Why Ohio Steelworkers Are Upset Over South Korea-US Trade Policy

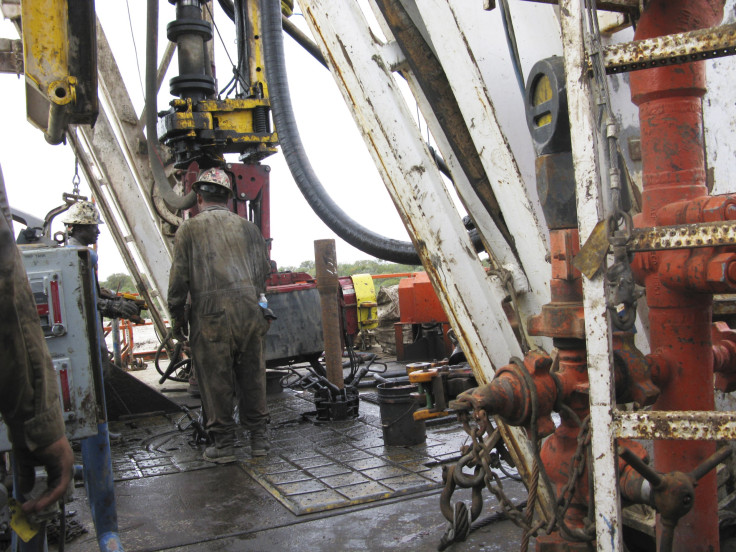

The current U.S. shale boom has created an ideal market for producers of the manufactured goods needed to bring oil and natural gas to the surface. But this spike in drilling activities has sparked a trade dispute between domestic manufacturers and foreign producers who are sending the U.S. a particular kind of steel tubing used to drill holes deep into the earth’s crust.

Ahead of a July 10 decision by the Department of Commerce, the United Steelworkers union and the Alliance for American Manufacturing are pushing the federal government to impose punitive tariffs on nine countries that produce oil country tubular goods, or OCTG, a particularly sturdy type of pipe made to withstand high pressures and corrosive chemicals.

The U.S. producers have accused these exporting countries, led by South Korean manufacturers, of exporting the tubes at prices below fair value. Domestic demand for the tubes has increased because they’re used in hydraulic fracturing, which extracts natural gas by injecting a high-pressure water-mixture with explosive force into shale rock layers to release the fuel.

“There’s not a problem in this country where we can’t produce enough,” said Dan Voorhees, president of USW Local 1104, at a rally at a steel plant in Lorain, Ohio. Workers at the Monday rally called for measures to prevent what they call a shift from dependence on foreign oil to dependence on foreign-made steel tubing for drilling. “We’ve proven time and time again. We have the most efficient highly skilled workers. Nobody has the safety and quality regulations that we do.”

Critics, however, argue the shale gas boom has created a need for more imported tubes than America can produce in order to sustain an energy boom that is bringing jobs and economy activity to Lorain and other cities in America’s Rust Belt.

“The U.S. industry is widely reported – perhaps not in Ohio – to have difficulty obtaining an adequate supply of this type of pipe,” said Tom Prusa, professor of economics at Rutgers University in New Jersey, who has studied the issue from a global trade perspective. “There were reports during the last oil shale boom in 2007 and 2008 of companies who had drilled a hole but they had to wait weeks before the got the pipe to insert into the hole.”

In February, the Department of Commerce issued a preliminary ruling that eight out of nine major OCTG producers were exporting the tubes at below fair value and announced tariffs for the pipes exported from those countries, including a 28 percent tariff on Indian-made tubes and a 61 percent levy on tubes made in Vietnam.

But in that decision, South Korea – which makes up 30 percent of all OCTG imports – was spared. In a separate ruling in mid-February, the department ruled that China was sending nearly completed pipes to other countries for finishing in order to mask their country of origin. OCTG imports more than doubled, to 1.8 million tons, from these nine countries between 2010 and 2012.

Last July, United States Steel Corporation (NYSE:X), which owns the plant where Monday’s rally took place, and several other steel manufacturers filed a trade complaint accusing the biggest OCTG exporters to the U.S. of dumping. The Department of Commerce will issue its final decision on July 10.

Prusa says that, historically, the department tends to favor domestic companies over foreign ones, so the preliminary ruling that South Korea isn’t dumping the steel product is likely to stand in the final decision, against the wishes of domestic steelworkers and their employers.

The U.S. has been facing a steep decline in manufacturing output and employment amid the economic globalization that has accelerated since the 1990s. In the U.S. jobs report on Friday, the manufacturing sector created about a third as many jobs as retail.

"This was a surprisingly weak manufacturing jobs number for April. In an economy that added 288,000 jobs, manufacturing saw only 12,000 of those,” Alliance for American Manufacturing President Scott Paul said in an email sent Friday. "It’s past time to address some of the challenges facing job creation. We need new investments in infrastructure and a plan to lower the trade deficit in manufactured goods.”

© Copyright IBTimes 2024. All rights reserved.