Coronavirus May Hasten US-China Disengagement That Trade Wars Started

KEY POINTS

- Coronavirus outbreak has forced a pause in the U.S. and China trade relations

- U.S. businesses have woken up to the perils of overdependence on one country

- Secretary Ross said last month the lockdown would bring back to U.S. hundreds of jobs

The recent coronavirus outbreak may be speeding up the “decoupling” of the United States and China, something that their prolonged trade wars had been threatening, according to an analyst. The supply chains that link the world’s top two economies are in tatters because of the lockdown of many key industrial hubs in China after infections spread from the hub of Wuhan in Hubei province. The epidemic has so far killed about 1,100 people, mostly in Mainland China, and infected more than 40,000.

A prolonged trade separation could force the two countries to pause the first phase trade agreement that they signed recently. It will allow U.S. businesses to look for other supply sources, even if that would push up the costs and probably require adjustments in the production processes, experts say.

Beneficial fallout

U.S. Secretary of Commerce Wilbur Ross said last month the quarantines would have a beneficial fallout for the U.S. as jobs could return to the country.

The coronavirus had made the perils of overdependence on one market clear to businesses in many countries including the United States, according to Curtis Chin, the Asia fellow of the Milken Institute. The epidemic is already speeding up the decoupling of the two economies more than the tariff barriers triggered by the trade wars, CNBC website said citing Chin. “We talked about China and the U.S. decoupling. The coronavirus more than the trade war has sped some of that decoupling as countries, as businesses think about their supply chain for the long run,” the report quotes Chin as saying. Chin termed it an “increased disengagement” of the two economies.

“It can’t all be in China, we’ve seen some of the consequences of over-reliance on just one key market,” he told CNBC at the Milken Institute’s Middle East and Africa Summit in Abu Dhabi Tuesday.

“In many ways, things are frozen right now — that U.S.-China trade dynamic. I don’t see negotiators coming from Beijing to Washington at this moment,” he said. “Interestingly, when we think about the phase one deal ... in a way the coronavirus gives both sides an out. If commitments aren’t met anytime soon, well it’s the coronavirus,” he told CNBC.

Tit-for-tat tariff barriers

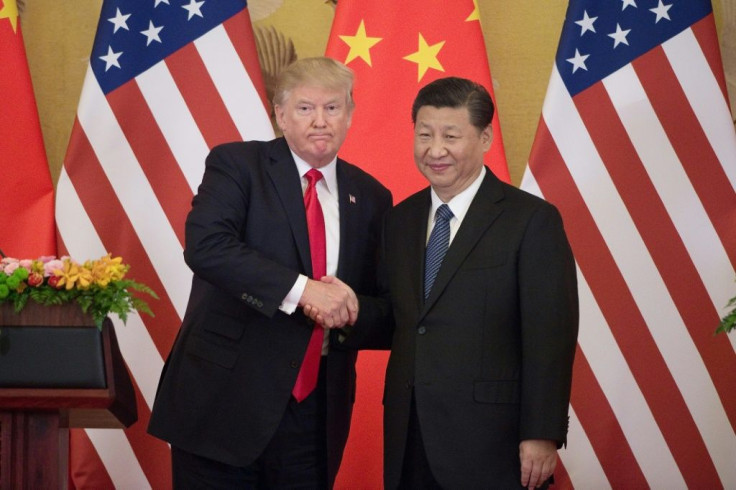

There had already been a talk of the “decoupling” of the two economic superpowers as the trade wars worsened with President Donald Trump and China’s Xi Jinping announcing tit-for-tat tariff barriers in 2018. Each side heaped billions of dollars of tariffs on the other’s goods and services. Washington and Beijing have signed a phase one agreement to ease some of the tariffs. There have also been reports about another imminent round of tariff negotiations. However, the novel coronavirus has made any trade difficult even with lower tariffs. The U.S. government had accused China of intellectual property theft and forced technology transfer, apart from failure to provide a level playing field.

A reported move of White House to curb some U.S. investments in China such as delisting Chinese stocks in the U.S. already drove a wedge between the two giants. “The reality is that the US and Chinese economies, from supply chains to investment and trade flows, will be intertwined for years to come,” Chin said. “The coronavirus crisis, however, has underscored to the United States and all of China’s trading and investment partners the value of diversification away from China.”

China's commitment

However, there are worries about the fallout of a separation because of the deep integration of China with the world economy. Nomura in a note Tuesday flagged China’s role in the global economy with the Asian giant contributing nearly 12% of global trade last year. Many markets depend heavily on supply chains linked to China for production. Some estimates say that the shutdowns could cost China about 2% of its GDP.

Secretary Ross said that the outbreak in China could lead businesses to reconsider their supply chains — and return jobs and manufacturing to the U.S. ″I think it will help to accelerate the return of jobs to North America,” he said in late January. “Some to the U.S., some to Mexico as well.”

The partial trade deal signed on Jan. 15 included a commitment by China to buy at least $200 billion worth of U.S. goods over two years, including manufactured goods, food, agricultural, energy products, and services.

© Copyright IBTimes 2025. All rights reserved.