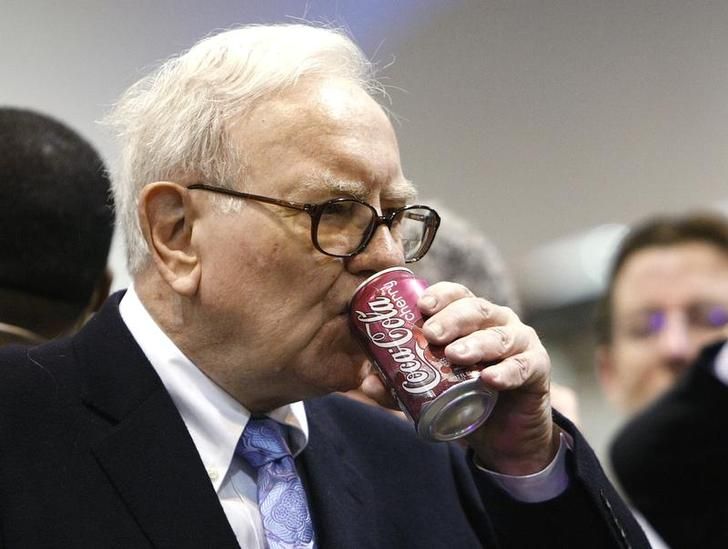

Warren Buffet Buys HJ Heinz For $23.3B; Other Companies Owned By Berskshire Hathaway [PHOTOS]

Billionaire Warren Buffett is making headlines as his multinational holding company Berkshire Hathaway gears up to purchase condiment giant H.J. Heinz Co (NYSE:HNZ).

The $23.3 billion deal, which was announced early Thursday, is the largest ever in the food industry and is intended to speed Heinz's transformation into a global business. Besides being known for its popular ketchup, the Pittsburgh-based company also makes Classico pasta sauces, Ore-Ida potatoes and Smart Ones frozen meals.

Berkshire Hathaway is teaming up with 3G Capital, the investment firm that bought Burger King in 2010, to broker the deal that will see Heinz continue to thrive at its headquarters in Pittsburgh.

Heinz CEO William Johnson said at a news conference that taking the company private would give Heinz the flexibility to make decisions more quickly, without the burden of having to report quarterly earnings.

Heinz was founded by Henry John Heinz and his neighbor L. Clarence Noble in 1869. Their first product was grated horseradish, bottled in a clear glass to showcase its purity. The first ketchup was introduced in 1876; the company says it was the country's first commercial grade ketchup.

At a press conference following the announcement, Johnson said the deal took shape eight weeks ago when managing partners from 3G Capital visited him for lunch. The men were familiar with each other because Heinz is a supplier for Burger King.

Buffett said on CNBC that Berkshire is putting $12 billion to $13 billion into the deal.

"It's our kind of company," Buffett said in the interview, noting its signature ketchup has been around for more than a century. "I've sampled it many times."

Current shareholders of Heinz will receive $72.50 in cash for each share, a 20 percent premium over the company’s closing price on Wednesday.

The deal is expected to close in the third quarter.

Click “Next” see some other popular food and beverage companies owned by Berkshire Hathaway

© Copyright IBTimes 2025. All rights reserved.