Alibaba Takes A Big Stake In China’s Gen Z Darling, Bilibili

Alibaba's (NYSE:BABA) Taobao recently took a 10.8% passive stake in Bilibili (NASDAQ:BILI), a Gen Z-oriented digital platform in China. The investment makes Alibaba one of Bilibil's top stakeholders alongside Tencent (NASDAQOTH:TCEHY), which took a 12% stake in the company last October.

Bilibili generates most of its revenue from mobile games, but it's been expanding its ecosystem with live videos, streaming content, online comics, ads, and a tiny e-commerce platform that sells licensed and tie-in products for its other digital content. The company went public last March at $11.50, and subsequently rallied more than 50% after two quarters of impressive growth.

Taobao's investment in Bilibili wasn't surprising, since the two companies partnered up last December to co-develop a "dynamic ecosystem that will better connect content creators, merchandise and users on both platforms."

That partnership enabled content creators on Bilibili to register accounts on Taobao to promote their own merchandise. The two companies also started commercializing Bilibili's other IP assets (including games, videos, and comics) while analyzing the platform's performance with Alibaba's analytics tools. Taobao's investment indicates that things are going well -- and it could benefit both companies.

How can Bilibili help Alibaba?

Alibaba's Tmall and Taobao are the largest online business-to-consumer and consumer-to-consumer marketplaces in China, respectively. However, a growing number of competitors are blurring the lines between social networks and e-commerce platforms.

These challengers include Pinduoduo, which encourages users to co-purchase products with their family members, friends, and co-workers across social media channels to get better bulk prices; and Mogu, which went public last December and lets merchants sell products from live streaming videos.

Tencent is also encouraging e-commerce companies, including its top partners JD.com and Vipshop, to launch their stores in "Mini Programs" for WeChat, the top mobile messaging app platform in China with over a billion monthly active users (MAUs).

Taobao reaches nearly 700 million mobile MAUs with its marketplace, but it's clearly concerned about the rise of social shopping. It launched an internal blogging platform three years ago, but it only had about 1.6 million content creators at the end of 2018. Bilibili hosted about 600,000 active content creators who uploaded 1.7 million videos monthly last quarter, so it tethering those content creators to Taobao could boost its social presence.

Bilibili's total MAUs rose 26% annually to 93 million last quarter. Of those MAUs, 82% are in China's Gen Z, which the company says is the generation that began in 1990. Its average user spent 85 minutes per day (excluding mobile games) on its platform.

Tethering those users to Taobao and Alipay, the payment platform run by Alibaba's affiliate Ant Financial, could help Alibaba lock in younger users. Alibaba's investment could also prevent Tencent, its main rival in the payments and smart retail markets, from tethering Bilibili more tightly to its WeChat ecosystem.

How can Alibaba help Bilibili?

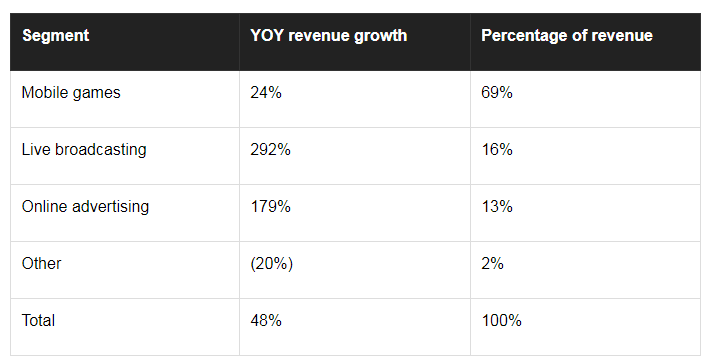

Bilibili's long-term goal is to reduce the weight of its mobile games on its top line, since they're vulnerable to competition, censorship, and fickle gaming trends. Last quarter, its mobile gaming revenue rose 24% annually and accounted for 69% of its top line, marking a significant drop from 77% a year earlier.

Bilibili wants to reduce that percentage to about 50% within three to five years. That's why it acquired a stake in Japanese animation studio Fun-Media, partnered with Tencent to launch additional anime content, and bought most of NetEase's online comic books last year. Here's how its core businesses fared last quarter:

The only sore spot is the "other" segment, which includes the company's tiny e-commerce business. Therefore it makes strategic sense to expand that platform with Taobao's help. If this partnership is fruitful, Bilibili could leverage the growth of its live broadcasting platform to sell more products, which would further diversify its business away from mobile games.

Is this a win-win deal?

Alibaba and Bilibili's tighter relationship could help both companies over the long run. Alibaba gains a valuable foothold in the social shopping and Gen Z markets, while Bilibili's fledgling e-commerce business gains the backing of China's top e-commerce company.

Moreover, Alibaba's interest could convince Tencent to boost its investment in Bilibili, which it considers a key way to counter the growth of ByteDance's Gen Z-oriented apps. That, in turn, could force Alibaba to match Tencent's stake -- which would be great news for Bilibili investors.

This article originally appeared in the Motley Fool.

Leo Sun owns shares of JD.com and Tencent Holdings. The Motley Fool owns shares of and recommends JD.com, NetEase, and Tencent Holdings. The Motley Fool recommends Bilibili. The Motley Fool has a disclosure policy.