China As GDP Growth Slows

As profits for U.S. companies in China have declined over the past two years, it appears likely that the days of the country's relentless growth are over.

As a result, China lowered its GDP growth goals and modified its economic model to aim for slower -- but more stable and quality-driven -- growth than it has had in recent years.

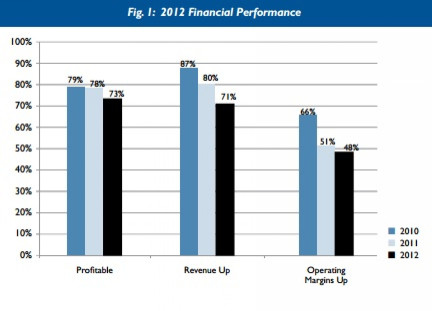

It seems that American companies should plan accordingly. According to data released by the American Chamber of Commerce in Shanghai, U.S. companies' profits are hurting. While China still ranks among the top three locations in the world for U.S. investment, only 73 percent of the 420 U.S.-based companies surveyed were profitable in 2012.

This number has been decreasing annually; it was 78 percent in 2011 and 79 percent the year before.

One reason why this occurred is because American businesses have faced a variety of new challenges in China recently, including rising costs, human resources constraints, and most of all, the development of domestic competition.

According to a report by the state-run Xinhua News Agency, China’s Lenovo Group Limited (PINK:LNVGY) recently surpassed Hewlett-Packard Co. (NYSE:HPQ) as the world’s top seller of PCs. Beyond that, Lenovo recently gave tech-gadget giant Apple, Inc. (NASDAQ:AAPL) a run for its money in China's domestic spartphone market.

Apple’s trendy, high-end iPhone has been successful in China, but Lenovo's phones have gained ground on them. Lenovo's 14.8 percent of the market surpassed Apple’s 6.9 percent market share in the third quarter of 2012.

But dwindling profits and market share do not mean that U.S. companies are pulling out of the China's domestic market.

“In 2012, U.S. companies in China continued to perform strongly, but for the second year in a row [they] experienced a dip in top-line performance indicators -- profitability, revenue and operating margins,” the report said.

While American companies are still finding some success in China, their slowed growth may partly be due to China’s continued movement away from export- and investment-led growth and toward sustained domestic consumption-led growth.

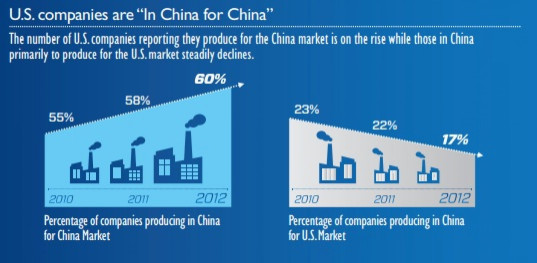

Following their Chinese counterparts, American companies are increasingly targeting China’s 1.3 billion domestic consumers.

As China’s domestic market changes, U.S. companies looking to do business there must change as well. A growing number of American-based Chinese companies now aim most products and services at the Chinese market instead of relying on exports. While the percentage of companies producing goods in China for the U.S. market has decreased over the last three years, companies looking to tap the domestic Chinese market now represent 60 percent of U.S. companies in China.

“It is true that people are talking about the economy slowing down [in China], and costs are rising,” Kent Kedl, a global risk consultancy managing director said to China Daily. “But we found [that] many companies are staying in China instead of leaving.”

China’s robust manufacturing market, coupled with its large, diverse domestic consumer market, may keep the nation attractive to businesses at the same rate as before -- and perhaps even more so.

“If you go to Bangladesh or Vietnam, you can get low-cost manufacturing, but you will not have the great market,” Kedl continued.

© Copyright IBTimes 2025. All rights reserved.