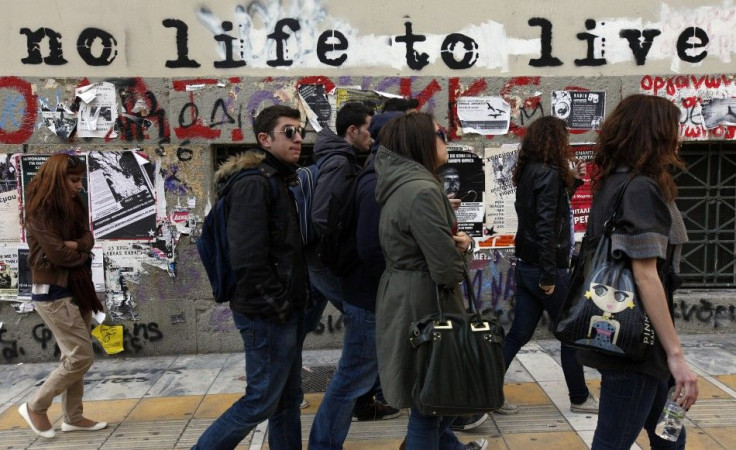

What Happened To Greek Credit Default Swaps?

Yields on Greek bonds have risen sharply since the Mediterranean country technically defaulted on its debt earlier this month, and insurance on Greek debt has disappeared, indicating that investors are unconvinced that the country will be able to avoid further financial turmoil. As buyers have avoided the market, banks and insurance firms have become increasingly reluctant to write new bond protection following substantial recent losses.

Last week, yields on Greek bonds maturing in February 2023 shot above 20 percent for the first time since the Athens government issued this debt on March 12, according to Bloomberg News. Bond yields tend to go up as prices go down.

There are a number of reasons why buyers of insurance on Greek bonds, also known as credit default swaps, or CDSs, are scarce and banks are reluctant to sell them on Greek sovereign debt. A CDS is a derivative that functions like an insurance contract for a debt default. If a borrower defaults, sellers compensate buyers.

For one thing, Greece's default hasn't produced concrete results, but the recovery appears to be historically weak. The recovery rate at the recent Greek bond auction was substantially lower than the average for sovereign defaults from 1983 to 2010, according to Moody's Investors Service. While Greece's recovery rate was 21.5 percent, the average value-weighted rate during that 28-year period was 31 percent. That augurs for another default.

For another, there is extreme volatility in the markets for Greek bonds and their derivative CDSs, and this has been exacerbated because settlement of the recent bond auction occurred after the default was still being carried out. The price of Greek bonds is unstable, and investors don't consider them valuable enough to hedge with CDS protection because of the 70 percent debt write-off Greece imposed on private creditors.

Investors' bond holdings have been reduced ... there's no willingness to buy protection right now, and no willingness from institutions to begin selling again. It's not a properly functioning market for the time being, said Sphia Salim, European rates and currencies strategist for Bank of America.

If you have a bond that's already beaten up in price, then what are you insuring against? Jerome Fons, executive vice president at Kroll Bond Ratings said, explaining why investors aren't seeking to buy insurance against Greek debt.

Not that there is any CDS protection to buy at present. Banks aren't writing new CDS coverage against Greek bonds because of the paper's already-low value and rising yields as well as uncertainty about how the CDS process works and possible political pressure within the country.

Some banks have stopped writing new CDS coverage because they're uncertain as to what would trigger a payout in the event of another default. Just as unclear is whether a payout could be forced immediately because of a 60-day look-back clause in CDS contracts, according to the Financial Times. Fewer than three global banks are writing CDS coverage against Greek debt, reports said.

Further frustration arises over governance of the CDS system. There may be substantial political will within institutions that write CDS protection not to issue it against Greece's debt for some time to come. Recent losses by CDS writers in the settlement of the Greek technical default on March 9 might discourage banks from re-entering the market.

I don't know how many institutions will be interested in offering CDS because it's so risky after they just took such losses on it, Salim said.

The reluctance of CDS writers and buyers to re-enter the market could be the strongest indication the CDS mechanism is functioning properly in Greece. If huge numbers of banks or buyers were lining up for CDS on Greek debt, that might signal an imbalance in the market.

Greece's fiscal future is far from certain. Many fear the country isn't out of the woods yet and that another default may be in the offing. Even if governance and political matters are resolved, banks might not issue CDSs as long as they feel another default is imminent.

Even if Greece gets through this, within the next year or so, they might face more problems ... This is still pretty risky and not for the faint of heart, Fons said.

© Copyright IBTimes 2024. All rights reserved.