Airbus Wins Deal With Japan's ANA Holdings For A380 Superjumbos

Airbus Group SE landed its first new airline customer in three years with the sale of three A380 superjumbos, the world’s largest passenger jet. ANA Holdings of Japan agreed to buy the jets, signaling a hopeful turnaround for the troubled A380 program.

The deal is worth about 150 billion yen ($1.23 billion), based on the current market price, the Japanese news service Nikkei first reported Friday. However, companies rarely pay the retail price.

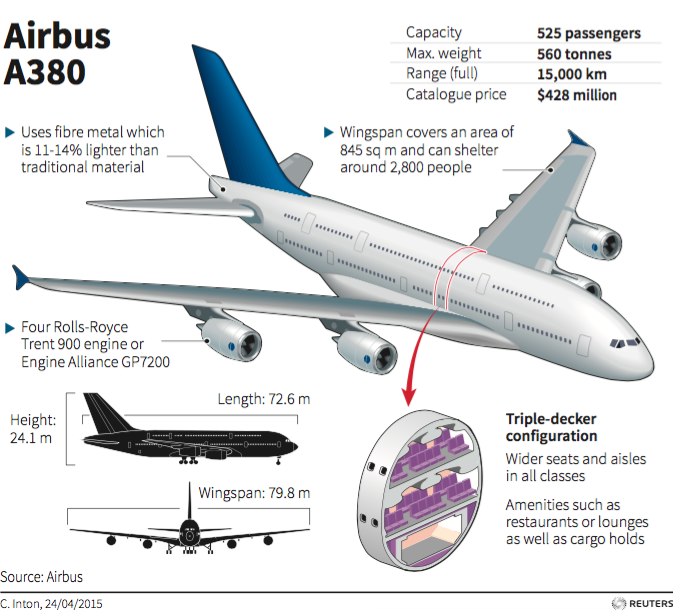

The deal was struck a year after Harald Wilhelm, Airbus’ chief financial officer, warned the A380 program could be scrapped without new orders, the Financial Times said. The decadelong development of the double-deck, four-engine jet cost more than $10 billion.

ANA Holdings Inc. bought the jets in a bid to expand its international service as domestic flights peak in Japan, Nikkei reported. The superjumbos could come by fiscal year 2018 for routes to Hawaii and beyond.

France-based Airbus declined to comment to financial news outlets. ANA representative Ryosei Nomura told Bloomberg News the company is “currently formulating the next medium-term management strategy and considering various options for planes.” He declined to comment specifically on the A380 deal, Bloomberg reported.

Airbus separately agreed last week to supply 10 of its A330-300 jets to China Southern Airlines Co. Ltd., Asia’s biggest carrier by fleet size. The order is valued at $2.27 billion at list prices, the airline said Dec. 23. Airbus is set to deliver the planes between 2017 and 2019, and the purchase will help boost the airline’s capacity by 4 percent, the company said in a statement to the Shanghai Stock Exchange.

Another Airbus deal hit a snag last week after the European plane manufacturer postponed delivery of its A320neo model airliner by at least several weeks as it addresses documentation issues.

The announcement Wednesday of the delayed delivery of the single-aisle plane to Deutsche Lufthansa AG came about a week after the IndiGo unit of Interglobe Aviation Ltd. said it had been told its first Airbus jet would be late due to “industrial reasons.” Qatar Airways Ltd., originally set to be the first A320neo customer, put back deliveries three weeks ago, citing engine issues.

The fuel-efficient A320neo constitutes the majority of Airbus’ production. The company has won close to 4,500 orders since launching sales of the model in 2010.

“It’s a disappointment for Airbus because they’d promised delivery by year-end,” Addison Schonland, an analyst with AirInsight Inc., told Bloomberg News in a report published Wednesday. “At the same time, delays seems to be the new normal for all plane programs as the only program that seems to be on time so far is the Boeing 737 Max.”

© Copyright IBTimes 2024. All rights reserved.