Canada's Inflation Rate Accelerates Again, But Not As Sharply As Forecast

Inflation in Canada picked up speed again in June with prices rising at their fastest pace since January 1983, official data showed on Wednesday, but the rise was not as steep as forecast, leaving analysts unsure about how forcefully the Bank of Canada would respond.

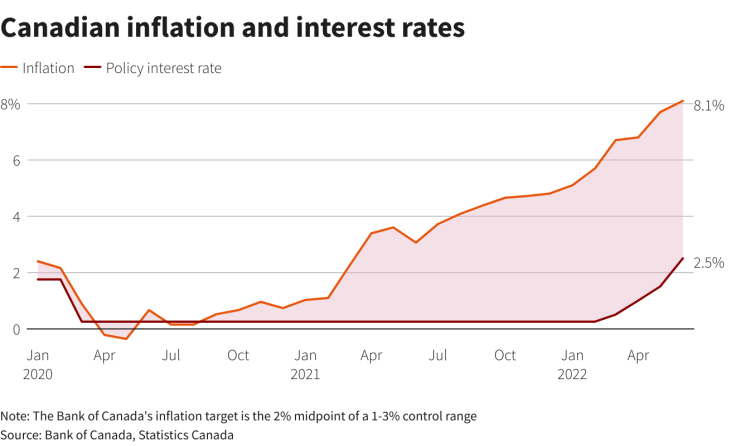

Canada's annual inflation rate hit 8.1% in June, up from 7.7% in May, driven by higher costs at the gas pump and almost everywhere else, Statistics Canada said, but short of forecasts it would accelerate to 8.4%.

"For one of the rare times in the last two years, we've actually got a number that's below expectations," said Doug Porter, chief economist at BMO Capital Markets. "The bad news is we still got the highest inflation in roughly forty years."

Gas prices rose 54.6% in June compared with a 48.0% gain in May, though "price increases remained broad-based with seven of eight major components rising by 3% or more."

Indeed, all three core measures of inflation, which the Bank of Canada watches carefully, rose in June. CPI Common, which the central bank says is the best gauge of the economy's performance, hit 4.6% from a upwardly revised 4.5% in May.

The central bank last week said it expected headline inflation to be around 8% for the next few months. It also surprised with a rare 100 basis points rate increase, a move aimed at fending off a price spiral.

Later on Wednesday, in an interview with broadcaster CTV, Bank of Canada Governor Tiff Macklem said inflation is likely to remain "painfully high" and above 7% for the rest of 2022, though it probably will ease back in July compared with June.

(Graphic: Canadian inflation and interest rates:

)

With inflation quadruple the 2% target, economists and money markets both see more oversized hikes coming, though not another 100-bp surprise.

"It's no time for complacency from the Bank of Canada and we expect them to maintain a relatively forceful policy stance in September," said Andrew Kelvin, chief Canada strategist at TD Securities. "The debate for September should really be between a 50 or a 75-basis-point move."

Money markets are betting on a 50-bp increase on Sept. 7, with two further hikes in October and December to bring the policy rate to 3.5%, up from a record low 0.25% at the beginning of the year.

The June data was not all negative, with grocery and shelter price gains easing after months of acceleration. Looking ahead, economists noted gas prices have fallen so far in July, giving Canadian consumers a bit of relief.

"Gasoline prices are currently tracking almost a 9% decline in July, so we know we're going to go the other way next month," said Doug Porter, chief economist at BMO Capital Markets.

The Canadian dollar was trading down at 1.2871 to the Greenback, or 77.69 U.S. cents.

© Copyright Thomson Reuters {{Year}}. All rights reserved.