US Wind Power To Grow Six-Fold By 2050 Thanks To Bigger, Better Wind Turbines [MAPS]

U.S. wind power is expected to grow more than six-fold over the next few decades, providing enough juice to light up nearly 100 million homes. The Department of Energy says it anticipates major advancements in turbine technologies and falling wind energy costs that will spur dramatic clean energy development in all 50 states.

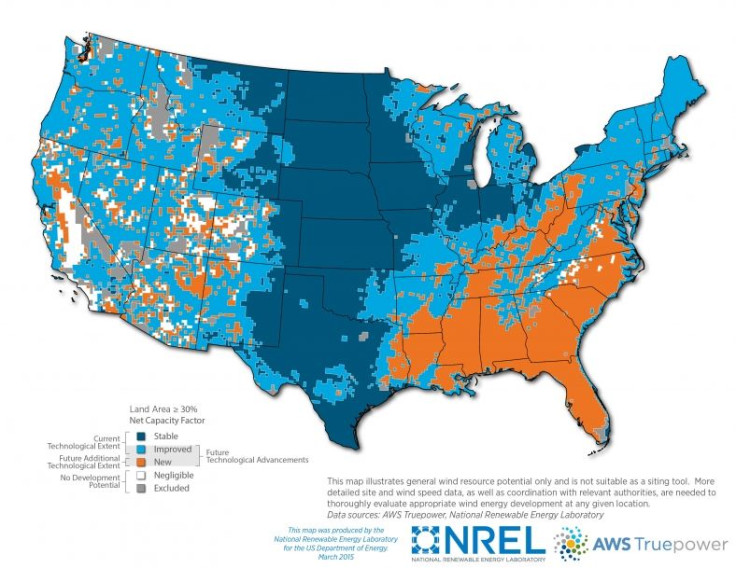

The agency released a report last week to illustrate how America’s wind industry could grow by 2050. U.S. wind capacity could jump from nearly 66,000 megawatts in 39 states today -- enough to power roughly 16 million homes -- to more than 400,000 megawatts in wind capacity within 35 years, federal analysts estimated.

Wind turbines produce about 5 percent of annual U.S. electricity generation, more than triple what they generated just six years ago. The costs of developing wind energy have dropped significantly -- down 90 percent since the 1980s -- thanks to improved technologies, more efficient installation techniques and federal and state tax incentives. Energy analysts say they expect costs will continue to decline as more projects are built and renewable energy becomes increasingly competitive with natural gas- and coal-fired electricity.

But the real driver behind the six-fold leap in U.S. wind development will be the turbines themselves.

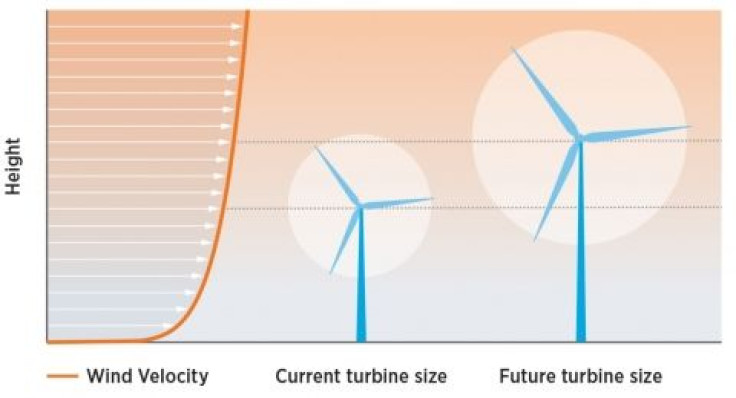

The Department of Energy announced it is working with industry partners to develop taller wind towers and larger rotors to capture the stronger wind energy resources typically found at greater heights. The turbine towers will stand up to 140 meters tall -- more than 1.5 times the height of the Statue of Liberty in New York City -- making them almost double the height of the average 80-meter towers installed today.

The tall towers will enable developers to produce wind power in areas where the wind resources are weaker at lower levels, including states in the Southeast region. The agency’s map shows substantial wind development in states with little or no wind production today, such as Georgia, Alabama and Mississippi.

“We are focused on expanding [wind's] clean power potential to every state in the country,” Energy Secretary Ernest Moniz said last week following the announcement. “By producing the next generation of larger and more efficient wind turbines, we can create thousands of new jobs and reduce greenhouse gas emissions as we fully unlock wind power as a critical natural resource."

Skyscraping turbines won’t be the only boost to the U.S. wind industry. Private companies with an eye for renewables are expected to invest heavily in projects nationwide as they seek to reduce corporate greenhouse gas emissions and lower their energy bills. In the first quarter this year, more than half of wind power contracts, called “power purchase agreements,” were signed by just four companies: Dow Chemical, Walmart, Kaiser Permanente and Google Energy. Until recently, utility companies were the main customers for new wind projects, the American Wind Energy Association said in a recent market report.

“Successful brands and businesses increasingly see low-cost wind power as a great value,” Tom Kiernan, CEO of the American Wind Energy Association, said in an emailed statement. “We’re seeing the expanding market for corporate purchasers that value wind both because it is clean and offers stable electricity prices.”

The interest from companies has helped to offset some of the recent sluggishness in the U.S. wind market.

New development has stagnated following the expiration of a critical Production Tax Credit. The incentive gave developers a tax credit of 2.3 cents for every kilowatt-hour of electricity produced in the first decade of operation. The tax credit expired at the end of 2013 and was renewed for 2014, before expiring again. Projects that began construction during those years, however, are still able to access the credit, even if they aren’t yet completed.

Uncertainty about whether Congress will renew the federal tax measure “means there is a lesser pool of investors who are available to put capital into the business of wind energy,” Jacob Susman, founder and CEO of OwnEnergy, a wind development company in Brooklyn, New York, said by phone. “It also means that more of the buyers of power -- the utilities, primarily -- sometimes hold back on their purchasing to see what the status is going to be of the production tax credit.”

Technology firms and large corporations have been less hesitant, however. In October, OwnEnergy signed a long-term power purchase agreement with Yahoo! Inc. for a wind project in Rush County, Kansas. Susman said his wind company is close to landing another power agreement with a Fortune 100 company, which he declined to name.

“There’s a whole new universe of customers for wind farms,” he said. “It somewhat serves to counteract that uncertainty with the ups and downs of the production tax credit.”

© Copyright IBTimes 2024. All rights reserved.