Crowdstreet Review 2021: How It Works, Services & Price

During the early days of the COVID-19 pandemic, the real estate market was in an uncertain position with so many sectors temporarily closing shop. However, after a decline in investor activity, it gradually experienced a rebound that changed the outlook for real estate investing especially for post-pandemic and post-vaccination.

With recovery and economic rebound being observed, even the commercial real estate market is seen to be bouncing back making it a ripe time to invest. CrowdStreet offers and streamlines investments in commercial real estate that can help you diversify your portfolio. However, you need to be an accredited investor to be able to invest in their institutional-level investments. Check out our CrowdStreet review below.

What is CrowdStreet?

CrowdStreet started in 2012 when co-founders Tore Steen and Darren Powderly saw the importance of diversification and independence from Wall Street’s investment opportunities. With equity crowdfunding gaining popularity, the founders created CrowdStreet to improve access to real estate investment through technology that everyone can easily use and understand.

CrowdStreet makes real estate investments more accessible to individual investors by matching them with project developers on their platform. Investors can choose to invest between individual properties or buy into CrowdStreet's mutual fund which consists of a number of real estate projects.

How Does CrowdStreet Work?

CrowdStreet only allows accredited investors to invest in any of their offered deals. It’s best for those with extra cash and are interested in investing their money rather than just letting sit in the bank. Projects require a minimum investment of $25,000 which can go up to $100,000. There are no fees for joining and registration.

Project developers and sponsors go through a rigorous vetting process to ensure uncompromised quality and safeguarding investors’ trust. All companies and firms are subjected to a background check and a track record review, while the deal goes through asset evaluation and legal documents review.

What Does CrowdStreet Offer?

CrowdStreet lets you choose from two types of funds to diversify your portfolio with commercial real estate investments. It's an ideal stepping stone for first-time investors because it offers great opportunities in real estate investing for beginners.

Single-sponsor funds

These are driven by a single real estate entity. The firm specializes in either asset type or a specific region in the USA. Here, investors can find the sponsor’s network advantageous in the future as the fund is strengthened with better deals.

CrowdStreet funds

These are funds that are built and managed by CrowdStreet’s in-house team of real estate professionals. Funds are diversified across numerous individual projects and sponsors which investors can take advantage of.

Check out what CrowdStreet has to offer here.

CrowdStreet Features & Services

One reason that CrowdStreet has become so successful is because of its robust features and its investment/website transparency. Here are its features which investors find most attractive:

Variety of Investment Types

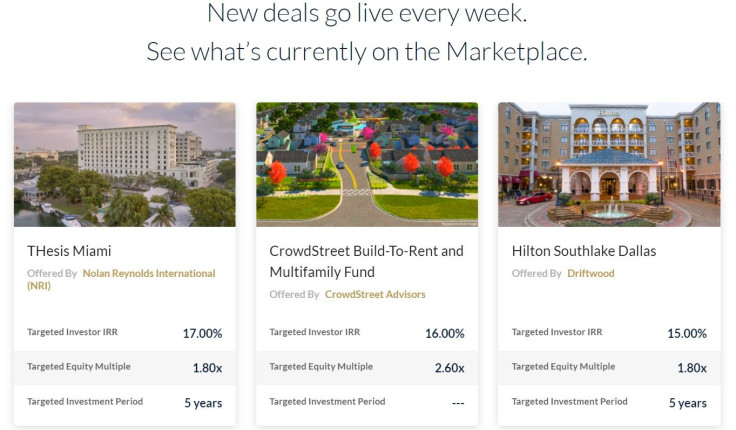

You can invest in a number of ways through CrowdStreet given the variety of their investment options for a diversified portfolio.

- Diversified funds and vehicles let you spread your investment across multiple projects. With similar minimum investments as individual properties, you can invest in numerous deals at once instead of just one.

- Individual deals let you directly choose among their curated options and pick which property or project you want to invest in. With a detailed document and direct communication to the sponsor, you can make the best decision and even monitor it.

- A tailored portfolio lets you sit back and have the professionals at CrowdStreet build and manage your commercial real estate portfolio for you. However, expect to have a much higher minimum investment requirement of at least $250,000 to start.

Check what they have available on the market here.

In-depth Knowledge

The website is full of information that you can easily access. CrowdStreet offers a plethora of resources you can use to gain real estate knowledge and make informed decisions. They have episodes of StreetBeats on their site which feature conversations with sponsors, investors and industry leaders discussing the effects of COVID-19 and the volatility of the market on the current commercial real estate market.

Educational resources are readily available for first-time investors with videos and guides to steer them in the right direction as well as live webinars and events. It also provides a 2021 Investment Thesis that has detailed insights and outlooks on the various assets available, whether hospitality, storage, student housing, multifamily, office and more.

CrowdStreet Pricing

CrowdStreet does not require registration fees on the platform but they do get a cut from your investments. For individual deals, the fees involved vary depending on the project. While CrowdStreet funds have a fee of 0.5% to 2.5% on the capital invested annually.

CrowdStreet may have lower fees compared to other investment platforms but it does have a steep minimum requirement and are strict with who gets to invest, allowing only accredited investors at this time.

Check out CrowdStreet’s offers today here.