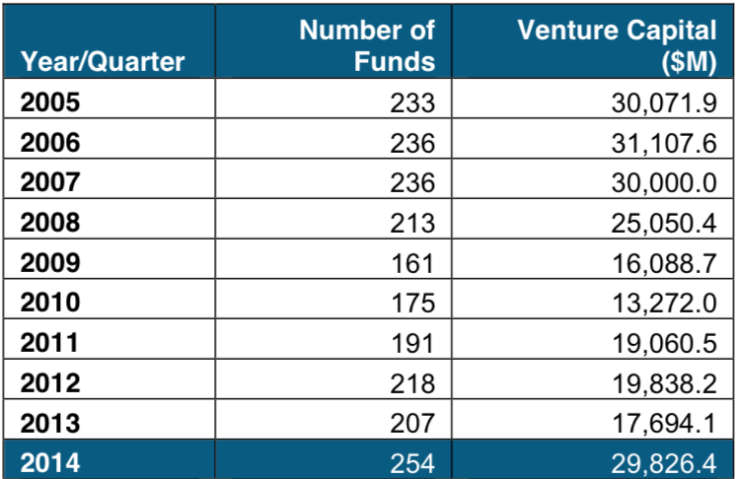

Venture Funds Raised $29.8 Billion In 2014, Most Since 2007

U.S. venture capital firms raised $29.8 billion in 2014, signifying that investors around the world remain highly interested in funding American startups. The money raised in 2014 is the most since 2007, just as the economy was hit by the Great Recession.

Last year’s total represents a 68 percent gain over 2013, when $17.7 billion was raised, according to a report released Monday by Thomson Reuters and National Venture Capital Association. The fundraising dollars came from a total of 254 funds, up from 207 in 2013 and the most since 2001, when 324 funds garnered investments.

Investor interest in U.S. startups was in part driven by the market's healthy exit ecosystem. In 2014, there were 273 U.S. initial public offerings, the most since 2000 and up 23 percent from 2013, according to Renaissance Capital.

“2014 was a strong fundraising year for the industry, both in the number of funds raised as well as the amount of capital commitments received," said Bobby Franklin, president and CEO of the NVCA. "It’s good to see that fundraising levels are finally starting to catch up with the overall level of investment we’ve witnessed in the last few quarters.”

The increase in fundraising dollars in 2014 bodes well for startups as it may translate into venture firms investing more money in 2015 than in previous years.

© Copyright IBTimes 2025. All rights reserved.