Wave Of Corporate Defaults Could Be Coming, Financial Watchdog Warns

A financial watchdog set off the alarm bells on corporate debt Wednesday in its annual report to Congress. With companies feeling growing pressure from painful exchange rates and energy prices, the U.S. is at a higher risk of seeing a wave of corporate defaults, the report said.

The report from the Office of Financial Research, a division of the Treasury Department, listed credit risk as one of the top three financial stability dangers facing the economy in 2016.

The combination of slowing global growth and plunging energy and commodities prices, the report said, "has diminished the ability of multinational companies and firms in the energy and commodity industries to repay their debts."

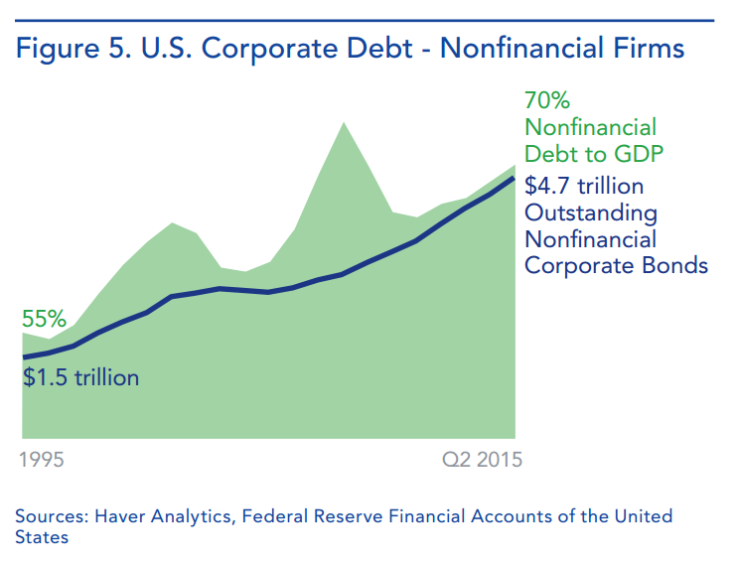

After years of issuing bonds at historically low interest rates — due to the Federal Reserve's historically low interest rates following the financial crisis — nonfinancial corporations now hold roughly $4.7 trillion in outstanding debt, or about 70 percent of national GDP, much of which is owned by institutional investors like pension funds and insurance companies.

But in recent months corporate profits have begun to dip, imperiling some companies' abilities to make regular bond payments. Together, the report said, those factors "are hallmarks of the late stage of the credit cycle, which typically precedes a rise in default rates."

Investors have been sounding their own warnings in recent weeks as global markets have tumbled on news of slower growth in China and in broader emerging markets. Last week saw the sharpest jump since early 2009 in an index that tracks investors' concerns about junk-bond defaults — the Markit CDX North American High Yield Index.

Meanwhile, the number of companies on a high probability-of-default watch list maintained by ratings agency Moody's Investor Services hit a six-year high this week.

Much of the pain is concentrated in the energy sector, which has faced a steep reversal in fortune in the past year as energy prices have tanked. With the price of crude oil down 40 percent since November, drillers, shippers and refiners have all felt the pinch. Fadel Gheit, senior energy analyst at Oppenheimer and Co., told CNBC earlier this month that half of all shale oil drillers could go bankrupt by the end of the year.

It's not just oil companies that are exposed, however. Regional banks that lend to the energy industry could suffer as a result of a default wave, the OFR report noted, adding that "the ultimate magnitude of losses in these industries and regions is uncertain."

© Copyright IBTimes 2025. All rights reserved.