Fed Set To Raise Interest Rates To Rein In Inflation

US central bankers on Wednesday are poised to take the first step to raise borrowing costs in a bid to cap rising inflation before it surges out of control.

The Federal Reserve will have to walk a tightrope to ensure its efforts don't derail the recovery from the Covid-19 pandemic as Russia's invasion of Ukraine introduces new uncertainty in an economy battered by supply chain snarls and labor shortages.

"There is no good answer to that in any economics textbook," David Wilcox, a former senior Fed advisor, told AFP, stressing that communication from the central bank about its willingness to act will be key in pulling off its balancing act.

The central bank's Federal Open Market Committee opened its second day of deliberations early Wednesday and is due to announce its rate decision at 1800 GMT.

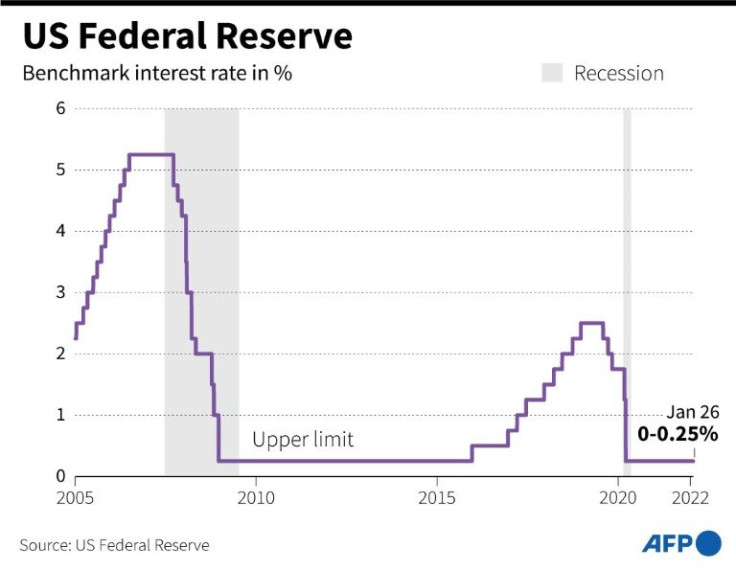

Fed Chair Jerome Powell has said he favors increasing the benchmark interest rate by 0.25 percentage points from zero, where it has been since March 2020.

It would be the first in a series of hikes, which would pull back on the stimulus rushed into place at the start of the Covid-19 pandemic.

The Fed chief has expressed confidence that inflation will retreat in the coming months as supply chain issues and shortages are resolved in the world's largest economy.

But China's latest lockdowns of several cities, affecting tens of millions of people and closing off a key supplier to American tech giant Apple, shows the pandemic and its disruptions are not over.

Policymakers are better equipped to handle inflation that is too high rather than too low, as was the case in the decade following the 2008 global financial crisis, during which inflation and employment were slow to recover.

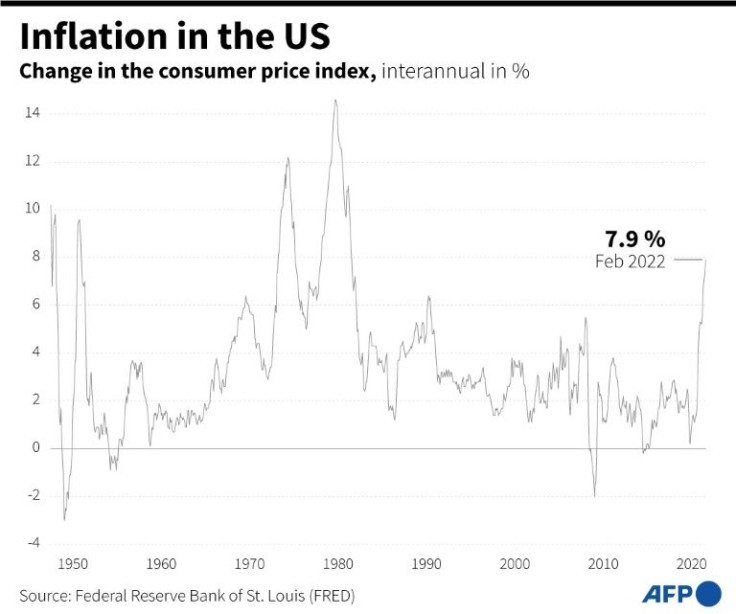

However, with the annual consumer price index growing 7.9 percent in February, its fastest pace in four decades, the central bank faces intense criticism that it missed the inflation danger, and has moved too slowly in response to rising prices for cars, housing and food.

And the war in Ukraine together with Western sanctions on Russia have sent oil prices surging, although they retreated Tuesday closing below $100 a barrel for the first time in three weeks.

"The Federal Reserve's delays in raising interest rates and its continued misreading of inflation, monetary and fiscal policies are now complicated by the negative supply shock imposed by Russia's invasion of Ukraine," said Mickey Levy of Berenberg Capital Markets.

"Even without the surge in oil and commodity prices, the Fed is wrong on every count," Levy wrote in a column in The Wall Street Journal, saying the central bank "must begin to raise rates."

But Wilcox, now with the Peterson Institute for International Economics and Bloomberg Economics, defended the Fed's performance, saying officials have adjusted to changing circumstances.

"I think the allegation that the Fed is behind the curve is considerably overdone," he said. "They have been caught by surprise, as the vast majority of prognosticators were," but "they've had the guts and the courage" to change their mind publicly.

Wall Street was in a cheerful mood ahead of the decision, with all three major indices up decisively in early trading.

Briefing.com analyst Patrick J. O'Hare said the sentiment was partly fueled by hopefulness -- however premature -- around Russia-Ukraine peace talks, and the expectation of further gains once the Fed makes its announcement.

"The supposition with respect to today's policy decision is that it could ultimately translate into a buy-the-fact event since the market has already sold the rumor," O'Hare said.

Economists project six or seven rate increases this year, which would still leave the policy rate below two percent, assuming central bankers raise it in quarter-point steps.

However, Powell and other policymakers have stressed that they will do whatever is needed to tamp down inflation, including more aggressive hikes.

"The most important thing for the Fed to communicate in an environment of enormous uncertainty" is to make clear "how it will respond," Wilcox said.

© Copyright AFP 2024. All rights reserved.