As banks around the world race to satisfy international capital requirements, they are going through a veritable fire sale, getting rid of non-core businesses no matter how much they will fetch. Beyond that, they are engaging in some odd transactions, including a substantial amount of balance sheet engineering.

European shares rose on Friday, recording their biggest weekly gain since late 2008, on hopes Eurozone leaders were coming together to find a solution to the Eurozone debt crisis.

When combined with upward revisions to the September (210,000) and October (100,000) job totals, November’s 120,000 job gain, and recent, strong manufacturing and auto sales data, the fundamentals show a U.S. economy that is strengthening. But will Europe's credit markets sap the economy's momentum?

It seemed like it was only yesterday (perhaps because it actually was only three days ago, on Tuesday), when the shares of the banking giant teetered precariously above the $5 mark, a few cents off the dreaded "4 handle." Many were predicting a catastrophic sell-off. Fast-forward to today and Bank of America is trading at $5.74 per share, a jump of 13.66 percent in slightly over 60 hours.

The top pre-market NASDAQ Stock Market gainers are: Clearwire, Logitech International, Sina, Marvell Technology Group, and Lululemon Athletica. The top pre-market NASDAQ Stock Market losers are: Exelixis, Seagate Technology, Research In Motion, Shire, and Qiagen.

European shares rose on Friday at mid-day and were headed for their biggest weekly gain in three years on hopes of a bold solution to the euro zone debt crisis at a summit next week.

Wedbush Securities upgraded its rating on shares of Anthera Pharmaceuticals, Inc. (NASDAQ: ANTH) to outperform from neutral based on valuation. The brokerage raised its fair value estimate to $8 from $7.

The Nikkei average extended gains to log its biggest weekly advance in two years on Friday, though the mood was far from upbeat given uncertainty over whether Europe will next week manage to cobble together steps to counter the debt crisis there.

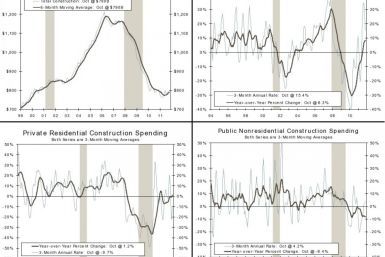

The U.S Department of Commerce released the construction spending index for the month of October. Total construction spending rose 0.8 percent in October, the third consecutive monthly increase.

Sanofi SA (NYSE: SNY) said in a letter sent to customers dated Nov. 30 that it has discontinued selling the Authorized Generic version of Lovenox (Enoxaparin).

Stock index futures pointed to a sharply higher open for equities on Wall Street Friday, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 up 1 to 1.1 percent ahead of a key jobs report.

Asian stocks are set for their first weekly rise in a month buoyed by coordinated central bank actions, while the euro held on to hefty gains before European policymakers make a fresh stab to tackle its crisis at a summit next week.

The top after-market NASDAQ stock market gainers are: Mitel Networks, Zumiez, BioMimetic Therapeutics, Zhongpin, PMC-Sierra, and Clearwire. The top after-market NASDAQ stock market losers are: Viacom, Angie's List, Ebix, AVEO Pharmaceuticals, Avago Technologies, and Equinix.

The Nikkei average edged up Friday, with investors focused on whether the benchmark can hold above its 25-day moving average ahead of crucial U.S. employment data later in the day.

European equities fell in choppy trade on Thursday, as a key index failed to break an important resistance level and weak macro economic data prompted profit taking after sharp gains in the previous session.

U.S. crude futures fell back on Thursday after government data showed that new filings for jobless benefits unexpectedly rose last week to their highest level since late October, a bad sign for oil demand. Oil traded down $1.01 to $99.41 per barrel on Thursday at mid-day.

Goldman Sachs (NYSE: GS) says it is betting the situation in Europe will deteriorate next year, eventually affecting the still-strong German economic engine and prompting a new wave of fears that European companies will default on their bonds.

European shares fell in choppy trade on Thursday after data showed new U.S. claims for unemployment benefits rose unexpectedly last week, with some investors booking profits after equities jumped 9 percent in the previous four sessions.

The Canadian dollar firmed against the U.S. dollar for a fourth straight day on Thursday as a Spanish bond sale saw decent demand and a liquidity move by major central banks raised hopes policymakers would step up action to tackle Europe's debt crisis.

If you can tolerate moderate-risk, Pepsi is a stock that offers that rare opportunity for a decent dividend with capital appreciation, according to one stock reviewer.

The Nikkei share average surged above its 25-day moving average to a two-week high on Thursday after the world's central banks took coordinated actionto ease funding strains among banks caused by the debt crisis in

Europe.

The top pre-market NASDAQ Stock Market gainers are: Magma Design Automation, Transcept Pharmaceuticals, Yahoo, Siliconware Precision Industries, and Melco Crown Entertainment. The top pre-market NASDAQ Stock Market losers are: Lululemon Athletica, ARM Holdings, ASML Holding, Intel, and Amazon.com.

Wells Fargo Securities said California's wholesale trade, transport and export industries have been big beneficiaries of the growing wealth of Asia and growing demand from other countries, such as Canada and Mexico.

Salesforce.com Inc. (NYSE: CRM) held its Cloudforce user event in New York City on Wednesday. The company formally launched its Social Marketing Cloud service and the AppExchange Mobile Site at the event.

Gold prices climbed to a nearly two-week high Thursday, along with other risky assets, after the world's richest central banks jointly pledged to make it easier for the Eurozone's acutely stressed banks to obtain funding.

Stock index futures pointed to a weaker open on Wall Street on Thursday, with futures for the S&P 500 down 0.5 percent, Dow Jones futures down 0.4 percent and Nasdaq 100 futures down 0.2 percent at 4:37 a.m. ET.

The top after-market NASDAQ stock market gainers are: Magma Design Automation, Transcept Pharmaceuticals, Merge Healthcare, Yahoo and Exide Technologies. The top after-market NASDAQ stock market losers are: Semtech, Sonus Networks, Digital Generation, Prospect Capital and Connecticut Water Service.

State-run oil firms will cut petrol prices by Rs. 0.78 (1.5 cents) a litre, or approximately 1.2 percent, from Thursday, Indian Oil Corp. (IOC) said. This will be the second cut this month, reflecting global prices and potentially easing near double-digit inflation.

India's Food Price Index rose 8 percent, which is its slowest pace in nearly 4 months, and the Fuel Price Index climbed 15.53 percent in the year (calculated till Nov. 19), government data released on Thursday showed.

The BSE Sensex Thursday gained 2.70 percent on hopes for a surge in foreign fund inflows after the world's six major central banks moved to tame a liquidity crunch for European banks.2