US Solar Energy Sector Sees Second-Best Quarter As Developers Rush To Tap Expiring Federal Tax Credit

The looming expiration of a key solar-energy tax credit is driving a surge in solar projects across the country. The U.S. solar sector this fall saw its second-largest quarter for new installations as developers rushed to tap the federal incentive before it lapses in 2016, an industry report released Tuesday found.

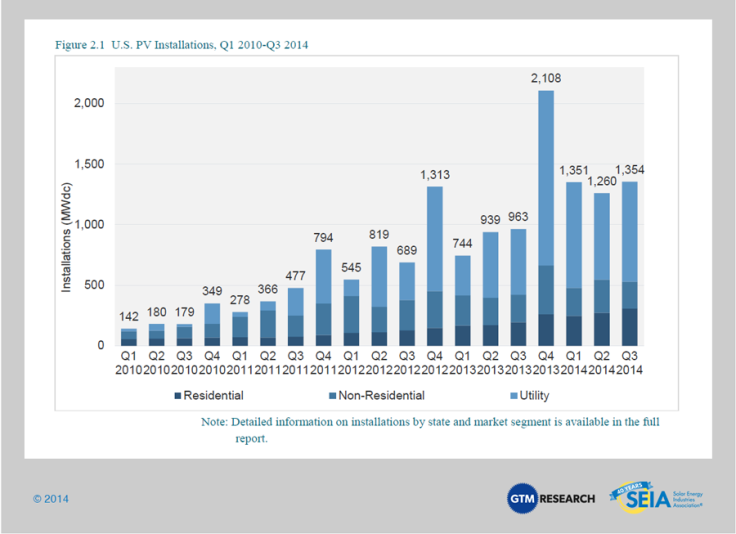

The U.S. installed 1,354 megawatts of solar photovoltaic projects in the third quarter of 2014, a more than 40 percent jump from the same period last year, according to a joint analysis by the Solar Energy Industries Association, the sector’s main trade group, and GTM Research. The country now has about 17,500 megawatts of solar capacity in place, or enough to power up roughly 2.8 million average American homes.

Installations could rise even higher in the fourth quarter and next year as the deadline for the Investment Tax Credit draws closer, Cory Honeyman, a GTM solar analyst, said. He said that developers of massive and expensive utility-scale projects are driving most of the activity, since these systems take years to build and connect online.

“There’s somewhere between 15 and 20 companies right now that have more than 500 megawatts of projects each that they need to bring online by 2016,” he said by phone. “A lot of developers have this laser focus to bring projects online, and we expect that to translate into unprecedented installation growth within the utility-scale solar market.”

Peyton Boswell, managing director of EnterSolar, a New York City developer, said his company expects to see a jump in smaller commercial-scale projects. The company has installed about 50 systems on the rooftops of warehouses and corporate headquarters since 2005; it could install that many or more come 2016, he said.

“It does create an artificial accelerant in 2015 and 2016 in some ways,” Boswell said of the tax credit’s deadline. “Our customers are really looking at their longer-term plans and thinking, ‘Let’s do it while it’s still economic.’ There’s a bigger question mark going into 2017.”

The ITC was passed by Congress in 2009 as part of the Obama administration’s financial stimulus package. The incentive provides a 30 percent tax break for utility, commercial and residential rooftop systems through Dec. 31, 2016. Once it ends, commercial systems will receive only a 10 percent tax credit through an existing program, while household systems will lose the benefit entirely -- unless lawmakers vote to extend or expand the program.

Solar companies and industry groups argue that the ITC is critical for enabling clean electricity to compete with conventional fossil fuels like coal and natural gas. While the costs of solar systems have dropped dramatically in recent years -- panel prices are down 75 percent since 2008 -- solar power is still more expensive than grid electricity in many states. “The tax credit is hugely important,” Boswell said. “The loss of the 30 percent credit would have a significant impact on deployment.”

Honeyman said that without the credit, utility-scale installations could drop off by 80 percent year-over-year compared to 2016. Commercial and residential projects, which are cheaper and easier to build, would drop off only by 15 percent in 2017 and beyond, he said.

Phil Cavallo, the owner and chief executive of Beaumont Solar, a Massachusetts developer that builds utility and commercial-scale projects, said his company will see a “natural slowdown” in business in 2017 without the 30 percent ITC. But he said he didn’t expect the decline to last beyond the initial year. In the Northeast region, electricity rates are among the most expensive in the nation, which makes solar power an attractive alternative, even without the tax break, he said. Continued improvements in solar panel technology and installation costs could further improve the economics of solar.

“We think 2018 will probably be right back to business as usual in the solar industry,” Cavallo said. “The perspective is that as power prices go up, and installed cost-per-watt goes down, it’s going to be a compelling reason for people to continue to install solar.”

© Copyright IBTimes 2024. All rights reserved.