Hong Kong stocks are set to ease on Friday morning as investors take profits after three days of strong gains, and shares of materials-related companies could decline due to falling commodity prices.

Coal freight lines could start reopening as early as Thursday in Australia's flooded Queensland coalfields as waters recede, rail officials said, prompting predictions of a faster-than-expected start to a recovery in exports.

Gold fell on Thursday, snapping three sessions of gains as safe-haven buying subsided after successful European bond sales and a more positive economic outlook from U.S. Federal Reserve Chairman Ben Bernanke.

Stocks edged down on a disappointing labor market data

Bullish earnings and dividend expectations pushed Industries Qatar (IQCD.QA) (IQ) to a 28-month high on Thursday, helping Doha's Index .QSI reach a similar milestone.

At least 10 asset managers are preparing to launch yuan-denominated funds in Hong Kong to tap robust overseas demand for yuan assets amid expectations of faster yuan appreciation and broader investment channels, two people with direct knowledge of the matter said.

Uganda's shilling looks set to plumb new record lows against the dollar over the next week due to soaring foreign exchange demand from the oil sector, while Kenya's unit should strengthen slightly.

The Kenyan shilling KES= edged up against the dollar on the back of higher coffee and tea prices at auctions this week, but signs of a drought in the country could limit the currency's gains, traders said on Thursday.

China is providing a $350 million concessionary loan to build a multi-lane toll road linking Uganda's capital with the country's Entebbe airport, 54 km (34 miles) away, Ugandan officials said on Thursday.

South African blue-chip stocks booked another 2-1/2-year closing high on Thursday, rising 0.6 percent as shares of Anglo Platinum and other resource companies continued their recent run.

Chinese banks are plagued by non-performing loans because their own financial system is heavily distorted.

U.S. stocks opened lower after jobs data disappointed investors.

Futures on major U.S. indices fell after the weekly jobless claims data came in worse than analyst expectations.

The Producer Price Index (PPI) for finished goods rose a seasonally adjusted 1.1 percent in December, marking a sixth week of rise, the U.S. Bureau of Labor Statistics said on Thursday.

The top pre-market NASDAQ stock market gainers are: EXFO, Kandi Technologies, Strategic Diagnostics, Micron Technology, and NeurogesX. The top pre-market NASDAQ stock market losers are: SemiLEDs, DragonWave, Infosys Technologies, Veeco Instruments, and Aixtron.

China will grow slower in 2011 due to the unwinding of fiscal stimulus and the restrictions placed on overheating sectors, the World Bank said in a report.

The top after-market NASDAQ stock market gainers are: EXFO, Sify Technologies, Mercury Computer Systems, Umpqua Holdings, and National CineMedia. The top after-market NASDAQ stock market losers are: DragonWave, optionsXpress Holdings, Geron, PostRock Energy, and American Capital Agency.

The rupee touched one-and-half-week highs early on Thursday, boosted by overnight losses in the dollar, but soon retreated tracking weak domestic shares, which added to worries of more foreign fund withdrawals.

Infosys Technologies' weaker-than-expected results sparked concerns over growth rates of India's showpiece outsourcing sector as the company flagged a sluggish global economic recovery and currency volatility.

Hong Kong stocks are likely to rise further on Thursday with traders expecting momentum to continue after the benchmark convincingly broke through short-term chart resistance on high volumes.

Following are news items and media reports that may affect the Taiwan stock market. Double click on the number in [] to read the stories.

China's largest lender, Industrial and Commercial Bank of China (ICBC), said it will not conduct fundraising from the capital markets within three years, the Securities Times reported on Thursday, citing the bank's chairman.

State-owned Bank of China Ltd's move to offer limited deposit services in the renminbi to U.S. customers represents a tiny step in what will be a long journey for the Chinese unit to become a widely-traded international currency.

Stock rallied as banks/financials stocks pushed higher following an upgrade of the sector by Wells Fargo and a successful bond offering in Portugal.

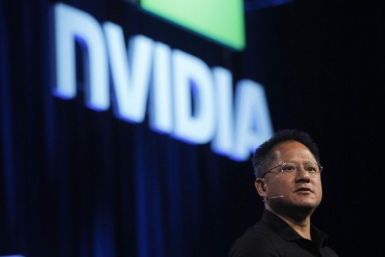

Shares of chip designer NVIDIA Corp. (Nasdaq: NVDA) are surging today, in what appears to be a delayed reaction to a series of good news surrounding the company.

The Nigerian naira NGN=D1 depreciated further against the dollar at both the interbank market and official window on Wednesday as the central bank was unable to meet demand for the greenback at its auction.

Ghana's inflation slowed to a new 18-year low of 8.58 percent in December, feeding expectations the West African economic heavyweight will keep its policy interest rate on hold in the short term.

Shanghai has launched a pilot scheme allowing qualified foreign institutions to make private equity investment in China, marking an important step in the liberalization of China's capital markets.

Cameroon will take a 207 billion CFA concessionary loan from the Export-Import Bank of China to fund construction of a deep sea port at Kribi, the government said on Wednesday.

Libya has abolished taxes and custom duties on locally-produced and imported food products in response to a global surge in food prices, Oea online newspaper reported.