The 7 Largest E-Commerce Companies In The World

If there's one big trend in retail, it's that more and more sales are happening online. Online shopping is growing significantly faster than brick-and-mortar stores.

This article originally appeared in the Motley Fool.

Online retailers brought in nearly half a trillion dollars in the U.S. over the past year with about 9% of total sales, according to data from the U.S. Census Bureau. And online sales are growing between 15% and 17% per year, compared to about 5% for the overall retail industry.

Globally, the trend is even stronger. Some 1.66 billion online shoppers spent $2.3 trillion in 2017. By 2021, sales could more than double from today's levels.

It's no surprise, then, that some of the world's largest internet companies are e-commerce companies. Meanwhile, many brick-and-mortar stores are moving aggressively into online retail to take advantage of the trend and protect their businesses.

In this article, we'll explore the seven largest e-commerce companies in the world, many of which present interesting investment opportunities to take advantage of the megatrend in online shopping.

What is e-commerce?

E-commerce, by its broadest definition, is any transaction of goods and services done over the internet. More colloquially, it refers to buying an item or service online with an electronic payment method, such as a credit or debit card or a digital wallet service. The item could be physical (a vinyl record), digital (an mp3 download), or a service (a music streaming subscription).

When talking about e-commerce companies, there's a broad range of businesses involved in making online stores work. Payment networks and digital wallet services ensure payment processing. Shipping and logistics companies make sure packages are delivered. And online stores connect buyers and sellers.

For the purposes of this article, we're focusing primarily on online stores. But those stores may operate in any one of the several flavors of e-commerce:

- Business-to-Consumer (B2C): This is the kind of e-commerce that comes to mind when most people hear the word. B2C e-commerce is when a business sells a good or service to an individual consumer. Some examples of B2C e-commerce operations include Amazon(NASDAQ:AMZN), Walmart's (NYSE:WMT) online stores, JD.com (NASDAQ:JD), and Alibaba's (NYSE:BABA) TMall.

- Business-to-Business (B2B): A business selling a good or service to another business. This can be done in the form of wholesalers like those found on Alibaba.com. It could also be businesses that offer software-as-a-service to other businesses to help manage their companies. Software-as-a-service is a term used to describe a software product offered to customers on a subscription basis and generally accessible through the internet.

- Consumer-to-Consumer (C2C): C2C e-commerce businesses create a marketplace to connect buyers and multiple sellers online. eBay (NASDAQ:EBAY) originally got its start as an auction clearinghouse for consumers to sell their unwanted items to other consumers, and it's a prime example of C2C e-commerce. Amazon also offers a marketplace for consumers to sell unwanted items, and Alibaba operates similar online marketplaces in China. In the context of this article, consumer-to-consumer e-commerce companies are businesses that merely facilitate e-commerce through their platform.

- Consumer-to-Business (C2B): A consumer-to-business transaction is when a consumer sells an item to a business. Instead of listing an item on a marketplace like eBay, C2B e-commerce companies buy items directly from consumers. They might then turn around and sell them on an online marketplace. An example would be companies that buy used smartphones, including eBay and Gazelle.

Which e-commerce company is the biggest?

There are several different ways one could measure the size of an e-commerce business. How many customers does it have? How much revenue do they generate? How much is the company itself worth?

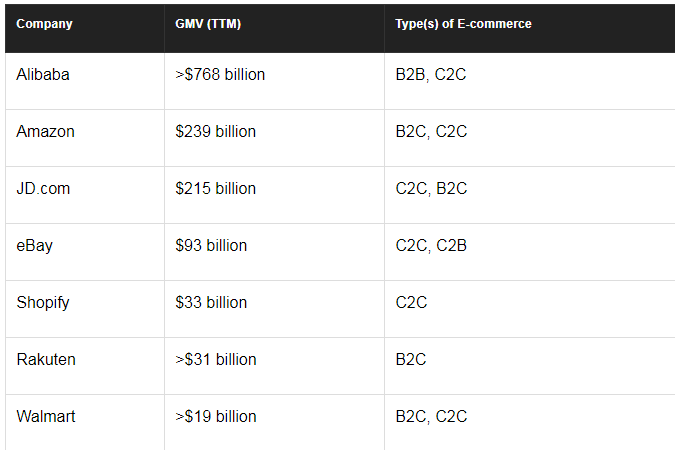

Perhaps the most universal way to compare online stores is with a metric called gross merchandise value, or GMV. (Gross merchandise value is also sometimes referred to as gross merchandise volume, or gross merchandise sales.) GMV is a measure of the total value of all items sold on an online store or marketplace.

GMV is a lot different from revenue. eBay operates as a marketplace, and it doesn't sell items directly to consumers. As such, its revenue is a small percentage of its GMV. Shopify(NYSE:SHOP) makes it easy for other businesses to sell goods on their own websites, so it also generates a small amount of revenue compared to GMV on its platform.

Amazon, meanwhile, splits its sales about 50/50 between its own retail operations and sales from third-party merchants on its marketplace. As a result, its revenue is a significantly higher share of its GMV. Online stores that exclusively sell their own inventory (think brand retailers) will produce practically the same amount of revenue as GMV.

Here's a table of the world's largest e-commerce companies sorted by GMV:

Alibaba

Alibaba first started its business online in 1999, launching Alibaba.com and 1688.com. Its flagship site operates as a global wholesale marketplace, while 1688.com handles similar transactions within China.

Alibaba's core commerce business also consists of:

- Taobao: Alibaba's consumer-to-consumer marketplace serving mainland China, enabling small businesses and entrepreneurs to reach individual consumers. Founded in 2003, it's now the world's biggest e-commerce website. It generated $428 billion in gross merchandise volume in Alibaba's fiscal 2017.

- Tmall: A spinoff from Taobao dedicated to business-to-consumer e-commerce in China. It's the second-largest e-commerce website in the world after Taobao, generating $340 billion in GMV during fiscal 2017.

- AliExpress: Aimed at international shoppers, enabling small businesses in China to sell to customers all over the world, particularly the U.S., Russia, Brazil, and Spain. Alibaba doesn't report GMV on AliExpress.

Even just looking at Alibaba's success with its Taobao brands, Taobao, and Tmall, Alibaba is an absolute giant compared to the rest of the competitors. Add in its wholesale marketplaces, which are the go-to source for finding manufacturers and suppliers in Asia to source white-label products, and Alibaba's share of all the commerce transacted on the internet is even bigger. With a growing international presence anchored by AliExpress and other investments in retail, Alibaba is by far the world's largest e-commerce company.

Amazon

Amazon is the largest online retailer in the United States. Amazon started as an online bookstore, but it quickly expanded to all sorts of different verticals, including electronics, fashion, and home goods.

Perhaps its most innovative and successful contribution to online retail is Amazon Prime. Amazon Prime is a subscription service that provides shoppers with unlimited 2-day shipping from Amazon. The company has continually added new benefits such as video and music streaming, exclusive access to certain items, early access to deals, free ebooks, unlimited cloud storage for photos, and more. As a result, Amazon now has over 100 million Prime members worldwide.

Amazon has also hit a homerun with its Fulfilled by Amazon service. FBA allows third-party merchants to use Amazon's warehouses, fulfillment center network, and logistics capabilities to fulfill orders. Items sold through FBA are Prime-eligible, which is increasingly important to attracting customers on Amazon. Fulfilled by Amazon allowed the online store to grow Prime-eligible items from 20 million to 100 million over the last three years.

Overall, Amazon's GMV totaled about $239 billion over the last 12 months. Consider that $116 billion of that is sold directly by Amazon, with the other $123 billion coming from third-party sellers on its marketplace. Amazon kept about $37 billion in fees for facilitating third-party sales. That's a much higher take rate than most marketplaces, but Amazon has much higher costs associated with its third-party sellers using services such as FBA.

JD.com

JD.com is very similar to Amazon, but operating in China. The company has built out an unparalleled logistics network with over 500 warehouses and 7,000 delivery stations. Unlike Amazon, though, JD.com operates the entire logistics operation itself, not handing off packages to third parties for last-mile delivery. That enables JD.com to ship 90% of orders to customers by the next day. Amazon is notably investing in its own delivery network.

JD operates a first-party retail segment just like Amazon's, but it also partners with international brands, including Walmart, to help them reach Chinese consumers. JD operates more like an online mall in that way than a centralized retailer. Walmart is notably a 5% stakeholder in JD.com after the American company sold its Chinese online store, Yihaodian, to JD.com in 2016.

JD launched JD Plus in 2016, its version of Amazon Prime. Plus members enjoy free shipping up to 60 times per year, free ebooks, special discounts, faster accrual of loyalty points, and iQiyi's premium service. iQiyi is China's largest online video platform. The company now claims over 10 million JD Plus members, and members renew at an 80% rate.

JD's strong logistics network and growing list of domestic and international retail partners (170,000 and counting) is helping it grow GMV rapidly. GMV increased 30% in the second quarter of 2018, outpacing Amazon by about 11 percentage points. At that rate, JD.com could overtake Amazon by 2019.

eBay

eBay started as an online auction house in the 90s for people to sell collectibles and used goods to one another. Today, 80% of items sold on the platform are new, and 89% of items are sold at a fixed price.

eBay is taking steps to make its platform look and operate more like Amazon. It's encouraging sellers to offer free guaranteed 3-day shipping. It's combining product listings from sellers with the same item, enabling consumers to find the best price more easily. It also launched a Best Price Guarantee, offering customers a 110% rebate on the difference between an item they bought on eBay and an identical listing on a competitors' website. eBay is operating more and more like a business-to-consumer retailer instead of a marketplace for other businesses.

The moves are starting to pay off. GMV growth (on a currency-neutral basis) started accelerating in 2018, growing 7% in the first half of the year. Still, that growth is considerably slower than other companies on this list, and slower than the overall growth of the e-commerce industry.

While eBay turns around its GMV growth, it's also working to increase its profit margin. It moved to intermediate payments itself by starting to cut ties with former subsidiary PayPal. The company will handle all of its payments in-house by 2021, which the company expects to provide significant value to sellers on the platform. That could result in both higher profits and better GMV growth.

Shopify

Shopify is very different than the other companies mentioned in this article. Instead of operating its own centralized marketplace, Shopify provides a platform for small merchants to sell items on their own websites and on other third-party marketplaces including Amazon and eBay. At the core of its business, Shopify provides an easy way to manage a retail business from one central location, tracking sales and inventory, helping fulfill orders, and helping customers create their own websites.

Shopify charges a subscription fee to use its service, offering several different tiers suitable for businesses of all sizes. Its 600,000 merchants range from one-person entrepreneurs with a single product all the way up to multibillion-dollar brands with hundreds of products.

However, more and more of its revenue is coming from what it calls merchant solutions. Shopify offers payment processing, shipping services, and cash advances to merchants. In the second quarter of 2018, merchant solutions accounted for 55% of total revenue for Shopify, and the segment is growing faster than its subscription business. While these services have much lower profit margin than its subscription offerings, they support subscriptions by locking merchants into Shopify's ecosystem.

Merchants are increasingly looking for an alternative to Amazon, as the marketplace becomes more and more crowded. Shopify is one of the top alternatives for businesses looking to establish a brand and take more control of their inventory and sales with their own websites. The growth of merchant solutions outpacing subscription revenue is a sign that there's strong demand for an alternative to Amazon, but entrepreneurs still want a bit of hand-holding. Shopify is in one of the best positions to offer that service.

Rakuten

Rakuten is very similar to JD.com and Amazon. The Japanese e-commerce company operates an online mall for big brands in Japan, but it also owns several e-commerce operations in other countries, including the U.S., France, Brazil, and the U.K., which are more unbranded marketplaces like Tmall, eBay, or Walmart's marketplace.

Rakuten has put a major focus on its delivery network, launching its One Delivery initiative last year. Rakuten hopes to improve delivery speed at a lower cost by relying on its own network as well as third parties in a similar manner as Amazon in the U.S. Amazon itself has made good progress in the Japanese market thanks to the growth of Prime and its shipping benefits. Amazon is the largest online retailer in Japan, according to some estimates.

In order to combat the growth of Amazon, Rakuten is also investing outside of retail and logistics. It operates Japan's largest internet bank and its third-largest credit-card company. It recently started building a wireless network to improve the profitability of its MVNO business. It also owns a travel agency, insurance company, matchmaking service, and golf-reservation system, among 60 or so other businesses. It's also a major investor in Lyft and Pinterest, and it owns 100% of Viber. The goal is to create an ecosystem of services that can provide everything customers need in order to promote its brand.

Rakuten's profits have been hurt by its heavy investments recently, and GMV growth isn't nearly as strong as others on this list. Domestic GMV grew just 11.1% year over year in the second quarter of 2018. What's more, the profitability of its core retail operations is declining as it invests in logistics and other efforts to stave off Amazon. Operating income from domestic e-commerce is declining despite modest improvements in revenue.

Rakuten's global transaction volume, which includes its international operations as well as credit-card payments, digital transactions, and other retail operations increased slightly faster, at 16.4%. Still, Rakuten's growth is relatively slow.

Walmart

Walmart is the world's largest brick-and-mortar retailer, generating revenue of nearly half a trillion dollars per year. But just a small portion of that revenue comes from online sales.

The company has been investing heavily in e-commerce over the past few years. It acquired Jet.com in 2016 along with a string of small U.S.-based e-commerce companies. It's also rapidly expanding its online grocery operations following Amazon's big push into groceries in 2017. As a result, Walmart has seen strong online sales growth over the past couple of years. It generated $11.5 billion in sales in the U.S. in 2017, and it expects to hit 40% online sales growth this year.

Walmart's most recent e-commerce investment is its acquisition of a 77% stake in Flipkart, one of the leading e-commerce companies in India. The move puts Walmart neck-and-neck with Amazon in India, another market where Amazon has grown to overtake native competition. India holds massive growth potential for online shopping, and Walmart's Flipkart stake gives it tremendous exposure to the market. Walmart says Flipkart's GMV in 2017 was about $7.5 billion.

Not all of Walmart's e-commerce investments have paid off. In 2017, the company made the decision to wind down its first-party e-commerce operations in Brazil. It also ended up selling an 80% stake in its brick-and-mortar business in the country as operations struggled during the Brazilian recession.

Walmart has largely grown its e-commerce sales through acquisitions and the expansion of grocery pickup and delivery. It's unclear how long the momentum can last as it finishes its grocery rollout and laps its acquisitions. The Flipkart acquisition will provide significant growth in one of the fastest-growing e-commerce markets in the world, but it doesn't protect Walmart's brick-and-mortar operations from ceding sales to online competitors in the 26 other countries in which it operates.

Investing in e-commerce

These seven companies each offer various opportunities to invest in e-commerce. Amazon offers global scale. Alibaba and JD.com offer access to the rapidly growing Chinese market. Shopify offers access to a growing number of small retail entrepreneurs. Walmart offers exposure to India with its Flipkart acquisition, but provides stability with its massive brick-and-mortar operations. eBay and Rakuten are growing more slowly than the competition, but eBay is finding ways to improve the profitability of its core business, while Rakuten is investing in other areas outside of retail to drive profit growth.

For investors interested in e-commerce, these seven companies provide a great start.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adam Levy owns shares of Amazon and eBay. The Motley Fool owns shares of and recommends Amazon, JD.com, PayPal Holdings, and Shopify. The Motley Fool recommends eBay. The Motley Fool has a disclosure policy.