US Prosecutors Probing Jack Dorsey's Block For Non-Compliance At Cash App, Square: Report

KEY POINTS

- Square allegedly facilitated thousands of transactions with countries subject to US sanctions

- Cash App allegedly did not collect enough information from customers to assess related risks

- Block said it has an existing 'responsible and extensive compliance program'

- Hindenburg Research accused Block last year of allowing widespread fraud among its users

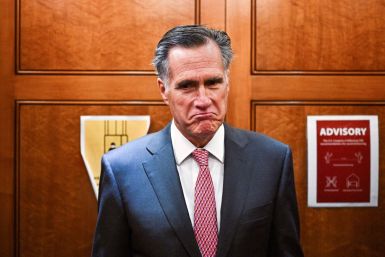

Federal prosecutors are investigating fintech firm Block over alleged years of compliance lapses at the company's key units, Square and mobile payment service Cash App.

Prosecutors are discussing with a former employee who alleged widespread non-compliance at Cash App and Square, NBC News reported Wednesday, citing two people with direct knowledge of the talks.

According to the report, internal documents provided by the ex-employee revealed that Square facilitated thousands of transactions with countries that were subject to sanctions. Both Square and Cash App allegedly did not collect adequate information from customers to assess risks related to their clients' transactions.

The documents reportedly revealed how Block, which was established by Twitter (now X) co-founder Jack Dorsey, processed cryptocurrency transactions for terrorist groups. "From the ground up, everything in the compliance section was flawed," the ex-staffer, who was granted anonymity to prevent potential reprisals, told the outlet.

Block has yet to issue an official statement on the report, and did not immediately respond to International Business Times' request for comment.

The report went on to reveal that some 100 pages of documents were provided to the outlet by the former employee, which then showed that many small dollar transactions involved countries subject to U.S. sanctions, including Russia and Iran.

A Block spokeswoman told the outlet that the fintech company has a "responsible and extensive compliance program and we regularly adapt our practices to meet emerging threats and an evolving sanctions regulatory environment." The company also said it voluntarily reported "thousands of transactions" to the U.S. Treasury Department's Office of Foreign Assets Control (OFAC). The former employee disputed Block's statement on the matter.

This isn't the first time Block has been placed under the radar regarding issues within its system. Dorsey's fortune saw a multi-hundred-million dip earlier last year after short seller Hindenburg Research alleged that the fintech firm inflated its metrics and there was widespread fraud among Block users.

There is no "magic" behind Block's business and its disruptive innovation isn't what has been driving the company forward, Hindenburg's report said at the time. Instead, it was "the company's willingness to facilitate fraud against consumers and the government, avoid regulation, dress up predatory loans and fees as revolutionary technology, and mislead investors with inflated metrics," it added.

Block told Forbes following the report that it was exploring possible "legal action" against Hindenburg, as the short-seller was only looking to deceive Block investors.

© Copyright IBTimes 2024. All rights reserved.