US Stock Futures Point To Higher Open Rebounding From Record Lows In Previous Session After Fed Reserve's QE Comments Triggered Broad Sell-off

U.S. stock index futures point to a higher open on Friday, rebounding from the previous session's record lows, as investors slowly come to terms with a possible end to the Federal Reserve’s monthly bond-buying program by mid-2014.

Futures on the Dow Jones Industrial Average were up 0.47 percent, futures on the Standard & Poor's 500 Index were up 0.53 percent while those on the Nasdaq 100 Index were up 0.32 percent.

Investors also await the Bureau of Labor Statistics’ mass layoffs report, which measures the number of job cuts that involve 50 or more workers from the same company, expected to be released at 10.a.m. EDT. Also awaited is the ECRI Weekly Annualized index, a measure of future economic growth, due at 10.30 a.m. EDT.

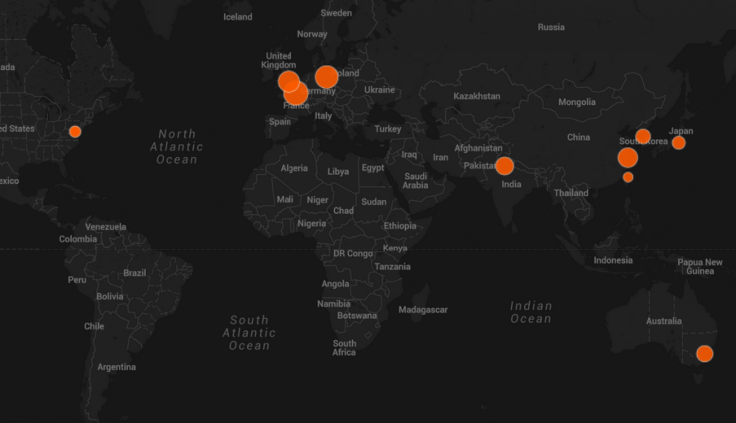

In Europe, London’s FTSE 100 was up 0.49 percent, Germany's DAX-30 traded up 0.25 percent, while France's CAC-40 rose 0.49 percent.

In Asia, most markets except Japan’s Nikkei remained volatile on Friday, alternating between steep falls and gains, following losses incurred over the past few trading sessions, as Federal Reserve Chairman Ben Bernanke's comments continued to weigh on investor sentiment.

China’s Shanghai Composite index ended down 0.53 percent while Hong Kong’s Hang Seng was down 0.59 percent on Friday. Both the indexes had dropped more than 2 percent earlier in the day. South Korea’s KOSPI Composite Index fell 1.49 percent while Australia’s S&P/ASX 200 dropped 0.41 percent.

Japan’s Nikkei, on the other hand, pared initial losses of up to 2 percent to end the day up 1.66 percent at 13,230.13, aided by a falling yen, which lost 0.66 percent against the dollar. India's benchmark BSE Sensex too trimmed early losses to end the day up 0.29 percent.

On Thursday, U.S. stocks recorded sharp losses, falling more than 2 percent across the board, following Bernanke's comments at a press conference held on Wednesday after the Fed’s two-day policy meeting.

Bernanke said the Fed is optimistic about the economic recovery and that the bank might start tapering its monthly bond-buying program “later this year” and wind it up altogether by mid-2014, if the economy recovers as projected by next year.

The Dow Jones Industrial Average reacted by falling 353.87 points, or 2.34 percent -- marking its biggest one-day drop since November 2011 -- to end at 14,758.32 and the Nasdaq Composite Index fell 78.56 points, or 2.28 percent, to end at 3,364.64. The S&P 500 plunged 2.5 percent, also to record its worst fall since November 2011.

© Copyright IBTimes 2025. All rights reserved.