U.S. Federal Reserve Rate Hike: Fed Officials Deliver Mixed Messages, But Nod Toward December Hike

A slew of Federal Reserve officials spoke on Thursday, offering clues about December’s closely watched Federal Open Markets Committee meeting. Investors and consumer advocates are anticipating the rate-setting vote, which could raise benchmark interest rates for the first time in nine years.

After holding off from a hike in October, Fed officials have one more chance to lift rates from their extraordinary near-zero threshold before the end of the year. Fed Chair Janet Yellen, who spoke publicly Thursday and refrained from commenting on monetary policy, called a December liftoff a “live possibility.”

New York Fed President William Dudley voiced his agreement in a speech on Thursday. “It is quite possible that the conditions the Committee has established to begin to normalize monetary policy could soon be satisfied,” Dudley said, noting a tightening labor market and hopes that inflation will rebound.

Last week’s blockbuster employment rates resounded throughout financial markets, where investors have been itching for certainty from the Fed on interest rates.

That number “was quite good,” said Chicago Fed President Charles Evans in comments on Thursday. But Evans pointed to “quite subdued” wage growth as well as persistent evidence that too many potential workers remain on the sidelines, discouraged from the job search or working part-time. “I don’t think we’re quite there yet,” he said.

Evans, who is considered one of the more dovish Fed officials, also worried about the lackluster pace of inflation. The Fed considers a solid 2 percent inflation rate to signal the economy is healthy enough to withstand an interest rate hike.

But overall inflation has clocked in at just 0.2 percent over the past year, dragged down by plummeting energy prices and a strengthening dollar, which dampens U.S. export revenues. Excluding volatile food energy prices, core inflation is still just 1.3 percent over the past year and 1.4 percent since 2008, Evans noted.

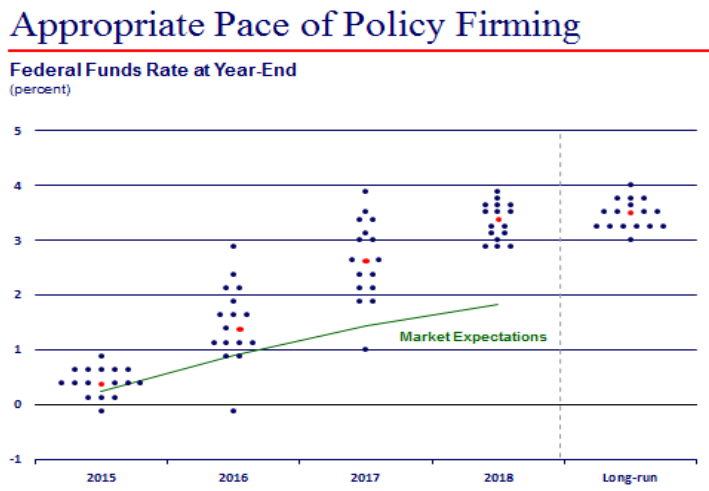

Given low inflation expectations, the market seems to concur with Evans, predicting a slower uptick in benchmark inflation rates than the majority of Fed officials forecast in their famous “dot plots.”

“The best policy is to take a very gradual approach to normalization,” Evans said, emphasizing that “an even more patient approach is warranted.”

The conflicting messages from Fed officials reflect a shakier-than-usual economic recovery in the years since the 2008 financial meltdown pushed monetary policymakers to extremes. In addition to bottoming out benchmark interest rates in an effort to discount everything from car loans to corporate borrowing rates, the Fed bought up nearly $2.5 trillion in financial assets to goose market activity.

Some Fed officials are more worried about possible ripple effects from those extraordinary measures than they are about a fiful economic recovery. “There is no reason to continue to experiment with extreme policy settings,” said St. Louis Fed President James Bullard on Thursday.

Bullard suggested that inflation was on its way up and unemployment levels werelow enough to raise rates. “Prudence alone suggests that, since the goals of policy have been met, we should be edging the policy rate and the balance sheet back toward more normal settings,” Bullard said.

His comments echoed those of San Francisco Fed President John Williams, who told USA Today on Tuesday that data permitting, there was a “very strong case for starting the process of raising interest rates” in December.

Regarding the overall economy, Williams said, “I don't see much evidence of fragility or lack of momentum.”

Despite their differences, the Fed officials agreed that the rate of liftoff should be slow and steady. “The precise timing for the first increase in the federal funds rate is less important to me than the path the funds rate will follow,” said Evans.

Though the overall thrust of the Fed officials’ musings seemed to lean away from Evans’ hesitant stance, it remains to be seen what November’s employment and inflation data will hold. Still, futures markets have grown increasingly confident about a December hike. As of Thursday, futures bets implied a 70 percent chance that the Fed will move before 2016.

© Copyright IBTimes 2025. All rights reserved.