Why US Auto Sales Have Yet To Reach Prerecession Peaks

The U.S. auto industry is in the midst of a rebound as annual sales of new cars and trucks approach prerecession levels this month. But it’s taken six years for annual new-auto sales to recover from a 30-year low in the midst of the Great Recession, and stagnant wage growth for U.S. workers could keep the industry from reaching its prerecession heights.

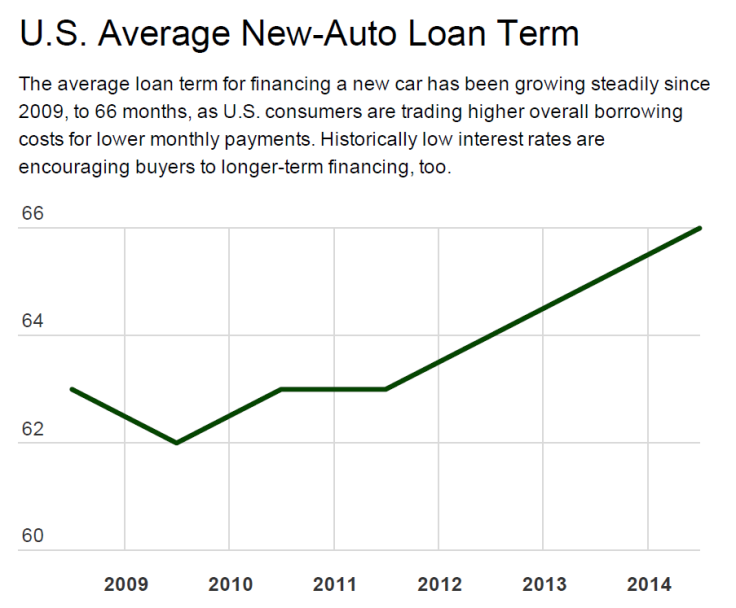

Hidden in 2014’s stellar sales numbers is a rarely acknowledge fact: Automakers are increasingly offering longer-term financing deals to lure reluctant buyers. The efforts boost sales in the short term, but borrow from future sales because buyers in longer-term loans buy new cars less often. The phenomenon is likely to hamper future sales.

"If wages were growing, we'd be in a market over 17 million already," Steven Szakaly, chief economist for the National Automobile Dealers Association (NADA), told Automotive News. By most estimates, new-auto sales are expected to hit 16.4 million in 2014. The last time sales topped 17 million was in 2001, a year after sales hit an all-time high of 17.4 million. The NADA expects new-car sales to remain below the historic high for years to come. "I think these wage and income challenges are with us for the next several years,” Szakaly added.

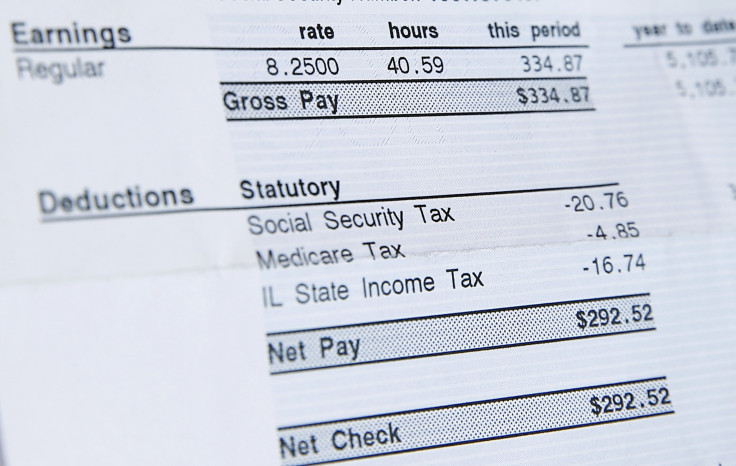

Hourly wages in the U.S. aren’t keeping pace with inflation. Wages have grown an average of 2 percent a year since the recession ended in 2009, but adjusted for inflation hourly wage growth stands at a tepid 0.5 percent since 2009, according to the U.S. Bureau of Labor Statistics. In past postrecession recoveries real wage growth could top 9 percent a year as the prosperity of employers and shareholders would trickle down to their workers. But not anymore.

In order to deal with less cash in the pockets of working Americans, automakers have been extending loan terms to record lengths. Chrysler Group in October began offering a staggering 84-month financing program through its Chrysler Capital affiliate for a range of new Chrysler cars, including the all-new Chryser 200 sedan. This is the first time 84-month loans have been used since before 2008 when some automakers tested long-term financing on select vehicles.

The industrywide average loan term has been marching upward as consumers sacrifice overall savings on interest in return for lower monthly payments. As of this year's third quarter, the average loan term for a new car stood at 66 months, 5 percent longer than it was in the same period of 2008 during the midst of the Great Recession.

© Copyright IBTimes 2025. All rights reserved.